Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

On Friday, crude oil bounced off the psychological barrier of $60 and almost erased two days of earlier declines. Additionally, Baker Hughes report showed a drop in the number of oil rigs. Encouraging? Yes. Reliable? That’s a different story.

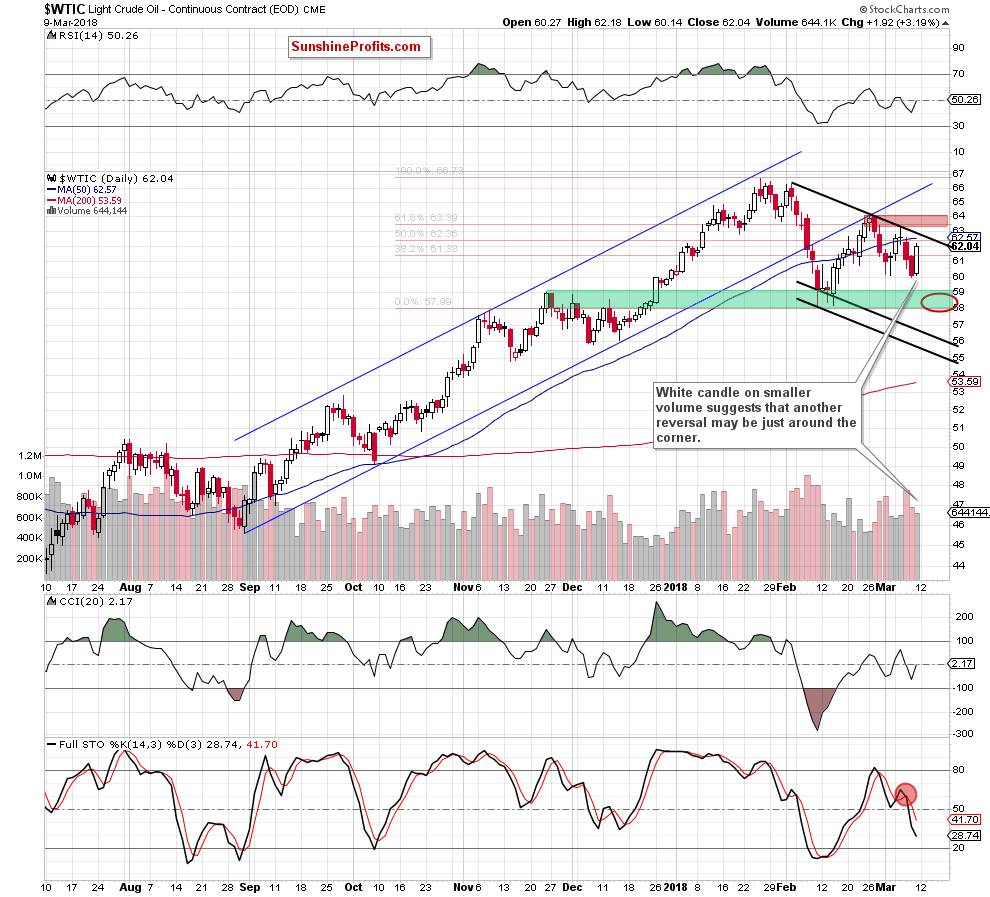

Crude Oil in Short Term

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Although crude oil closed Thursday’s session under the early March lows, oil bears didn’t use this opportunity to push the price higher. Thanks to their weakness, the buyers took control and triggered a quite sharp rebound.

But is this move as positive as it looks at the first sight? In our opinion, it’s not and there are several reasons why we think so.

First, although the commodity increased, it is still trading under the black declining line based on the February highs. As a reminder, this resistance stopped oil bulls at the beginning of the previous week, which means that as long as there is no breakout above it further improvement is not likely to be seen.

Second, light crude remains also under the previously-broken 50-day moving average, which means that the last week’s invalidation of the breakout and its negative impact on the price are still in effect, supporting oil bears.

Third, Friday’s move materialized on visibly lower volume than earlier declines, which suggests that oil bulls may not be as strong as it looks at first glance. At this point it is worth noting that similar situations we saw at the turn of January and February and then at the beginning of March. Back then, the volume levels didn’t grow in line with the price, which was the first clue that the bulls are losing strength.

Fourth, the sell signal generated by the Stochastic Oscillator remains in the cards, indicating that lower prices of black gold are still ahead of us.

Fifth, the fundamental picture of light crude continues to support oil bears. Although Friday’s Baker Hughes report showed that U.S. energy companies cut oil rigs for the first time in almost two months (from 800 to 796), drilling activity remains much higher than a year ago when just 617 rigs were active. Such increase suggests that U.S. crude oil production (which has already risen by over a fifth since mid-2016) will rise even further, putting pressure on the price in the coming weeks/months.

On top of that, earlier today, Dutch bank ING said that money managers liquidated over 15,000 long positions in WTI and created over 4,000 new shorts in the previous week, which pushed the price of crude oil futures lower. Such price action suggests that we’ll likely see a similar drop in the commodity after the market’s open.

Do bulls have any arguments on their side?

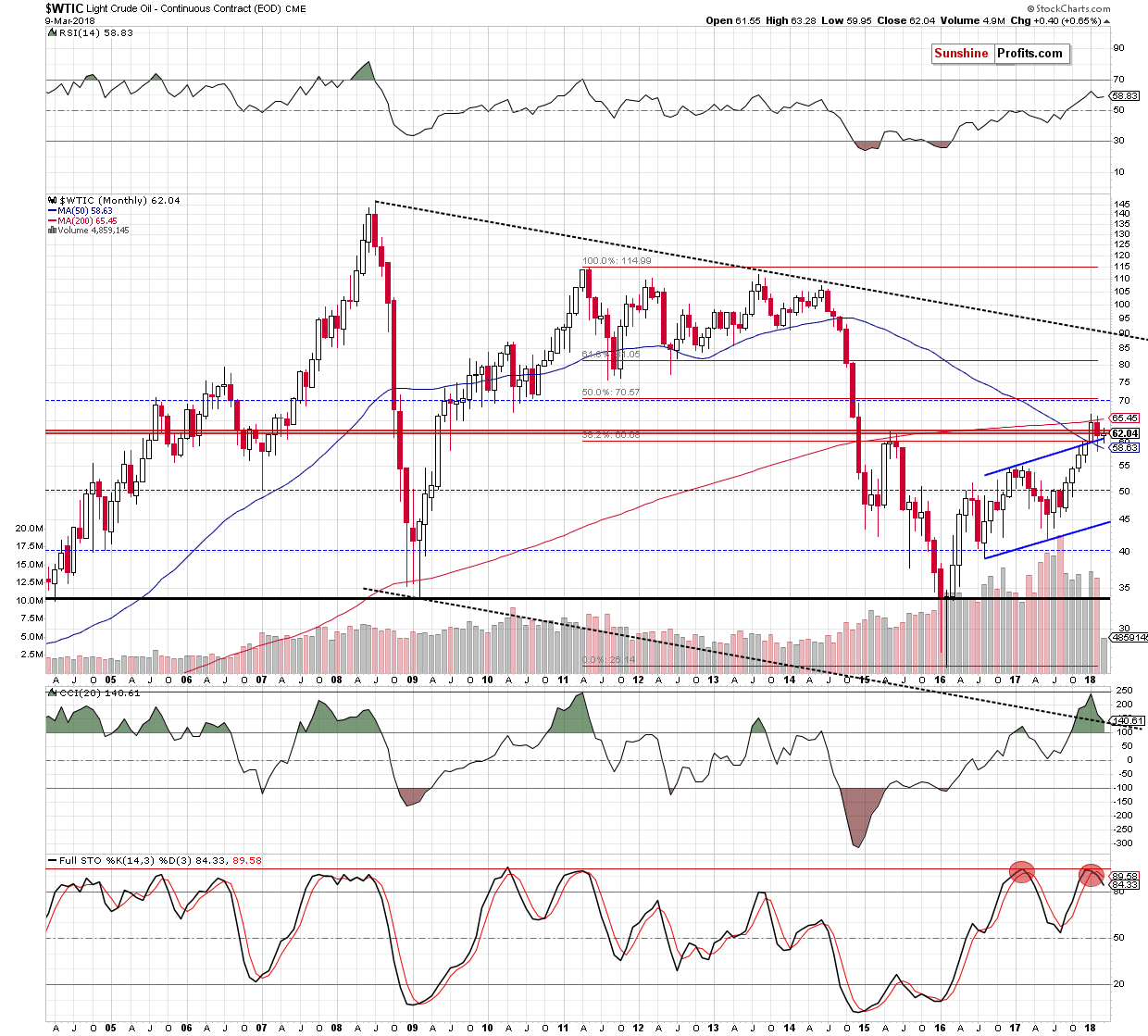

Long-term Picture of Crude Oil

In our opinion, just one – a support from the upper border of the blue rising trend channel. As you see on the monthly chart, the price bounced off it two times this year, which suggests that as long as there is no invalidation of the breakout above this line short-lived moves in both directions should not surprise us.

Nevertheless, we should keep in mind that light crude remains under the May 2015 peak and the 200-month moving average, which means that invalidation of the earlier breakouts and their negative impact on the price are still in effect.

Additionally, the sell signal generated by the Stochastic Oscillator continues to support the bears. At this point, please note that last time when we saw such situation was a year ago. What happened back then? The sell signal preceded a bigger decline, which took crude oil to almost $42 in the following months.

Will black gold test this level in the coming weeks?

In our opinion, such scenario can’t be ruled out, however, it will be more reliable only if the commodity drops below the lower border of the blue rising trend channel, which is currently around $44.40

Summing up, although crude oil bounced off the barrier of $60, the pronunciation of the Friday’s session is not as positive as it might seem at first glance. Additionally, the fundamental picture suggests that dark clouds are gathering over oil and the price drop is only a matter of time. Therefore, we believe that short positions continue to be justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts