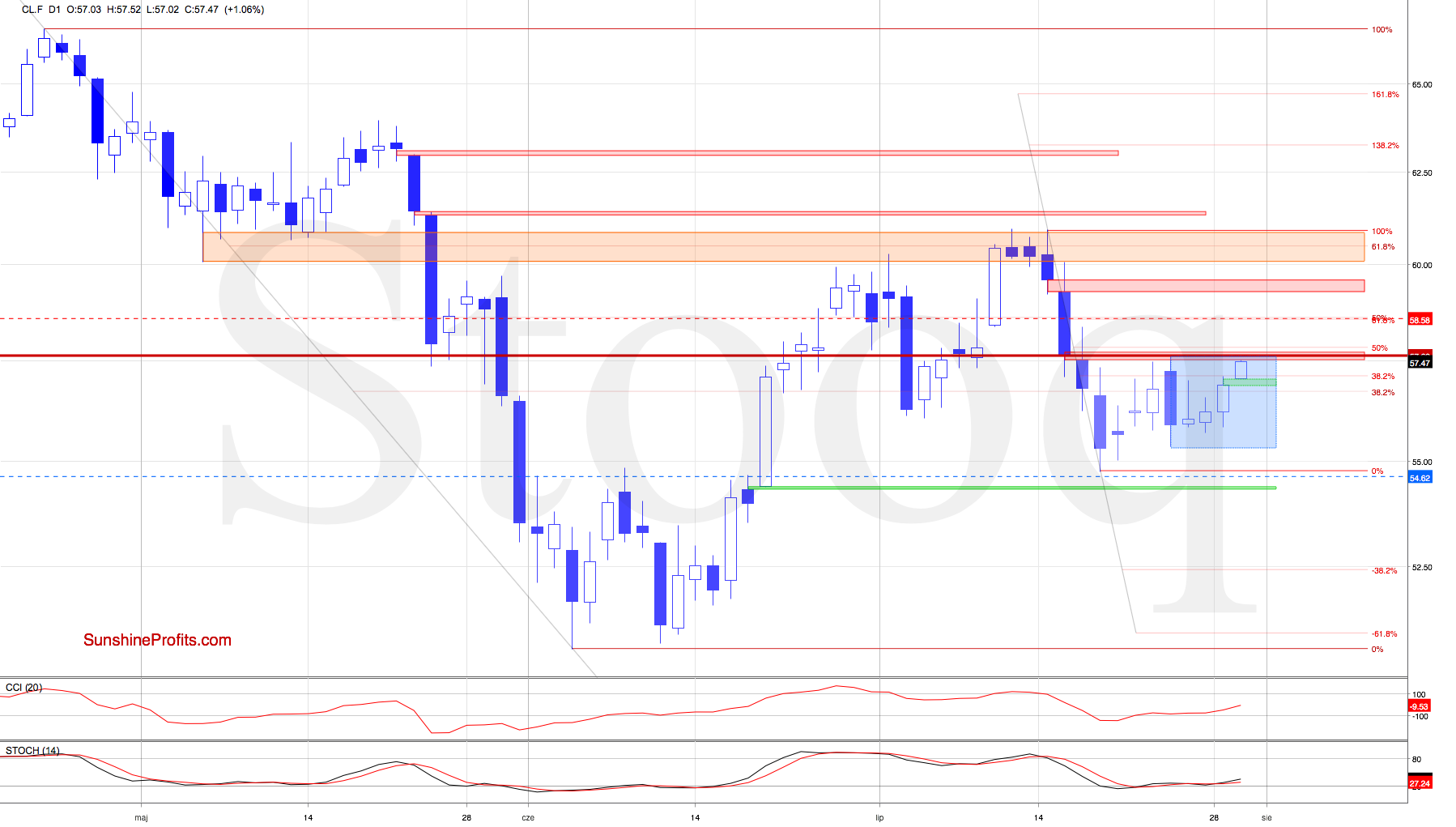

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Oil has gained yesterday and the modest move higher continues today. Very modestly so. Does it look like there's strong overhead resistance nearby, perhaps not just one? That's exactly what we cover in today's Alert, with implications thrown in for good measure.

Let's take a closer look at the charts below (charts courtesy of www.stooq.com ).

Earlier today, crude oil futures opened with a green gap, emboldening the buyers. However, they are still trading below the last week's peak, the red gap and also below the upper border of the blue consolidation.

Let's take a look at the 4-hour chart below. We see that the CCI and the Stochastic Oscillator are very close to generating their sell signals, which in combination with the above increases the probability of seeing a reversal in the very near future.

Should it be the case and crude oil futures go south from here, the initial downside target for the bears will be the lower border of the blue consolidation (at around $55.35).

Summing up, while crude oil moved higher yesterday, the bulls were unable to overcome any of the nearby resistances. The daily indicators are on the verge of issuing their sell signals and the short position remains justified. This is further supported by both the weekly chart and daily chart's declining volume on the upswings, attesting to declining strength and involvement of the bulls.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist