Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $33.78 as the stop-loss level. We might adjust this target in the following Alerts.

In today's Oil Trading Alert, we'll dive into more charts than we did yesterday. What do they tell us about the upcoming oil move?

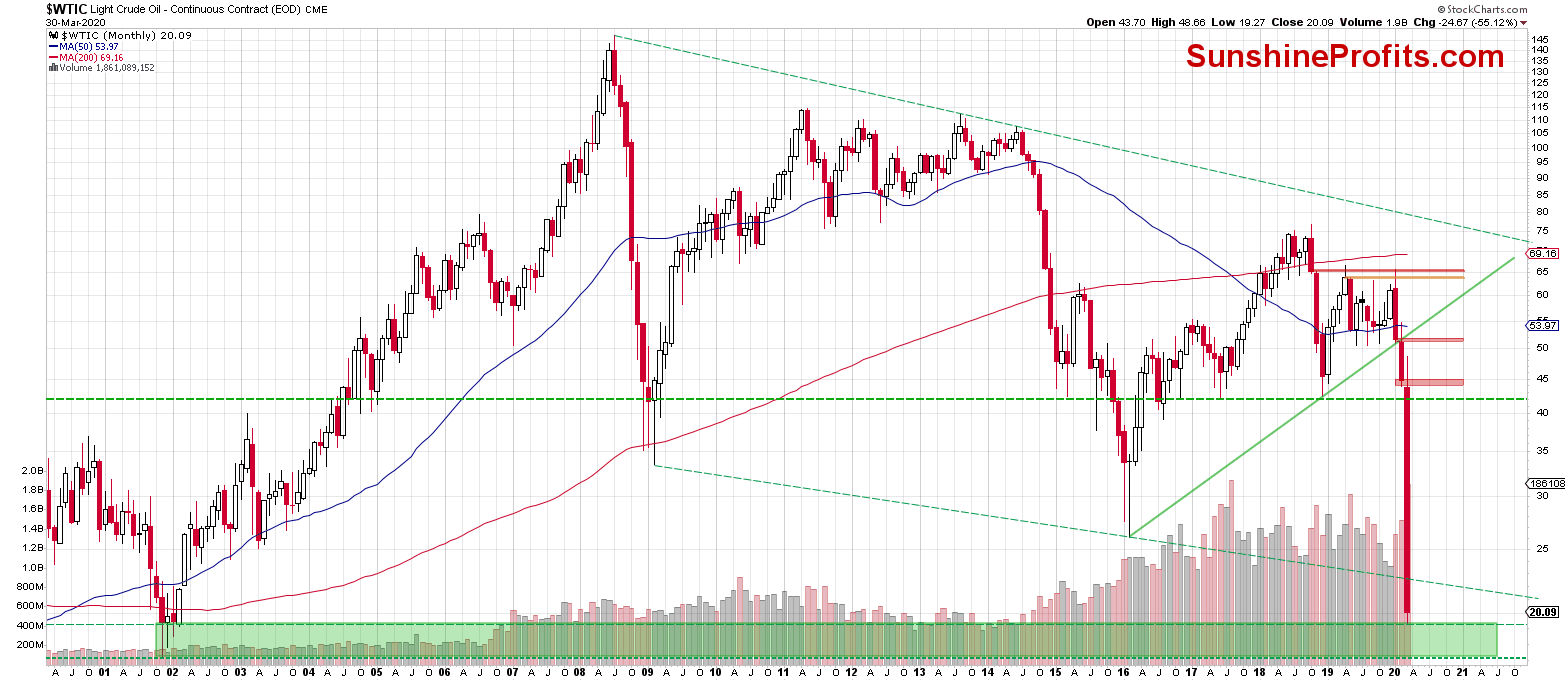

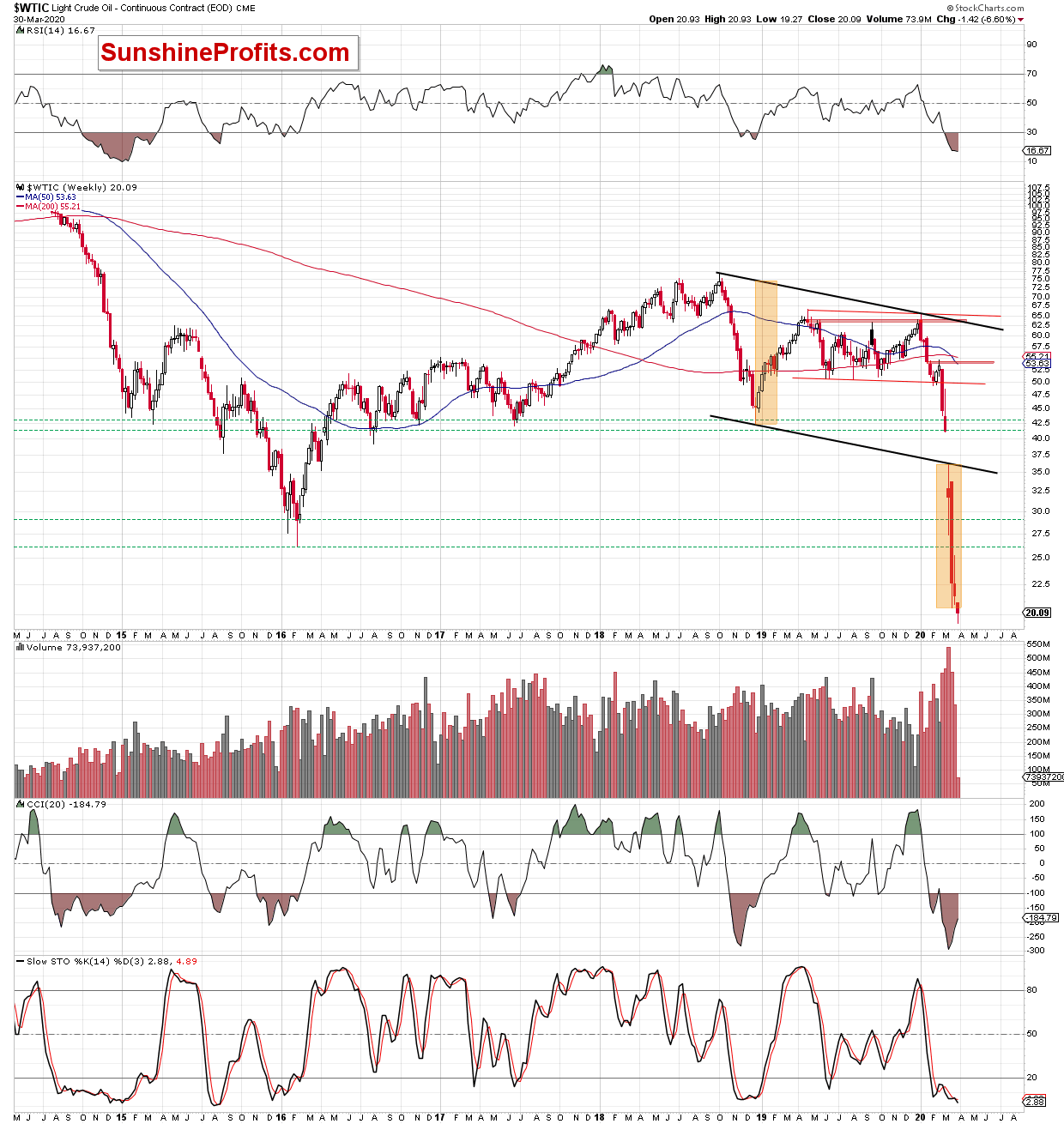

Let's start today's analysis looking at the long-term (chart courtesy of http://stockcharts.com and www.stooq.com ).

The long-term chart shows that the commodity approached the upper border of the green support zone based on the late 2001 and early 2002 lows.

Additionally, this month's decline took black gold to the area, where the size of the downward move corresponds to the height of the long-term black declining trend channel. Both factors could encourage the bulls to fight for higher prices ahead.

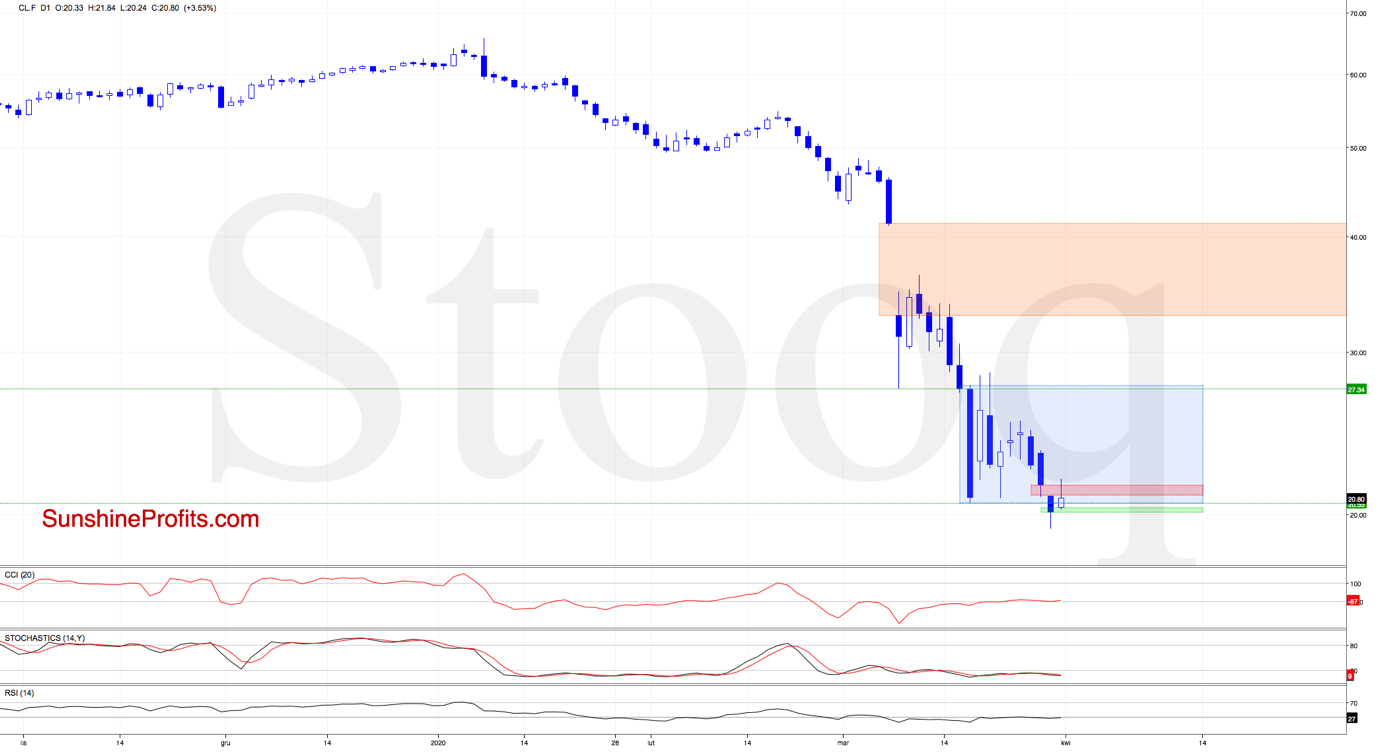

How did all these affect investors' moods before today's market open?

Crude oil futures opened the day with the green bullish gap, which triggered further improvement in the following hours. Thanks to this upswing, the futures invalidated yesterday's breakdown below the lower border of the blue consolidation marked on the above chart.

Although this could be bullish development, it would be more reliable only if the futures finish today's session above $20.52.

Before summarizing today's Alert, we would like to draw your attention to the fact that despite today's very short-term improvement, the futures are still trading below the upper border of the red bearish gap created yesterday. This means that as long as it remains open, the way to the north is blocked and another reversal from this area is likely.

Connecting the dots, today's close can have a big impact on the very short-term picture of crude oil futures.

Summing up, today's close will test our yesterday's conclusion that the corrective upswing in crude oil seems to have ended, and another leg lower is already underway. Despite today's volatility and the bulls standing up to fight today, it appears highly likely that our profits on the current short position are likely to grow considerably in the following days.

Trading position (short-term; our opinion): Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $33.78 as the stop-loss level. We might adjust this target in the following Alerts.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager