Trading position (short-term; our opinion): Short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

It turns out, the bulls haven't made it that far. And we were ready with a game plan to take advantage of it. Let's dive in to the details of the trading action.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

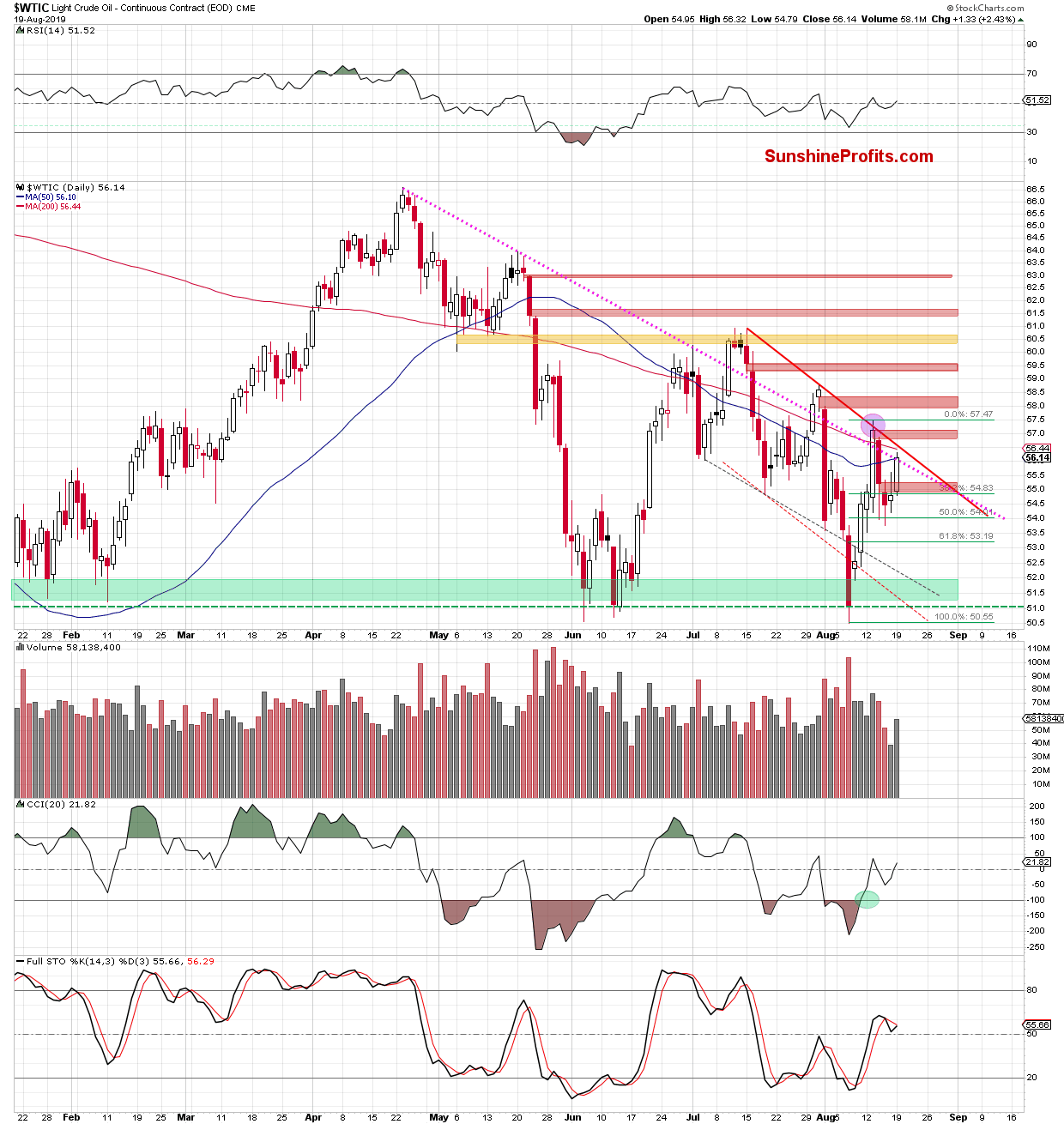

Yesterday, crude oil extended gains and climbed to the previously-broken 50-day moving average. Despite the tiny intraday breakout however, the commodity reversed and closed the day below this resistance. Such price action looks like a verification of the earlier breakdown.

Additionally, black gold rose to the pink dotted resistance line marked by the April and May highs. Let's quote our August 15th Alert - it applies to the recent instances of the bulls reaching this important resistance:

(...) This is similar to the price action we have seen two times in the past: on July 16 and then on August 1. In both cases, such development translated into further deterioration in the following days.

Combining the above with the sell signal generated by the Stochastic Oscillator, a reversal and lower prices of light crude may be just around the corner.

How did yesterday's price action affect the futures market earlier today?

Before we answer this question, let's recall what we wrote yesterday:

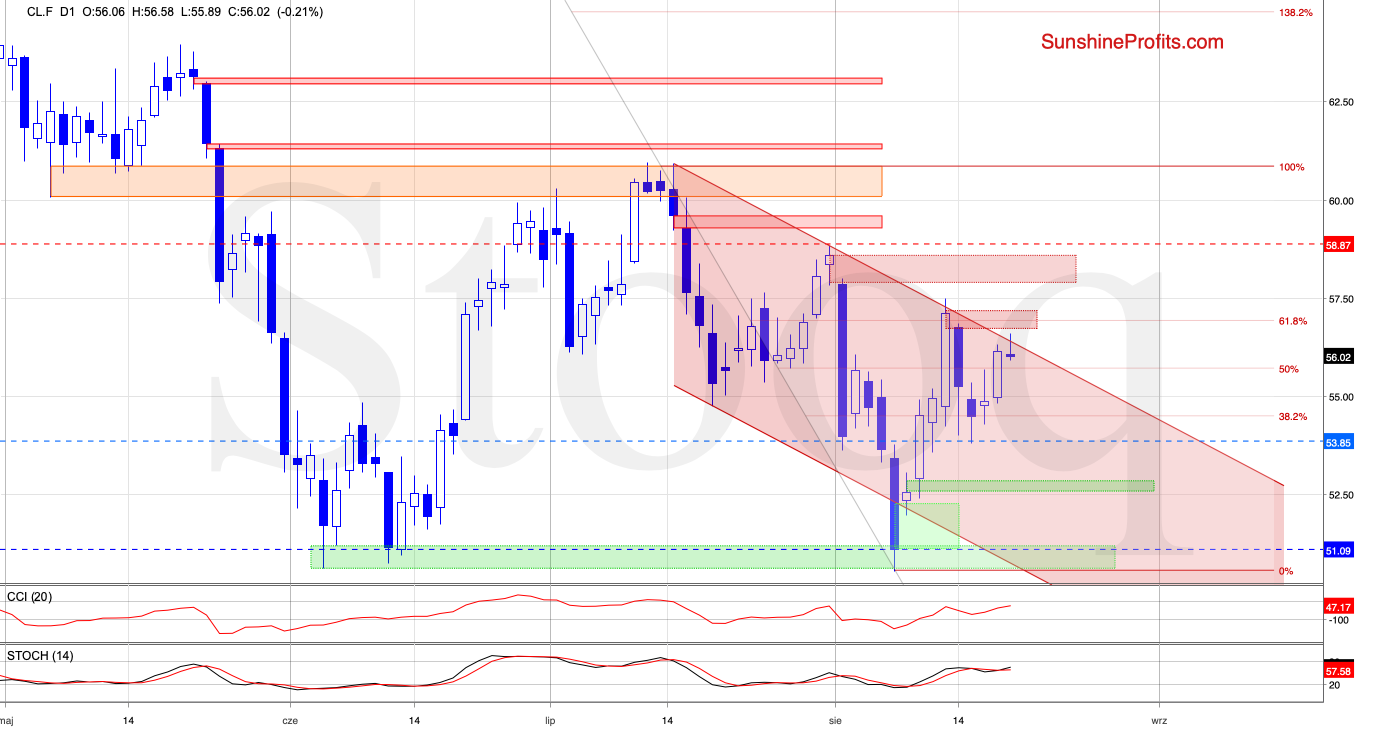

(...) If ... the bulls march higher from here, we'll likely see them test the upper border of the declining red trend channel or even Wednesday's red gap.

Crude oil futures indeed moved a bit higher earlier today, breaking above the upper border of the declining red trend channel. They approached the red gap and the 61.8% Fibonacci retracement.

These resistances encouraged the sellers to act and the futures pulled back invalidating the earlier breakout. This is a bearish development, which suggests that further deterioration may be just around the corner - especially when we factor in the current position of the daily indicators and the very short-term picture as this 4-hour chart shows.

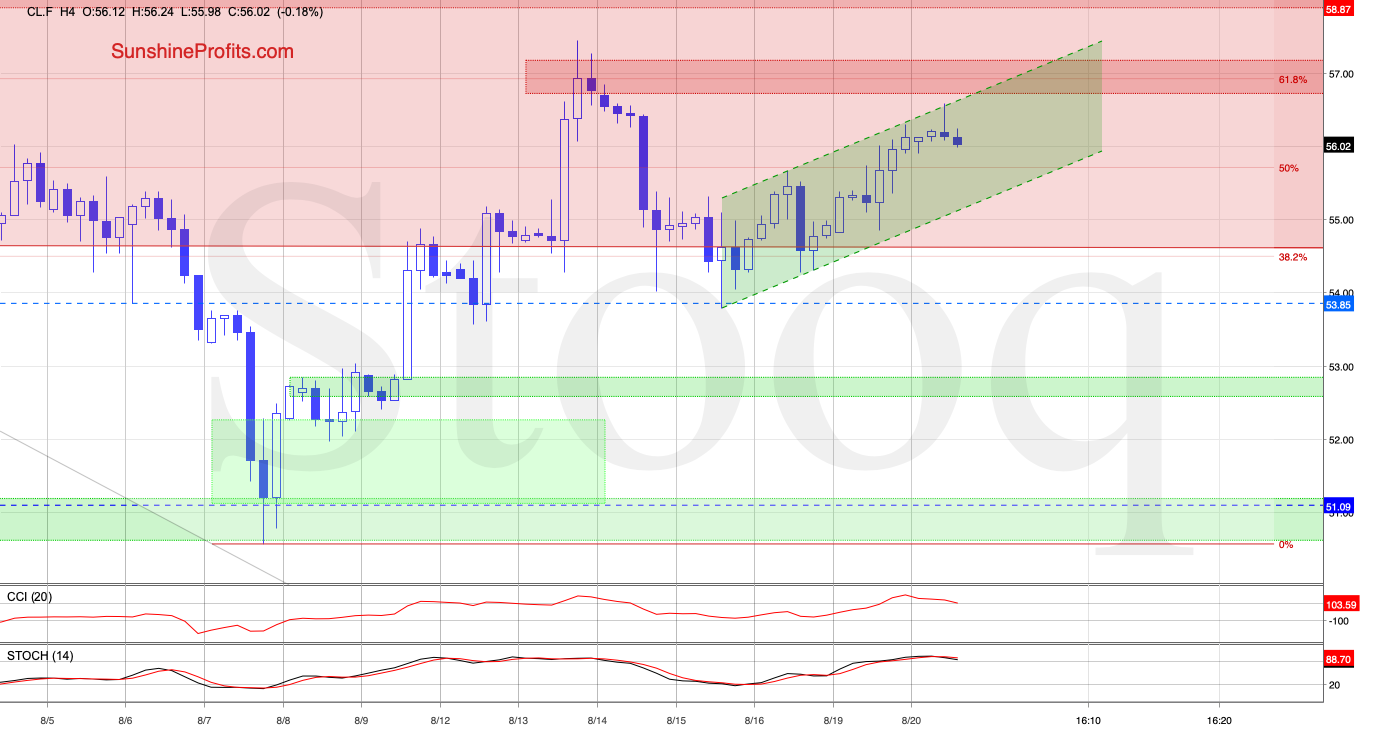

Thanks to today's upswing, crude oil futures moved to the upper border of the very short-term green rising trend channel. Despite this positive development, the bulls didn't manage to push them any higher, and the commodity pulled back.

Additionally, the CCI and the Stochastic Oscillator are very close to generating their sell signals, which increases the probability of a move to the downside in the very near future. Such a move would aim to test at least the lower border of the green formation.

Connecting the dots, opening short position is justified from the risk/reward perspective. All details below.

Summing up, oil bulls have reached an important resistance yesterday, and have been unable to build on their gains earlier today. The recent instances of reaching this resistance, the Stochastic Oscillator's sell signal and the 4-hour chart indicate that a downward oil reversal is very likely. Opening a short position is therefore justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist