Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Oil on the path to recovery. Or is it oil taking a breather?

Let's assess the odds of its upcoming move - what would need to happen for the outlook to solidify?

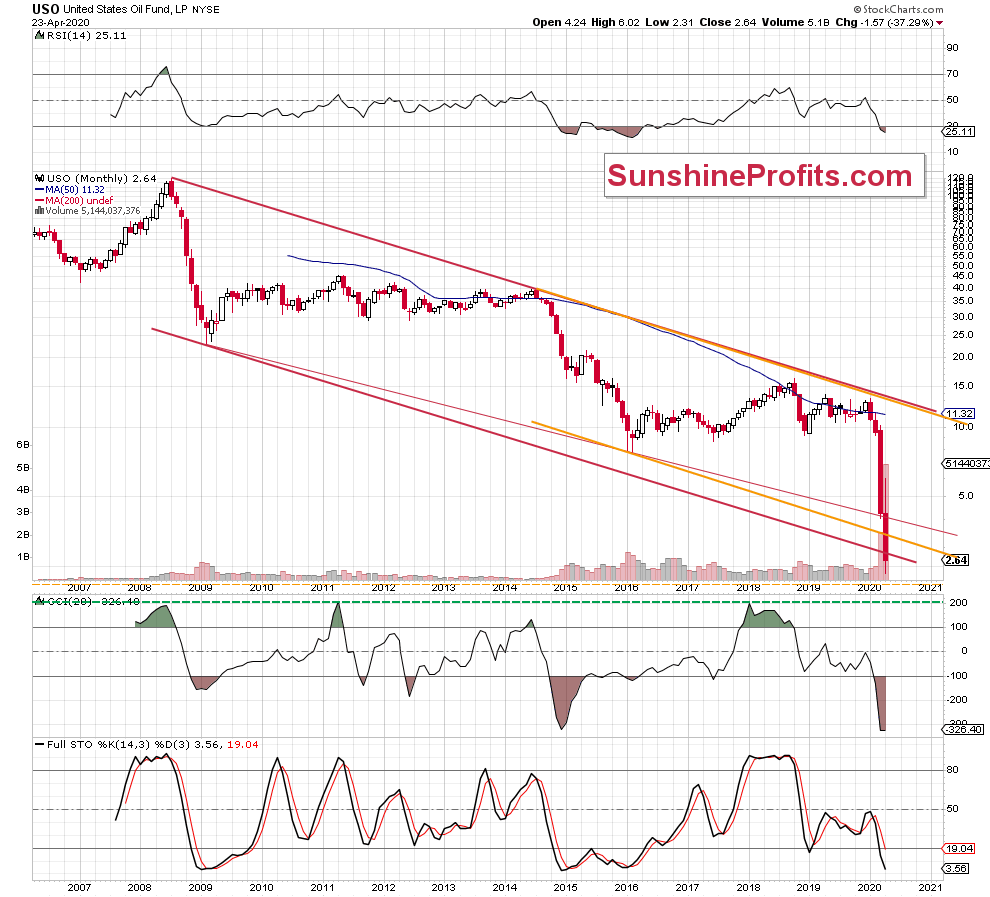

Since the situation in the futures market is too unclear right now, our chart analysis will focus on the most popular crude oil ETF, the USO ETF. We'll look at both the monthly and daily charts once again (charts courtesy of www.stockcharts.com ).

In our yesterday's Oil Trading Alert, we wrote the following:

(...) at the moment of writing these words the USO ETF is trading over 4% above yesterday's close, which could encourage the bulls to fight for higher levels in the following hours. Perhaps that will bring the kind of result that yesterday didn't.

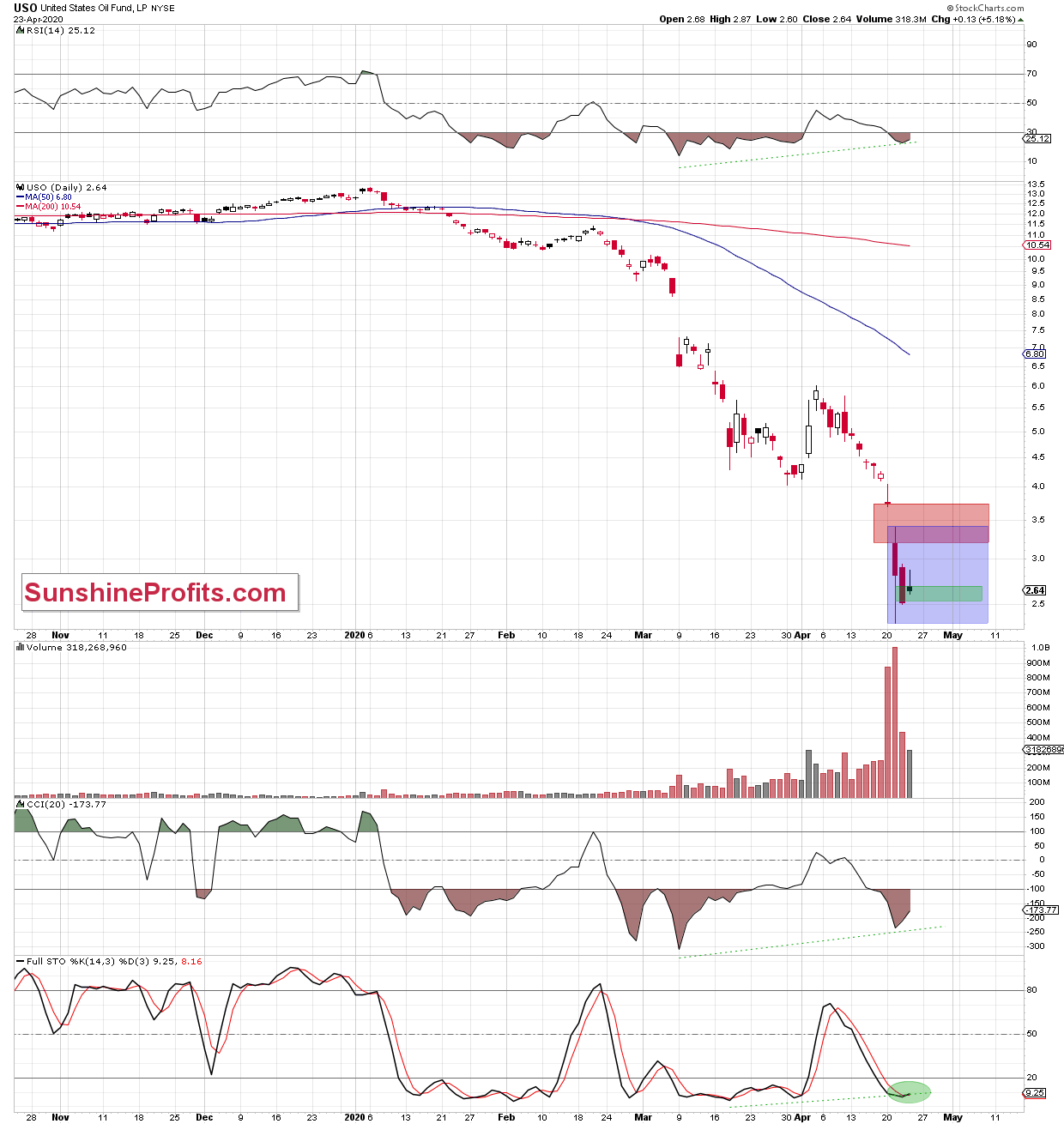

From today's point of view, we see that the USO ETF opened yesterday's session with a green bullish gap, which triggered further improvement.

Despite this "improvement", Wednesday's high in combination with the previously broken lower border of the red declining trend channel stopped the buyers for the second time in a row. As a result, the ETF pulled back and closed slightly below the opening price.

What's next?

In our opinion, as long as yesterday's green gap remains open, the bulls have a chance to push the ETF prices higher. Nevertheless, a bigger move to the upside will be more likely and reliable only if the USO closes today's session (or one of the following) above the above-mentioned lower border of the long-term red declining trend channel.

On the other hand, if the bears manage to close the green gap, the realization of our bearish scenario from Wednesday's Oil Trading Alert will be even more likely:

(...) the USO moved to the previously broken lower border of the red declining trend channel. Unfortunately for the bulls though, this could be just a verification of the earlier breakdown.

Should it be the case, another move to the downside and likely a fresh low (maybe even around 0.50-0.70), is a strong possibility.

(...) in our opinion, it is too early to say that the worst is already behind the bulls, the USO ETF and the oil market. The rush to open any positions can easily prove premature.

Summing up, while crude oil disappointed the bulls and dropped some more yesterday, it's rebounding now. Its strength will determine whether the short-term outlook turns bullish. After Monday's enormous and unbelievable profits in crude oil, it doesn't appear that opening new positions right now is justified from the risk to reward point of view. Soon, it might be though.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager