Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

While yesterday's trading brought oil higher, today's trading is marked by back-and-forth movement. Can we glean more information from the tight range crude oil is trading in currently? Yes, and you can find below the odds of the upcoming move.

Let's take a closer look at the charts below charts courtesy of http://stockcharts.com and www.stooq.com ).

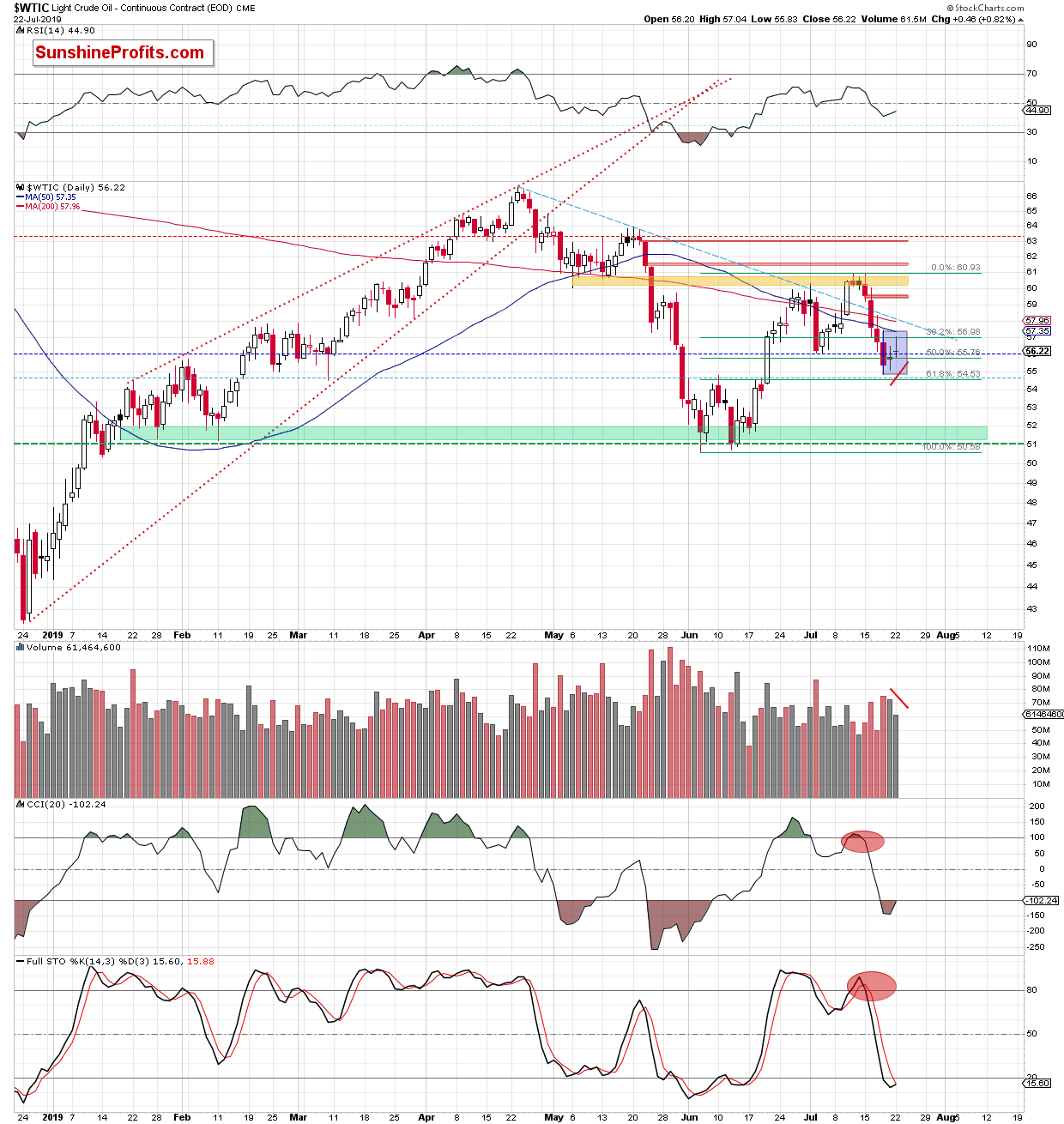

While crude oil has moved higher during yesterday's session, the volume of the upswing has decreased. The sell signals of the daily indicators together with the resolution to the bearish divergences, remain on the cards.

Overall, the situation has little changed as the commodity keeps trading inside the blue consolidation. Let's check the action in the futures for more clues.

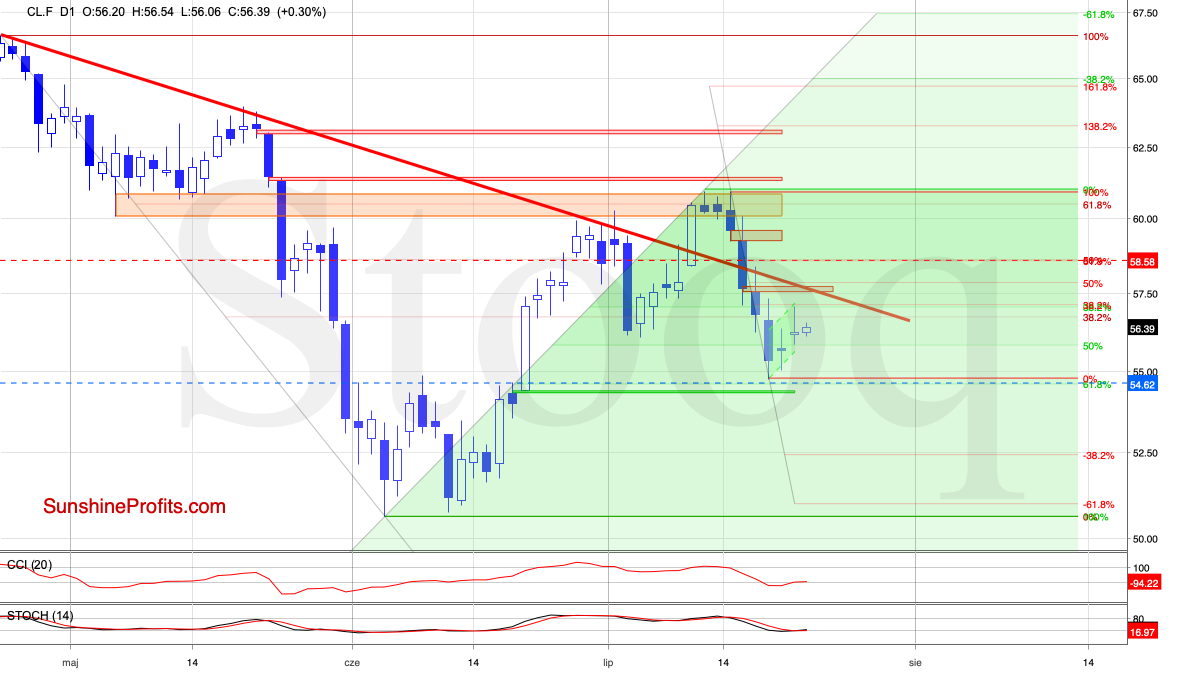

Also here, the situation remains almost unchanged - crude oil futures are still trading in the tight range between yesterday's high and low. It's the 4-hour chart that brings more clarity to the picture. It's apparent that the bulls may not be as strong as they project themselves to be.

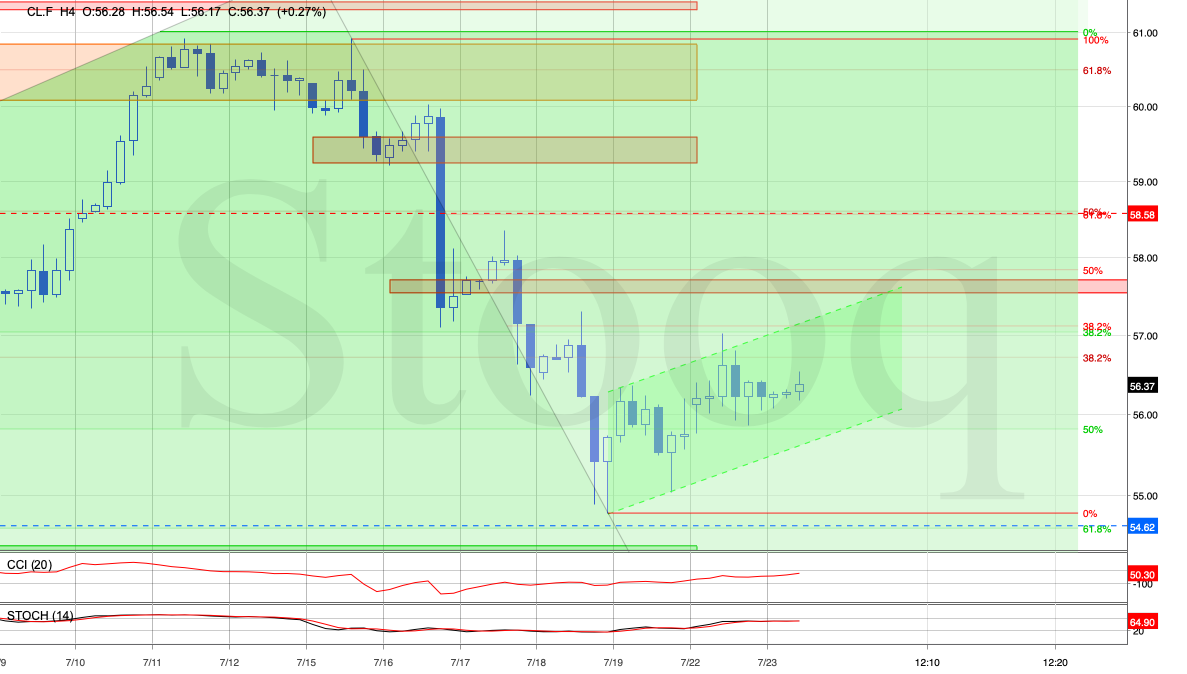

Although crude oil futures moved even higher after yesterday's Alert was posted, the bulls didn't manage to keep the price above the upper border of the very short-term rising green trend channel.

As a result, the price action reverted back into the channel, invalidating the earlier tiny breakout. This is a negative development, which together with all the above suggests that least one more downswing and a fresh July low are still ahead of us.

Let's recall our yesterday's observations:

(...) when we zoom in and take a look at the 4-hour changes, we see that crude oil futures are also trading inside the very short-term green rising trend channel and below the 38.2% Fibonacci retracement based on the entire recent downward move.

Therefore, even if the futures move a bit higher and test the above-mentioned retracement, the short-term picture will remain unchanged as the CCI and the Stochastic Oscillator still have some space for grow.

How low could oil go? The next downside target for the bears will be around $54.58, which is where the 61.8% Fibonacci retracement is.

Summing up, while crude oil moved higher on Monday, the bulls gave up most of their gains before the closing bell. The odds continue to favor the bears heavily. This shows in the increased weekly volume, and in the position of the daily indicators. Even the 4-hour chart reveals that the bulls aren't as strong as they appear to be. All the above factors support the bears and the short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist