Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday’s feeble price action might have easily slipped your attention. After all, the oil price hasn’t done much in terms of a movement on a closing basis. You could be forgiven for not drawing appropriate conclusions therefrom. We are here to help you do so that no significant clue goes unnoticed – however self-evident or subtle.

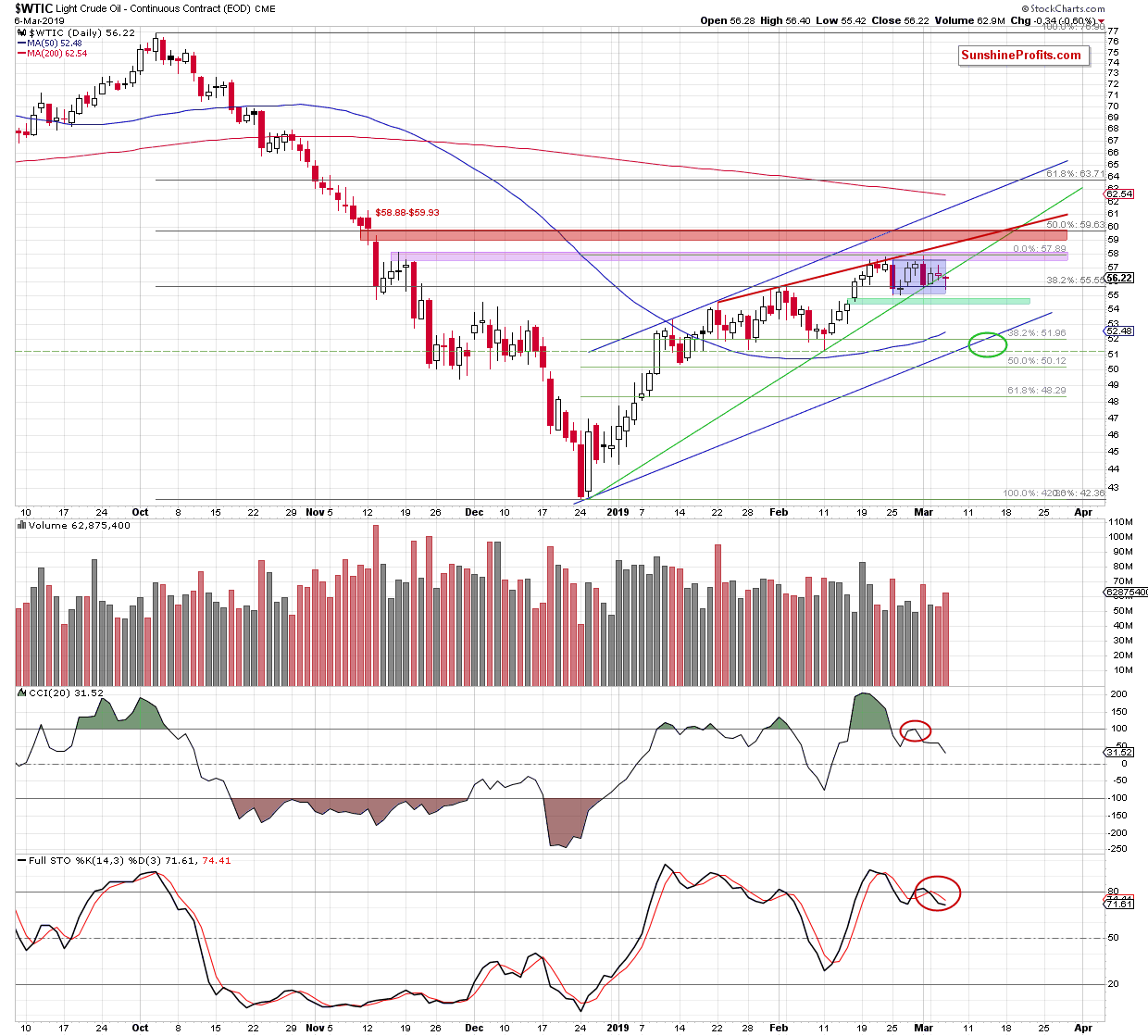

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, crude oil slipped below the rising green support line and closed the day below it. However, the difference between the opening and closing prices hasn’t been huge in any way and an intraday attempt to go lower has been rebuffed. Earlier today, crude oil futures moved a bit higher (they trade at around $56.80 currently), which suggests that we may first see a verification of yesterday’s breakdown below the rising green line before any serious move lower.

Further, black gold is still trading inside the blue consolidation, which suggests that any bigger move will be more likely only after a breakout above the upper consolidation border or a breakdown below the lower consolidation border. It is also trading below two nearest resistances: the purple resistance zone and the rising red resistance line.

For your convenience, we have marked with a green circle the position of our initial downside target: it’s right at the lower border of the rising blue trend channel, reinforced by the 38.2% Fibonacci retracement of the whole 2019 oil price upswing.

Let’s quote our yesterday’s summary that remains up-to-date also today:

(...) Summing up, short positions continue to be justified from the risk/reward perspective as the bears have many factors on their side - recent tiny breakout invalidations, price trading beneath important resistances, the bearish volume implications and the bearish positioning of the daily indicators. All these favor the sellers and another move to the downside in the nearest days.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist