Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Yes, crude oil has closed higher yesterday. Yes, the volume it had done so on was higher than in two previous session. Is that necessarily bullish, though? Has the charm of OPEC production cuts extension run out? Let's see the chart to examine the chances of the bears returning to the trading floor both soon and with force.

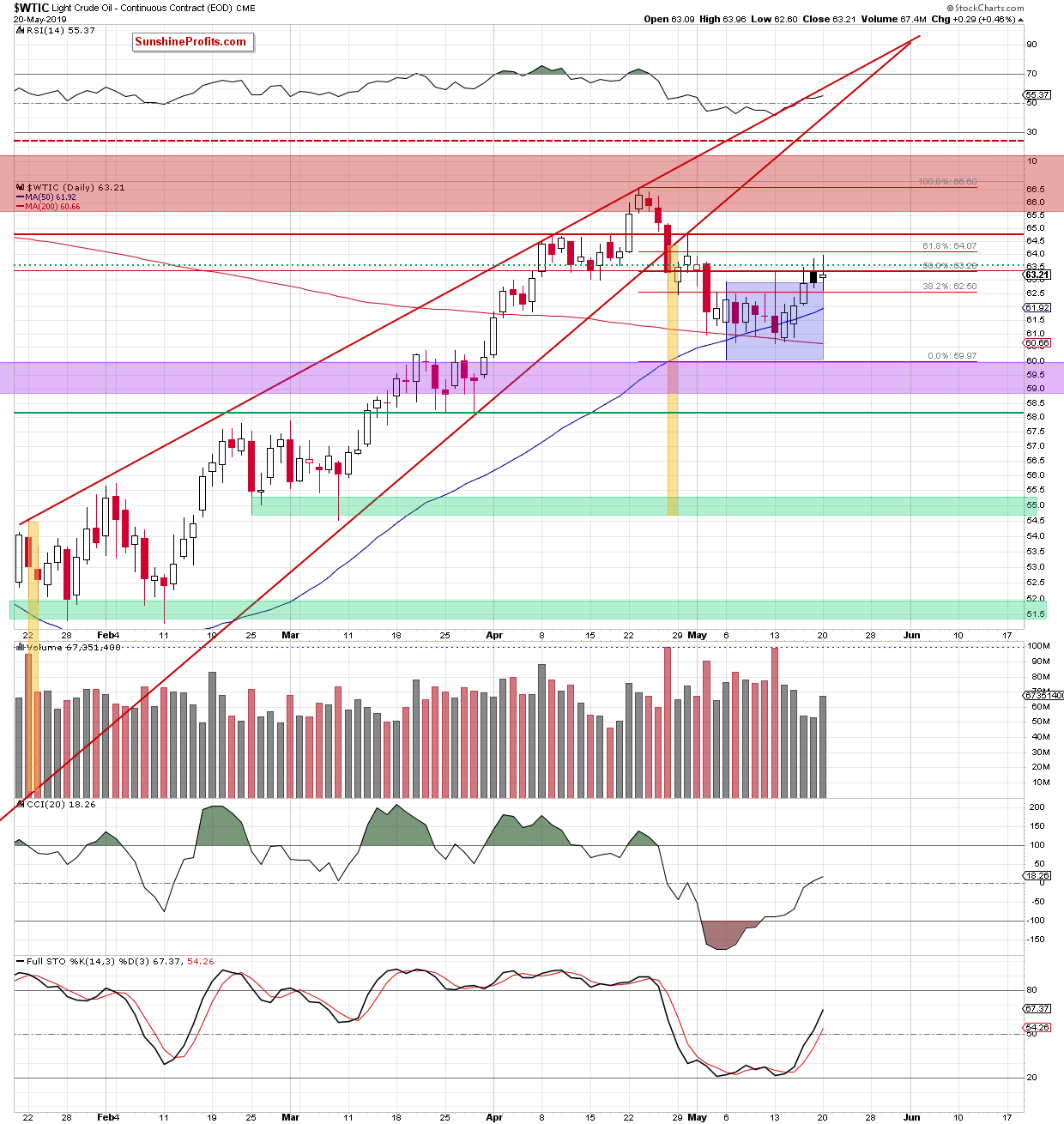

We'll take a look at the daily chart below (chart courtesy of http://stockcharts.com).

Crude oil rose yesterday though the session represents nothing to call home about for the bulls. They haven't reached the 61.8% Fibonacci retracement and gave up most of their gains before the session was over.

The bears seized the opportunity and brought the price down below the 50% Fibonacci retracement. This has been the third unsuccessful attempt to overcome it in a row. While seeing black gold close above the blue consolidation might seem positive on the surface, an upcoming reversal is a more likely possibility.

And indeed, oil is changing hands below $63.10 currently. Should the commodity keep moving lower from current levels, we're likely to see at least a test of the lower border of the blue consolidation.

Summing up, the outlook for oil remains bearish. Oil is still trading below the previously-broken red horizontal line and has trouble overcoming the 50% Fibonacci retracement. The volume on upswing days has been decreasing and yesterday's higher value coupled with significant upper knot points to increasing bearish pressure around the corner. Besides, the weekly indicators still supports the downside move. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist