Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $60.55 and the next downside target at $54.47 is justified from the risk/reward perspective.

After a relative indecision of quite a few recent sessions, yesterday's oil trading has very much been a one-sided event. It was a move that didn't lack conviction in the least. But the bulls are attempting a comeback today. While the prices are modestly higher, can the buyers manage to push them higher still? By the way, how much higher would be high enough to repair the damage from yesterday's slide? Let's find out.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

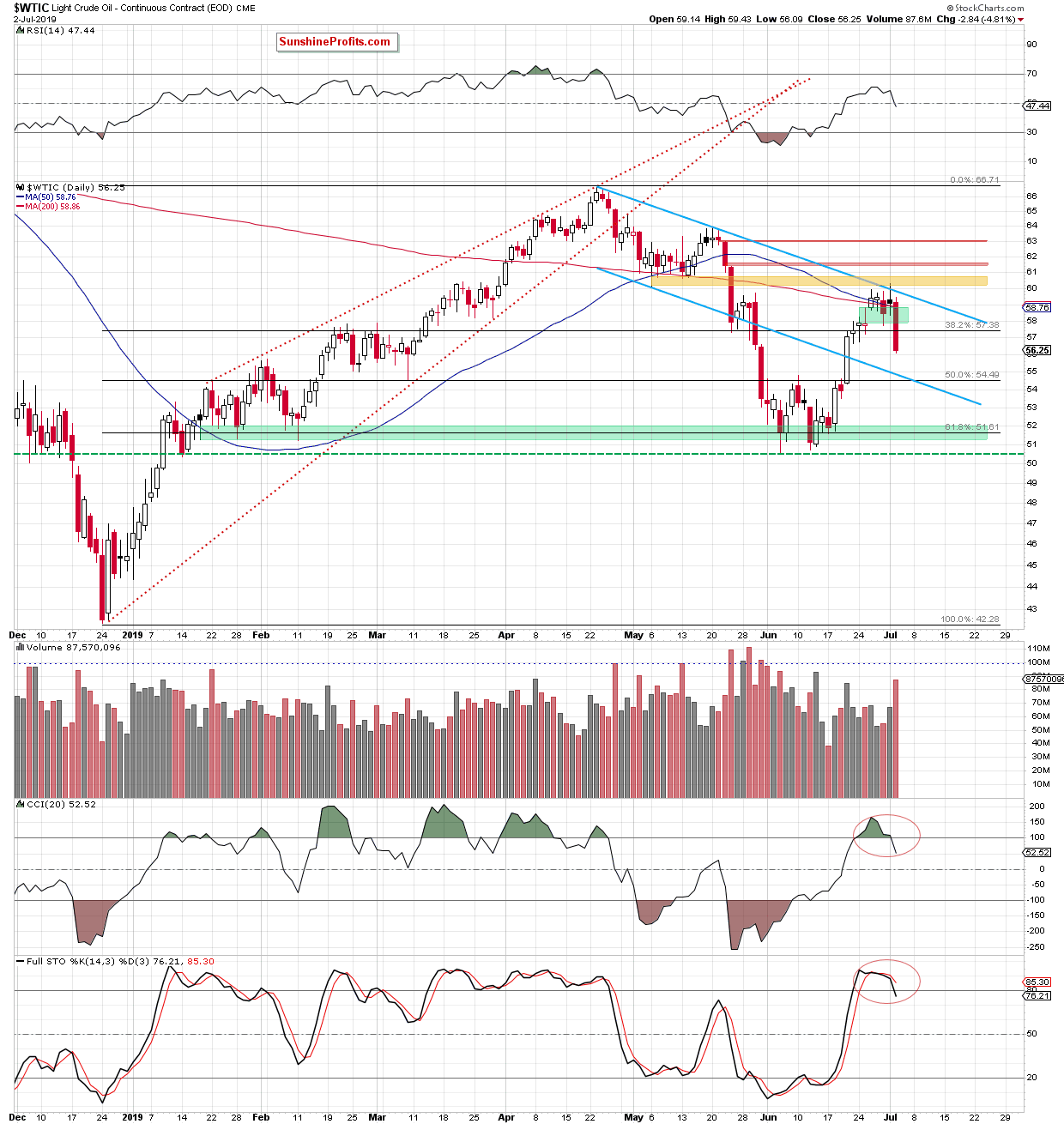

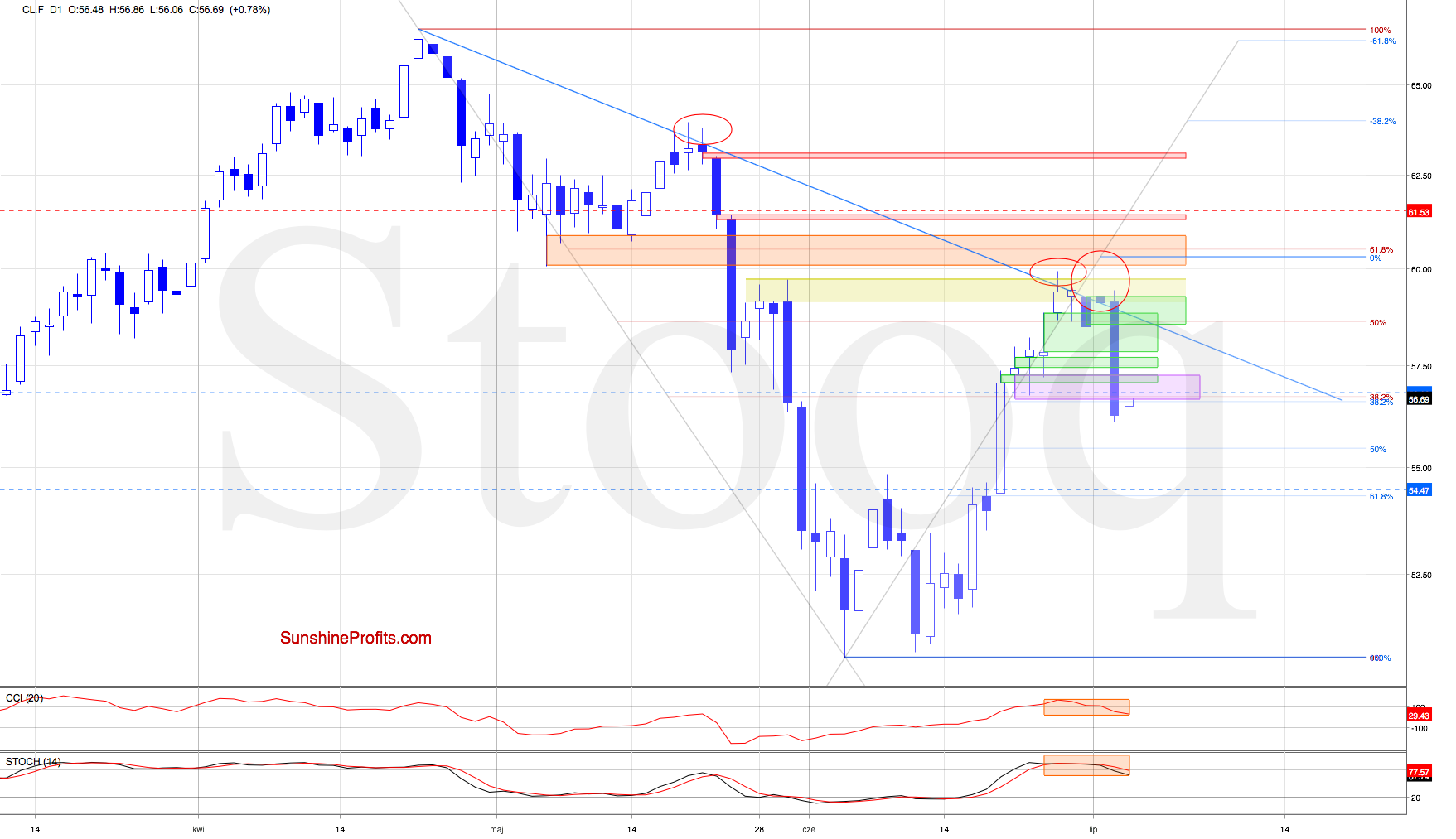

The tiny intraday breakout above the upper border of the declining blue trend channel has been invalidated on Monday, and yesterday's session brought follow-through selling. Crude oil has turned lower with a vengeance, and the green gap has been closed.

The daily close meant also a close below our initial downside target. The volume of yesterday's decline has been visibly higher than the volume of earlier increases, confirming the strength of the sellers.

Additionally, the CCI and the Stochastic Oscillator have generated their sell signals, providing further support for the bears.

Let's see how much they've made out of the favorable technical posture earlier today.

The bears have already closed all the bullish green gaps, and finished yesterday's session below the 38.2% Fibonacci retracement, opening the way to lower levels.

Nevertheless, the bulls triggered a rebound earlier today. Though, it doesn't appear to have changed much (oil currently changes hands at around $57.00) as only the previously-broken support area that is created by the June 21, June 24 and June 25 lows, has been reached. Such a weak price action looks like a verification of the earlier breakdown, and doesn't bode well for the bulls.

Also, if crude oil futures close today below the 38.2% Fibonacci retracement, they would just verify yesterday's breakdown below this important support level. That would be one more bearish factor to count with.

Should the situation develops in tune with our assumptions, black gold is likely to extend losses and test the previously-broken lower border of the blue declining trend channel (currently at around $54.70), or even drop to the 61.8% Fibonacci retracement in the following days. Reflecting all the above, we decided to adjust our stop-loss order and the downside target. All details below.

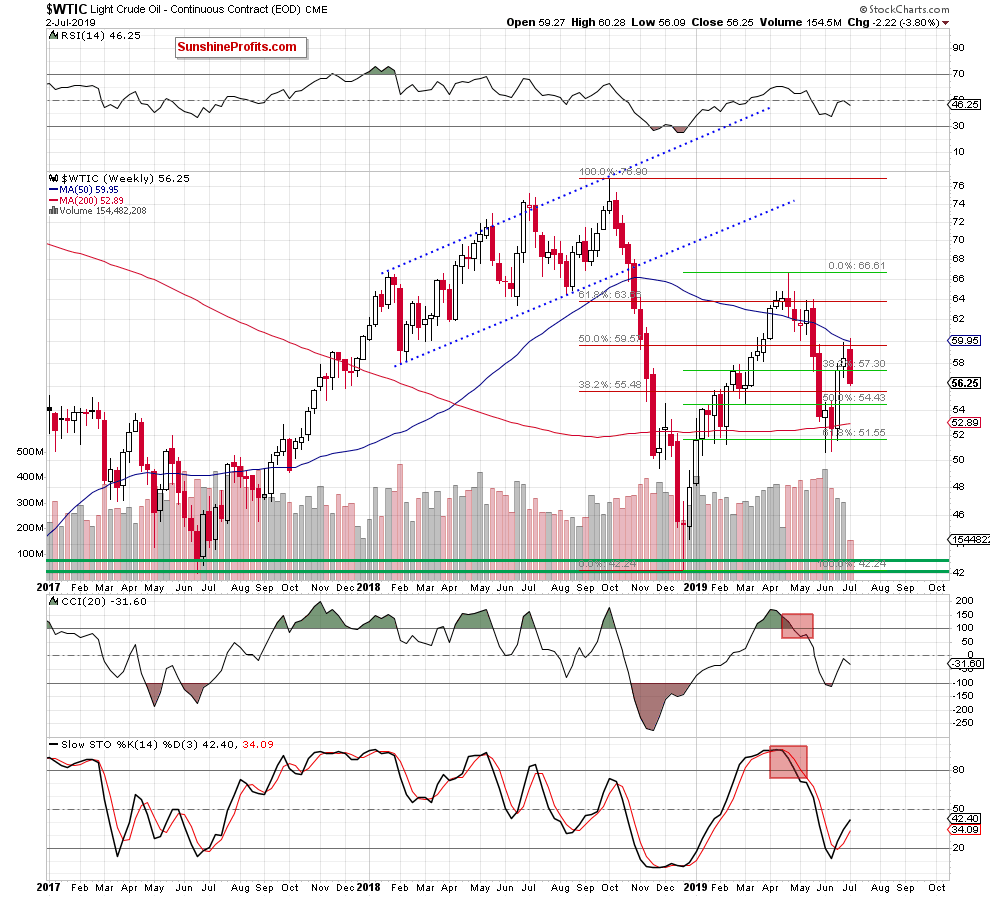

Before summarizing, let's take a look at one more chart.

This week's upswing took crude oil to the previously-broken 50-week moving average, verifying the earlier breakdown below it. The following sharp move to the downside doesn't bode well for the bulls in the very near future - especially if the bears manage to close this week below $56.75.

This is where last week's low is. Should the bears close this week below it, the weekly chart would flash a bearish engulfing pattern. As the name implies, this formation has bearish implications, and could translate into further deterioration in the week(s) ahead.

Connecting the dots, our (already profitable) short position continues to be justified from the risk/reward perspective.

Summing up, emboldened by the Monday's failure of the bulls to break higher, yesterday's session brought sharply lower oil prices. The bears are supported by the daily indicators' sell signals, the higher volume of yesterday's downswing, and the closing of the bullish gaps of recent days. Our already profitable short position remains justified, and in light of our first downside target being reached, we're adjusting the trade parameters. All details below. As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $60.55 and the next downside target at $54.47 is justified from the risk/reward perspective.

On an administrative note, the 4th of July – the U.S. Independence Day is tomorrow, and the long weekend begins, which means that the trading should be limited as the U.S. markets will be closed tomorrow, and many traders will still be out of their offices until Monday. Consequently, there will be no regular Oil Trading Alerts (the same goes for our other Alerts) posted tomorrow and on Friday, but if anything changes regarding our outlook in the meantime, we will keep you informed via intraday Alerts.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist