Trading position (short-term; our opinion): short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

The oil buyers kept more of their gains yesterday than the day before. And have opened strongly earlier today. Will it translate into their overcoming nearby resistances? Let's assess the odds.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

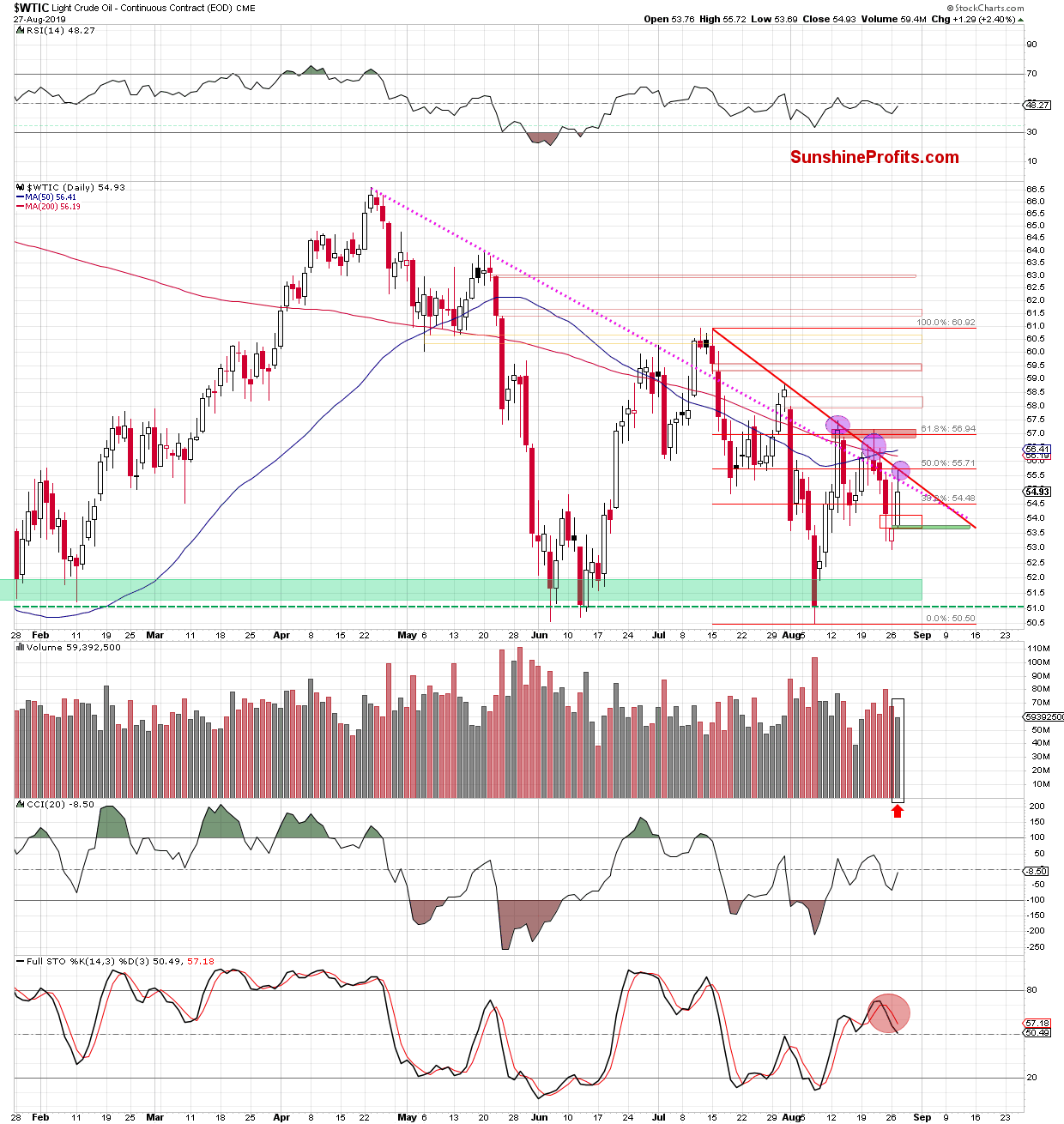

Crude oil opened yesterday with a bullish green gap, and its daily upswing closed the previous day's bearish red gap. The commodity tested the pink dotted resistance line and also the declining red resistance line.

Black gold then went on to pull back. This is similar to what we saw quite a few times already - and we have conveniently circled such instances with purple color. Despite yesterday's upswing, the Stochastic Oscillator still remains on its sell signal.

Additionally, yesterday's volume was noticeably lower than that of preceding downswing days. This also serves as one more bearish sign.

Let's check how yesterday's price action affected investors earlier today.

The bulls opened today with yet another green gap. Yet the subsequent move to the upside is quite small compared to the size of the gap, and that's not a bullish sign.

This is especially so when we factor in the situation on the 4-hour chart.

Black gold is trading inside the very short-term rising green trend channel, suggesting that we could see a test of the upper border of the formation.

Should the bulls fail to push prices higher (or should we see an invalidation of a potential breakout above the upper border of the channel), the sellers will likely take the reins. Then, crude oil futures can be expected to trade down to at least the lower border of the formation or even to the lower border of the purple declining trend channel and the recent lows.

Summing up, oil bulls emerged victorious yesterday, yet the upswing volume hasn't been convincing and neither is Stochastic's lasting sell signal. There's also the recent history of failed breakout attempts over the many resistances at hand. We keep monitoring the fate of today's bullish opening - the bulls would have to show up in force to change the bearishly-leaning short-term technicals. The short position remains justified.

Trading position (short-term; our opinion): short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist