Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved a bit higher on Monday, the previously-broken resistance line and the May 2015 high continue to keep gains in check. Will they withstand the buying pressure in the coming days?

Let’s take a look at the technical picture of black gold (charts courtesy of http://stockcharts.com).

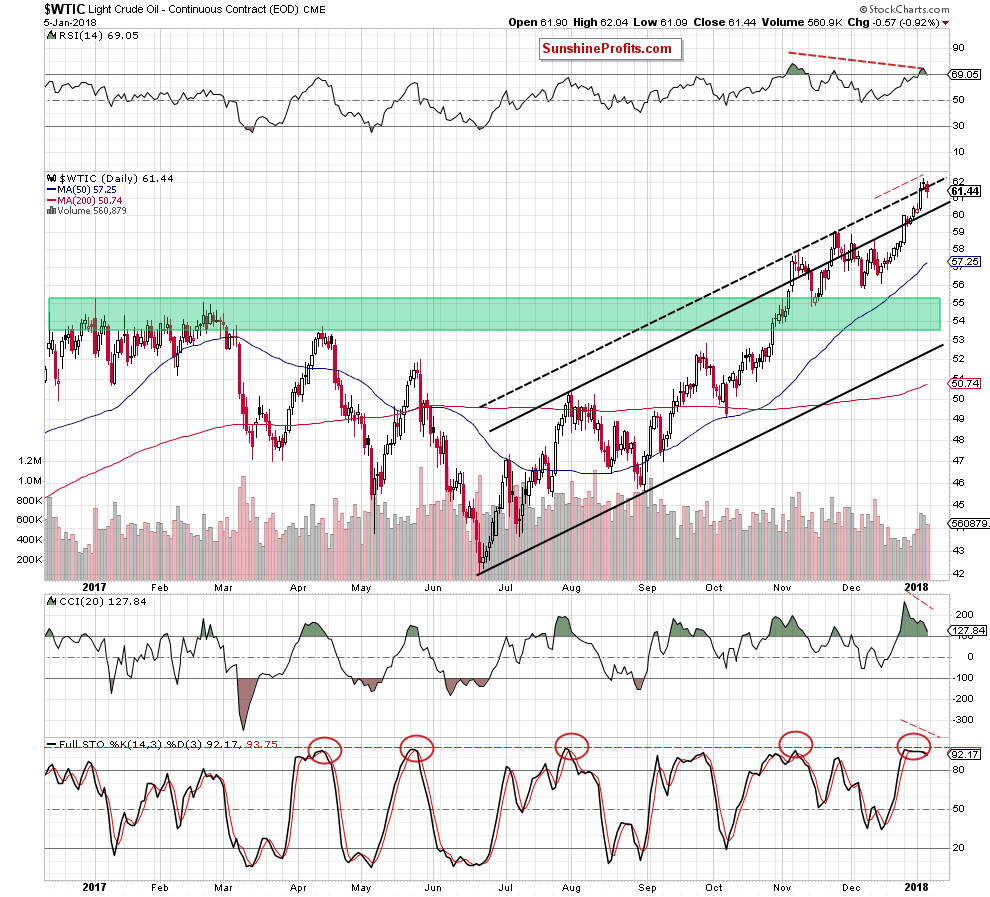

Looking at the daily chart, we see that oil bulls pushed the price of light crude higher, which resulted in a comeback above the black dashed line. As it turned out in the following hours, this “improvement” was very temporary and crude oil closed the day below this line, invalidating the earlier tiny breakout.

Although this is a negative sign, it’s worth noting that volume was quite high, which suggests that we could see a test of the recent high later in the day – especially when we take into account the fact that crude oil futures extended yesterday’s gains earlier today.

Nevertheless, even if we see such price action, we should keep in mind that all negative factors about which we wrote yesterday remain in cards, suggesting that the space for increases may be limited:

(…) clearly visible bearish divergences between the commodity and all daily indicators marked on the above chart. Additionally, the RSI and the Stochastic Oscillator generated the sell signals (while the CCI is very close to doing the same in the very near future), increasing the probability of lower prices of light crude.

On top of that, the May 2015 continues to block the way to higher levels. We realize that this is not the strongest resistance at this moment, but many technical details suggest that space for growth is really limited. What do we mean? Let’s analyze the long-term chart below.

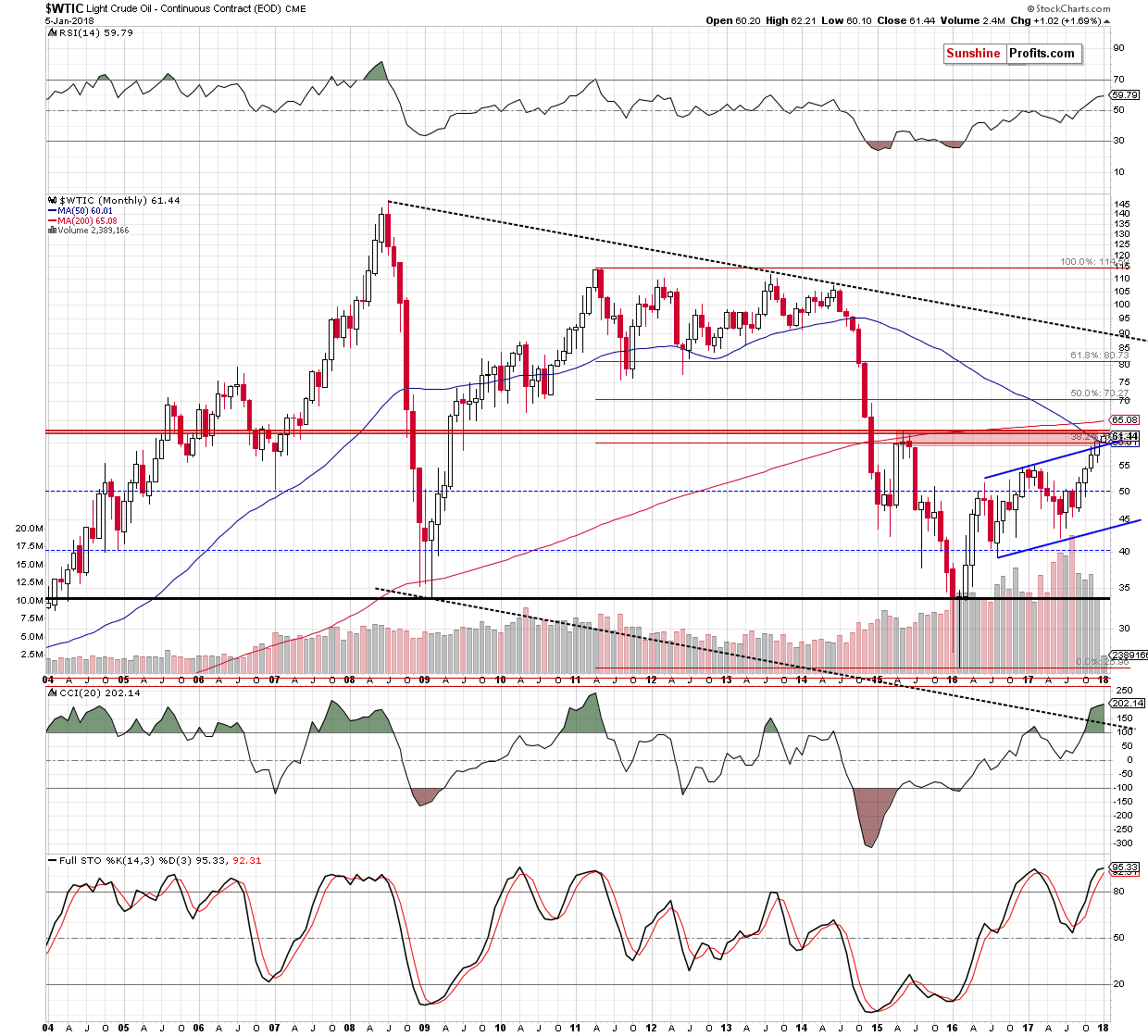

Looking at the monthly chart, we see that volume, which accompanied December increase was visibly smaller than in the previous months, which suggests that oil bulls’ strength may not be as big as it may seem.

Additionally, the CCI and the Stochastic Oscillator climbed to their highest levels since April 2011 and there is a bearish divergence between the latter indicator and the price of crude oil, which increase the probability of reversal in near future. As a reminder, the April 2011 peak preceded the first wave of sizable declines in the following months.

Summing up, the overall situation hasn’t changed much as crude oil wavers around the black dashed line, but still below the May 2015 high. All bearish divergences between the price and indicators together with the sell signals suggest that further deterioration may be just around the corner. Nevertheless, until we see more reliable developments (bullish or bearish) waiting on the sidelines and watching bullish-bearish scuffles under the May 2015 high without open positions seems to be the best investment solution for the moment.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts