Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Yesterday, we haven’t seen a tentative move higher in oil as the day before. How close to the end of the bull run in black gold are we actually? Or will it be a pause only? After all, OPEC looks to be keeping their production cuts promise and the situation around U.S. sanctions on Iran makes good fodder for the bulls. Tomorrow, we’ll get U.S. crude oil inventories data. How do the news translate into the charts – and what can we learn from the charts actually?

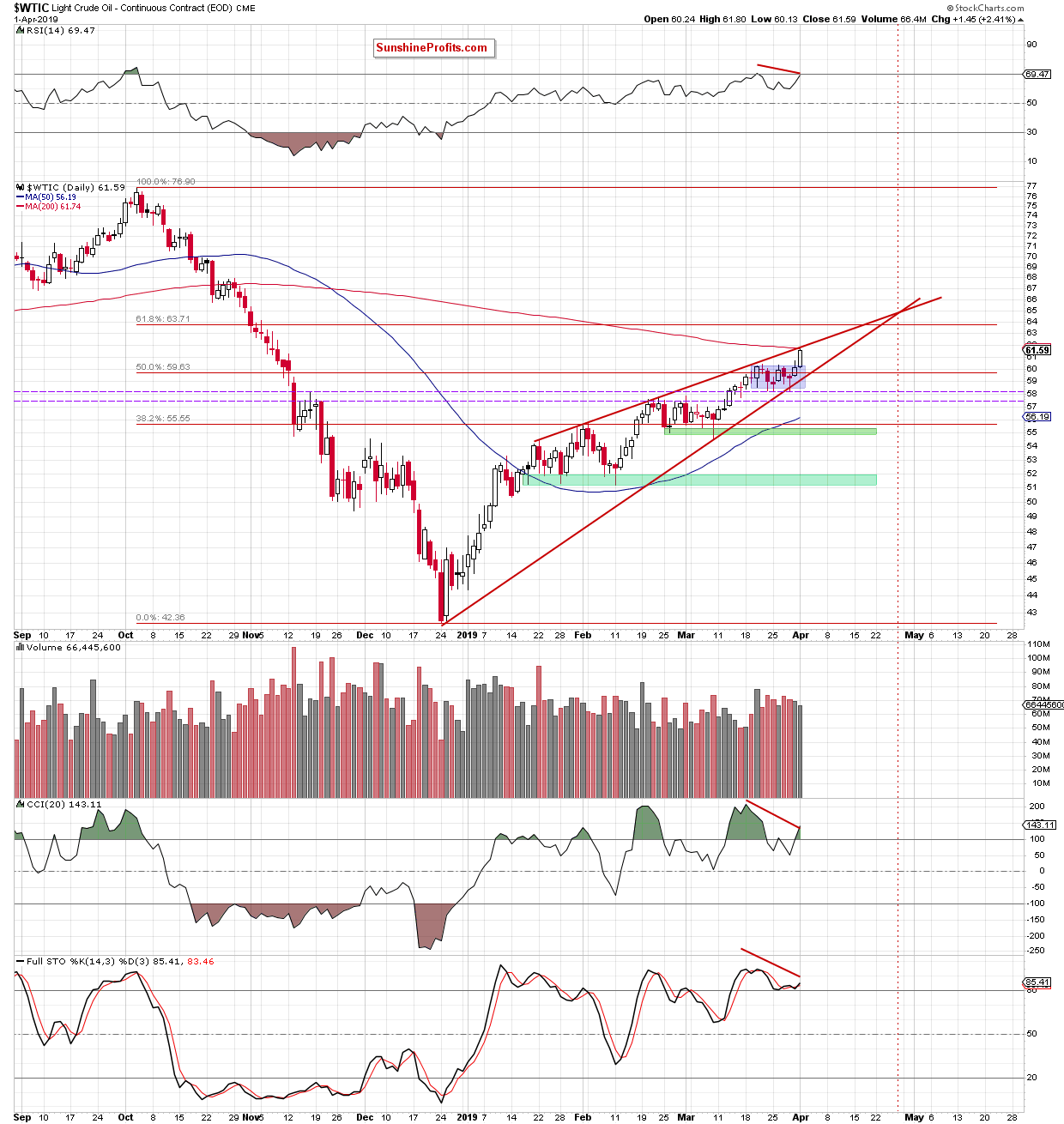

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

We wrote these words on Friday:

(…) we’re likely to see a test of the upper border of the blue consolidation or even an increase to the upper line of the red rising wedge and the 200-days moving average in the very near future.

Yesterday, we added:

(…) crude oil extended gains and closed the week (and (…) March) above the 50% Fibonacci retracement of the downswing starting in October 2018. The volume accompanying past week’s rise increased, suggesting underlying buying power.

This is a bullish development, which suggests the likelihood of yet another attempt to move higher (…)

Indeed, the price of black gold hit a fresh 2019 peak on Monday. Thanks to this move, the commodity reached our Friday’s upside targets: the upper border of the red rising wedge and the 200-days moving average. Having reached them increases the probability of reversal in the coming day(s).

The bearish scenario is also reinforced by the current position of the daily indicators. We see their bearish divergences forming and have written about that also yesterday. Last but not least, there’s the volume. As it looks to have plateaued and slightly declines from one session to the other, it really somewhat calls into question the strength of the bulls.

Nonetheless, as long as the commodity remains inside the red rising wedge, another bigger move is not likely to be seen and short-lived moves in both directions should not surprise us.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. However, if crude oil drops below major short-term supports, we’ll consider opening short positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist