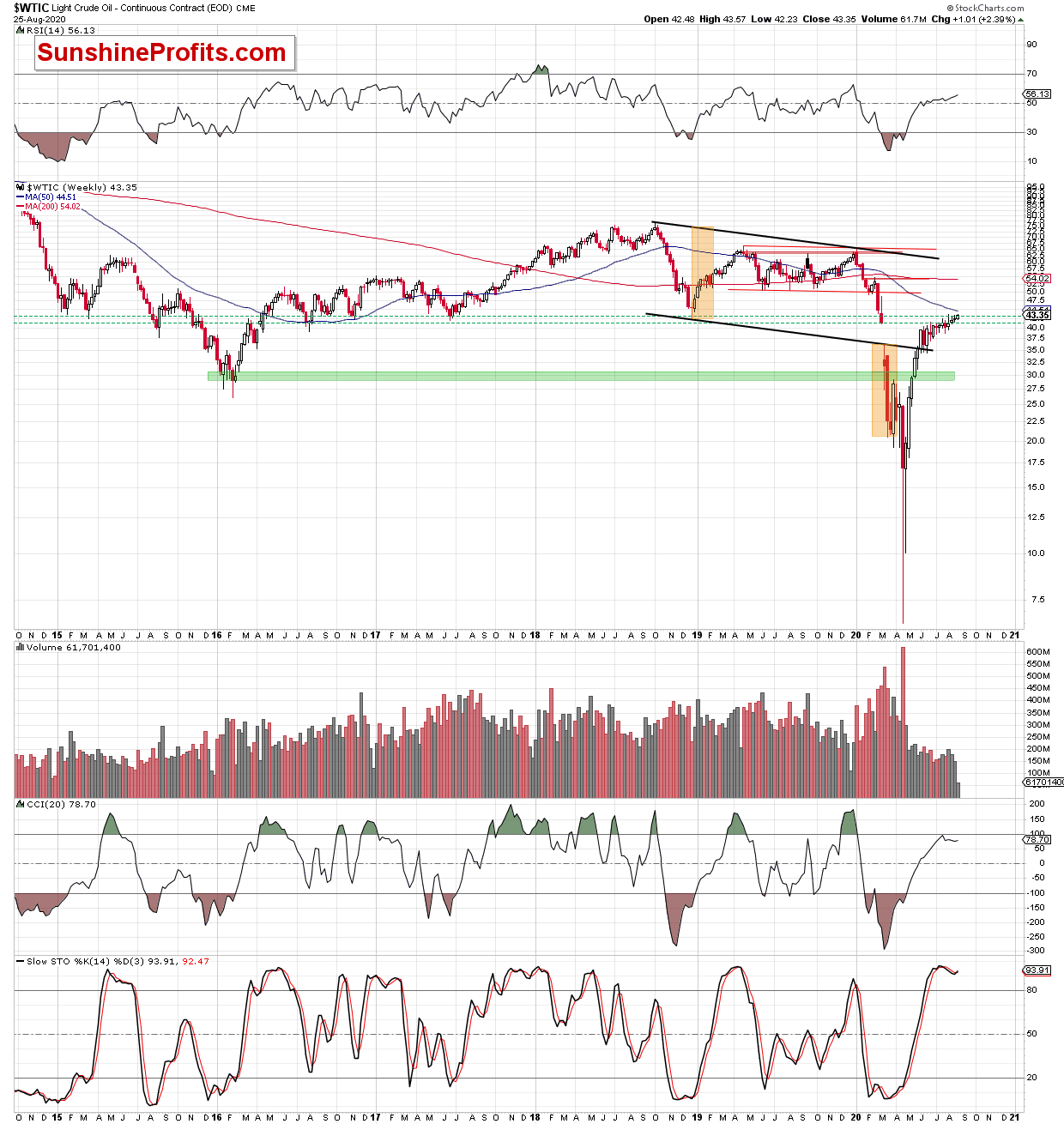

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Today is one of the days when we have practically nothing new to report. Crude oil moved higher on Tuesday, and while this move was not particularly big, you might be wondering if its aftermath changed anything with regard to crude oil's outlook.

In short, it didn't.

Crude oil moved just a few cents above the previous August high, and it didn't change anything from the technical point of view.

Black gold didn't confirm the breakout above the 61.8% Fibonacci retracement level, and it didn't move above the early-March low.

Consequently, nothing really changed, and our previous comments remain up-to-date:

Crude oil continues to trade in practically the same price range, and the forces that make it likely to decline haven't changed since. This means that we have practically nothing new to report in today's analysis - points made on Friday and yesterday, remain valid also today.

We realize that the situation in crude oil is boring and might be discouraging, but please note that it doesn't mean that nothing interesting will happen in the future. Conversely, the periods of very low volatility tend to precede periods with high volatility.

While the USD Index invalidated its breakdown (which is likely bearish for crude oil as USDs strength accompanied oil's huge slide earlier this year), the general stock market moved higher - above its previous high. The latter is a bullish factor for crude oil in the short run, so it's no wonder that we saw some strength. Still, it's important to note that while the S&P 500 moved to new highs, crude oil didn't. It just moved slightly above the August high - not even close to the previous 2020 high.

So, it seems that crude oil will decline, but it might postpone the biggest part of the move until the stock market invalidates its breakout and heads south.

Moreover, let's keep in mind that crude oil still remains below the horizontal resistance level provided by the previous lows.

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications and on the indications from the USD Index. Once we see weakness in stocks, crude oil is likely to get another significant bearish push - and I don't think we'll have to wait for long.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager