Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil wavered between small gains and losses, but finally finished the day 0.19% below Wednesday’s closing price. Does it mean that oil bears lost their strength and we will see another rebound?

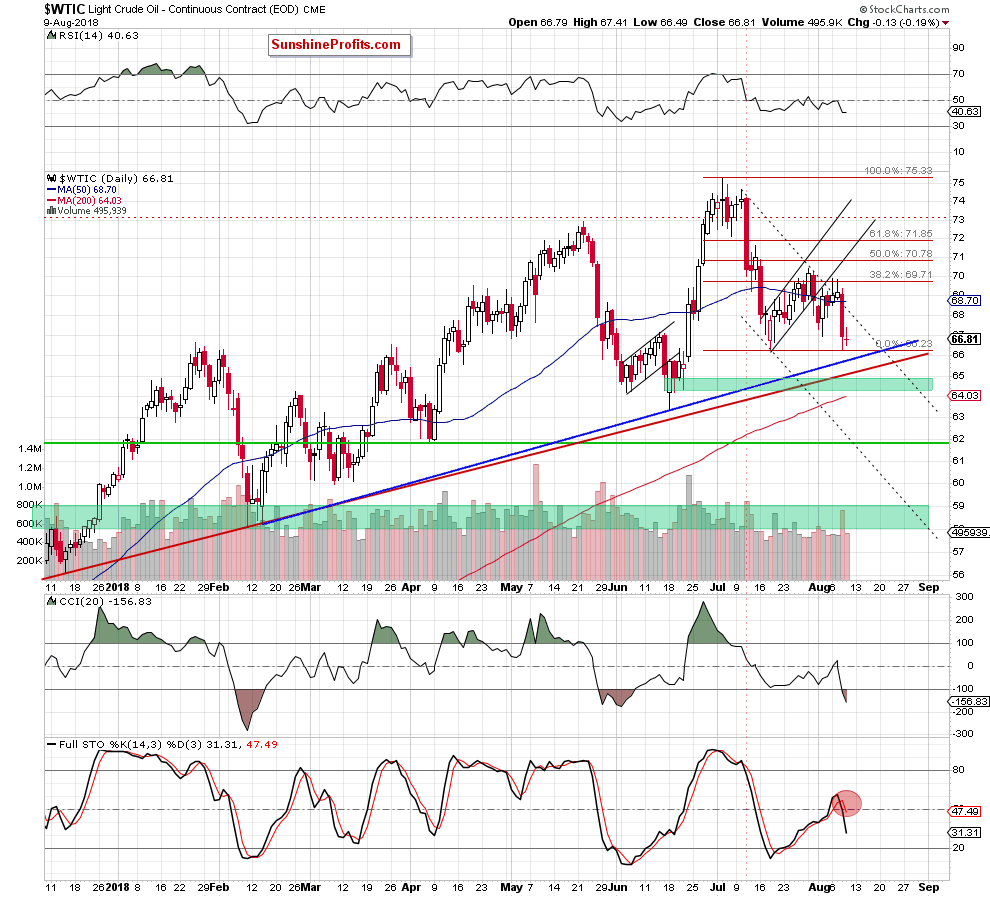

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Looking at the daily chart, we see that the very short-term situation hasn’t changed much as crude oil wavered in a narrow range during yesterday’s session. As a result, investors created a doji candlestick, which suggests that some uncertainty crept onto the market.

Frankly speaking, such behavior doesn’t surprise us - especially if we take into account the proximity to the recent lows and two medium-term support lines: the blue line based on February and June lows and the red one based on December 2017 and February 2018 lows.

Additionally, yesterday’s price action materialized on smaller volume than earlier declines, which suggests that the interest of oil bears to continue pushing the price down could have weakened.

What does it mean for black gold?

Although the sell signal generated by the Stochastic Oscillator continues to support the sellers and lower values of the commodity in the very near future (yes, we think that one more downswing and a fresh “summer” low can’t be ruled out), we believe that the probability of reversal from here (or slightly lower levels designated by the blue and red support lines) is too big to justify the continued holding of short positions.

As the proverb says: “a bird in the hand is worth two in the bush”. Therefore, we believe that closing short positions and taking profits off the table (as a reminder, we opened our short positions when crude oil was trading at around $73.16) is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts