Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil finished another day inside the declining trend channel, it was not enough to close December above the 61.8% Fibonacci retracement. How can this show of weakness affect the fate of black gold?

Let’s analyze the charts below (charts courtesy of http://stockcharts.com).

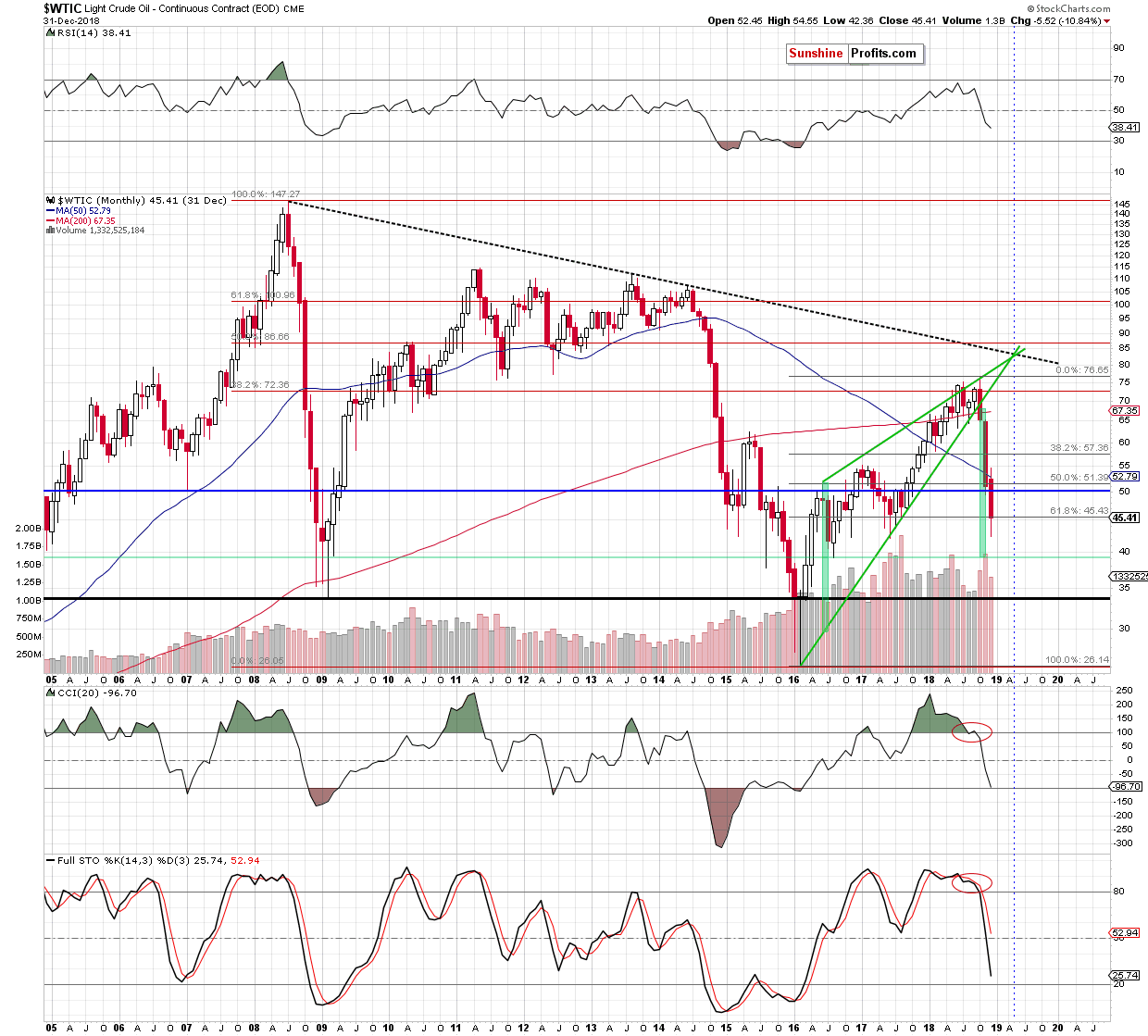

From the monthly perspective, we see that crude closed December slightly below the 61.8% Fibonacci retracement, which can encourage oil bears to trigger another downswing.

Nevertheless, for consolation of distressed oil bulls we can add that the volume in December was smaller than in November, which suggests lower involvement of the sellers in declines. In other words, there is still a chance for the buyers to fight for the maintenance of December lows.

Having said that, let's check the short-term chart below.

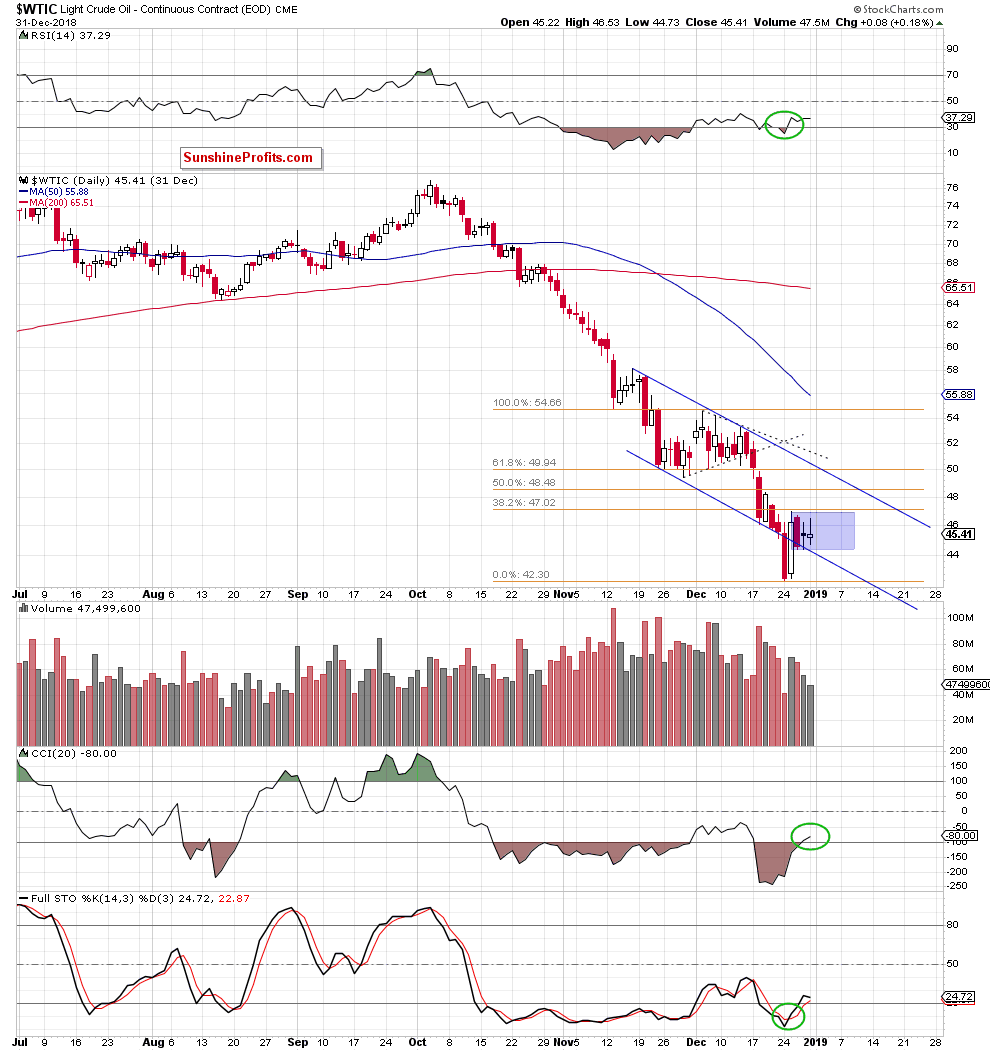

From this perspective, we see that although oil bulls closed another day inside the blue declining trend channel, the overall situation hasn’t changed much as light crude remains inside the blue consolidation.

Therefore, as long as there is no breakout above the upper line of the formation (based on the last week’s peak and the 38.2% Fibonacci retracement) or a breakdown under the lower border (and the lower line of the blue declining trend channel) another bigger move is not likely to be seen.

Nevertheless, bearing in mind the closing of December below the 61.8% Fibonacci retracement and the falling volume during the last "rises" we think that oil bears will test the bull's strength and determination to maintain the lower line of the blue channel and consolidation in the coming day(s). In other words, a test of the above-mentioned supports is very likely.

The result of the clash in this area will probably determine the next moves of black gold in a very short-term perspective.

What can happen if the bulls maintain these levels? In our opinion, we’ll see a rebound and a re-test of the nearest resistance area created by the Wednesday's high and the 38.2% Fibonacci retracement. If they manage to break above these levels, the way to the next retracements, the upper border of the blue trend channel and the barrier of $50 will be likely open.

However, on the other hand, if they do not withstand the selling pressure, the probability of a test of the recent lows in the following days will increase significantly. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up, crude oil closed another day inside the blue declining trend channel, but it was not enough to close December above the 61.8% Fibonacci retracement seen on the monthly chart. Therefore, another attempt to move lower and a test of the nearest supports should not surprise us in the coming day(s).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts