Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Crude oil hasn't made much headway in the current back-and-forth trading. But can we glean any insights from the momentary balance of forces? Let's do it.

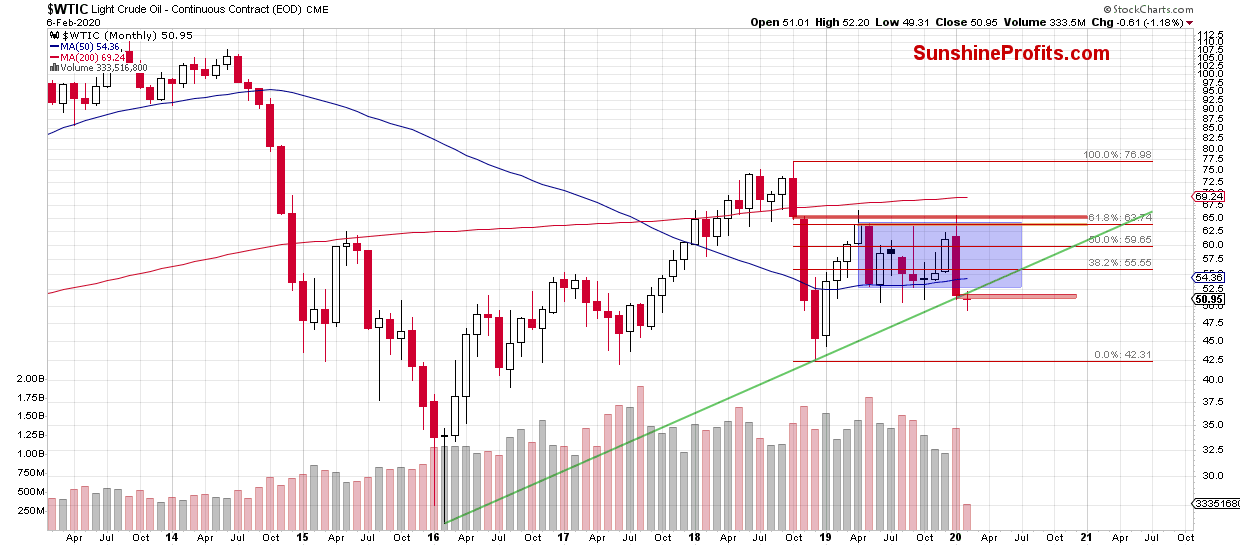

We'll start by examining the monthly chart (charts courtesy of http://stockcharts.com).

The overall situation in the long term hasn't changed much as the commodity is still trading below the following major resistances: the previously broken long-term green line, the red gap and the lower border of the blue consolidation.

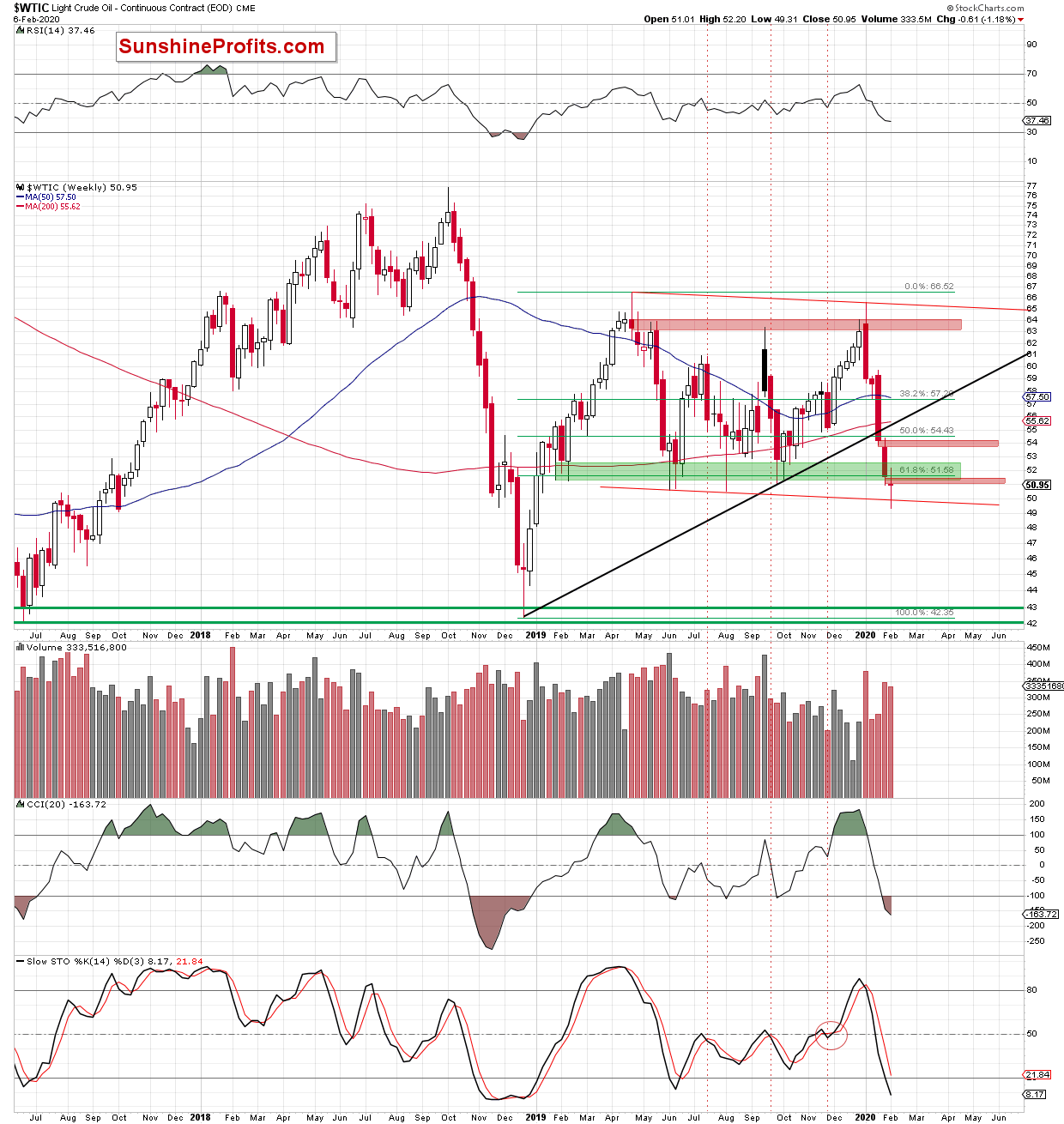

Has anything important changed on the medium-term chart?

Not really, because crude oil is still trading below the red gap created at the beginning of the week. Nevertheless, the potentially bullish signal about which we wrote in our yesterday's Alert remains in the game:

(...) The first thing that catches the eye on the weekly chart is an invalidation of the earlier breakdown under the lower border of the red declining trend channel. Is this a positive sign? Yes, but only at first glance. Why? Because the week is not over yet, today's and tomorrow's session will decide whether this factor can be considered as a bullish.

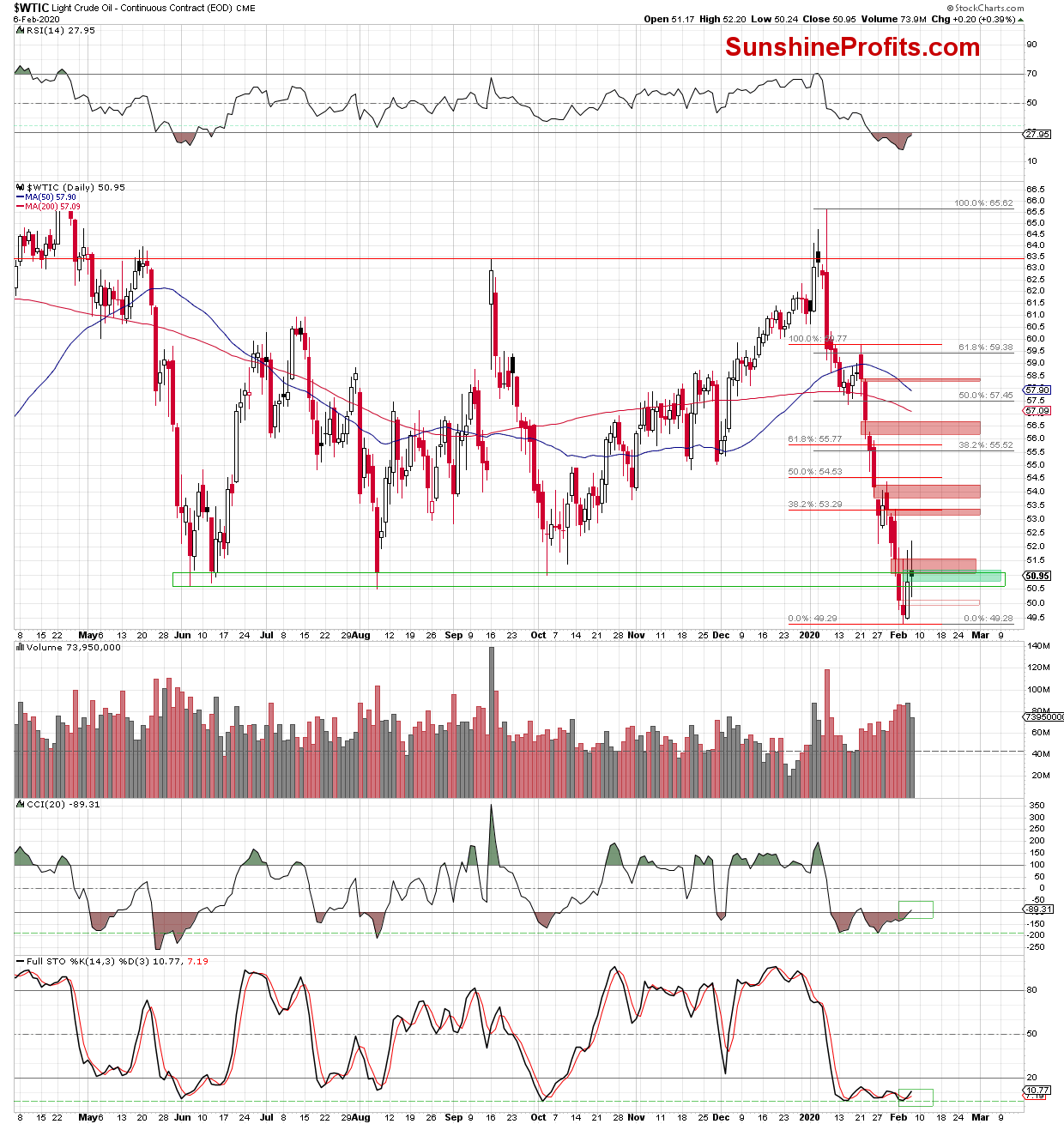

And what was the impact of yesterday's price action on the daily chart?

Yesterday, crude oil opened with a green gap, which triggered further improvement in the following hours. Despite black gold climbing once again above the green zone and the red gap, the bulls didn't manage to hold gained ground. Prices pulled back before the session was over.

The commodity slipped below the upper border of the gap, invalidating the earlier breakout for the second time in a row. This raises doubts about the buyers' strength.

Let's take a closer look at the chart. The green gap remains open and continues to serve as the nearest support. Then, the CCI joined Stochastics in generating a buy signal, further supporting the bulls.

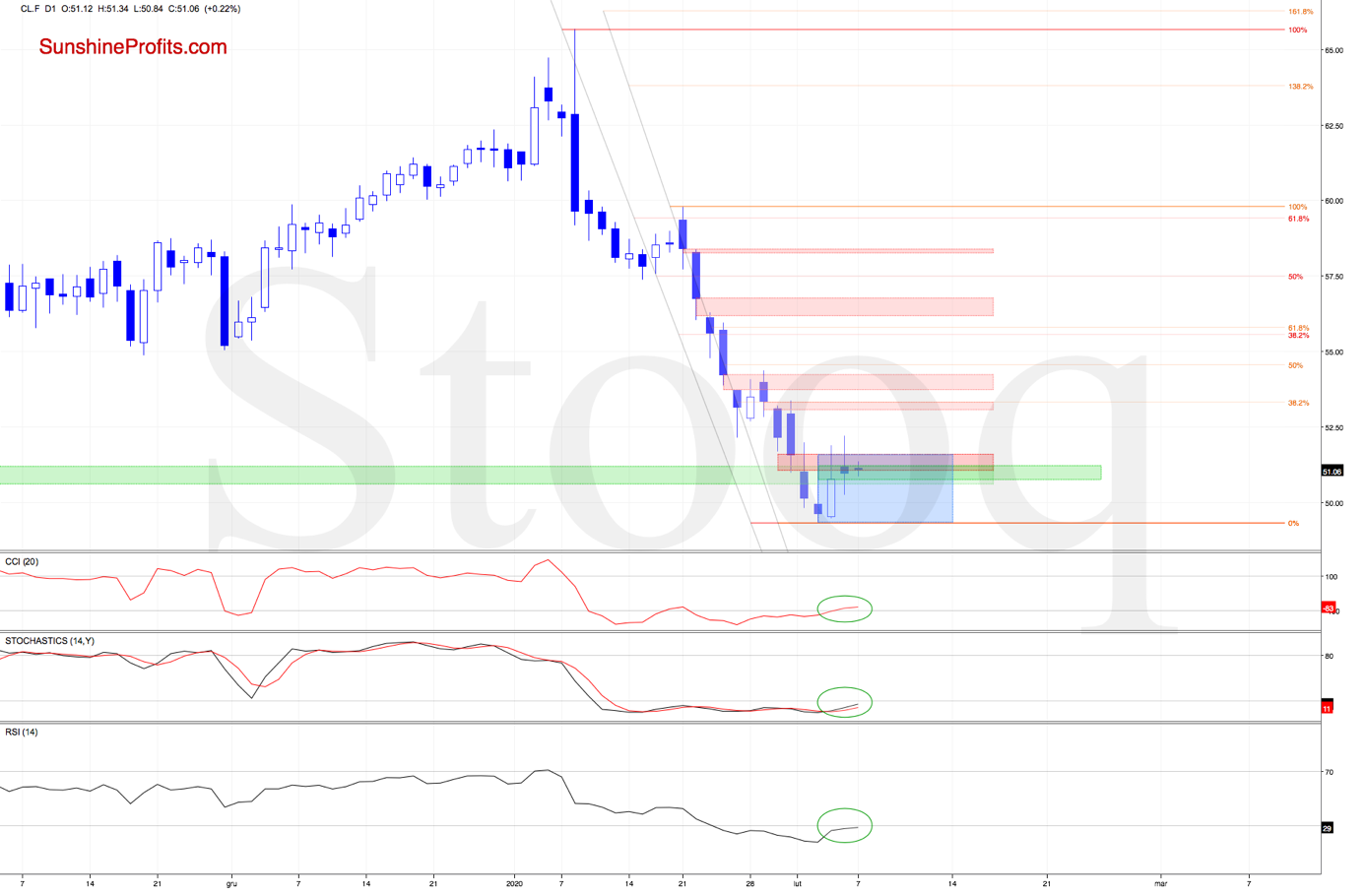

So, have the buyers put these tailwinds into good use in today's pre-market trade?

They didn't. At least not yet.

As you can see, the situation in the very short term hasn't changed much. Crude oil futures are still trading in a very narrow range between the red and the green gap, making the picture a bit unclear.

Therefore, we continue to think that our recent commentaries remain valid also today:

(...) the current position of the indicators is on [the bulls] side (...). However, in our opinion, as long as the nearest resistance zone remains in the cards, the way to the north is closed and another decline can't be ruled out (...)

Nevertheless, if the bulls manage to close the day above the mentioned zone and invalidates the breakdown under the lower border of the red declining trend channel marked on the weekly chart, we'll consider opening long positions.

Summing up, the situation in crude oil is currently too unclear to justify opening any trading positions, but it seems that we might get more signs and decide to open a new trading position shortly.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager