Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

The short-term oil price action can easily remind one of a seesaw. Which side will emerge victorious? While letting the market to show us its hand, it’s important to be prepared for both scenarios in order to jump on the opportunity that is shaping before our very eyes. Take a seat and let’s do so together.

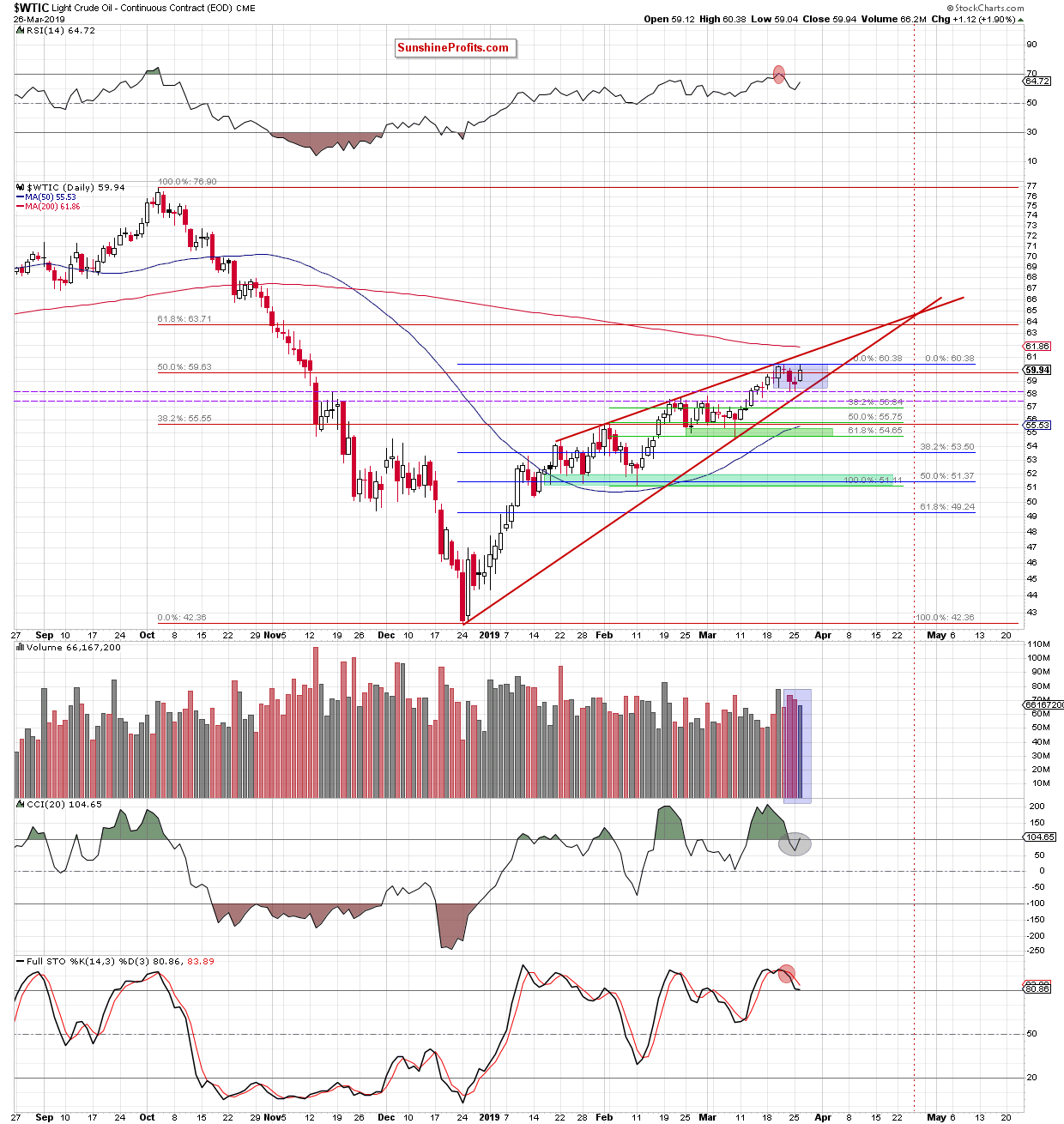

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Crude oil scored an important gain yesterday and revisited the area of last week’s highs. How important that gain truly is, remains to be seen. Is it a double top or a further rally lies ahead?

On one hand, the CCI invalidated its sell signal. With CCI being one of the more sensitive indicators out there, we’ll have to look for other clues elsewhere. On the other hand, black gold is still trading inside the blue consolidation and of course inside the rising red wedge, too. These factors make the very short-term picture a bit unclear.

The volume accompanying yesterday’s upswing was visibly smaller than during immediately preceding declines, but that’s quite normal during consolidations. Therefore, we can’t draw any conclusions from the declining volume alone.

Taking all the above into account, we think that as long as there is no breakout above the upper border of the rising red wedge or a breakdown below its lower border, a bigger and lasting move up or down is not likely to be seen in our opinion.

What could happen if either the buyers or the sellers win? Let’s consider both scenarios now:

- if the buyers take black gold higher, their first upside target would be the upper border of the red rising wedge (currently at around $61.20),

- if the sellers mange to push light crude below the nearest supports (those two dashed horizontal purple lines: the previously-broken February and March 2019 and mid-November 2018 peaks), the way to the first green support zone (created by the late-February and early-March lows and the potential 61.8% Fibonacci retracement of the recent upswing from February lows) would be open as a minimum.

Now comes the question on everyone’s mind: when will we consider opening the next position? Probably if we see a successful breakout above the upper border of the rising red wedge or a breakdown below the lower line of the formation. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. However, if crude oil drops under major short-term supports, we’ll consider opening short positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist