Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $33.78 as the stop-loss level. We might adjust this target in the following Alerts.

Yesterday's oil rebound has fizzled out, but what about today? Will oil bulls fare any better?

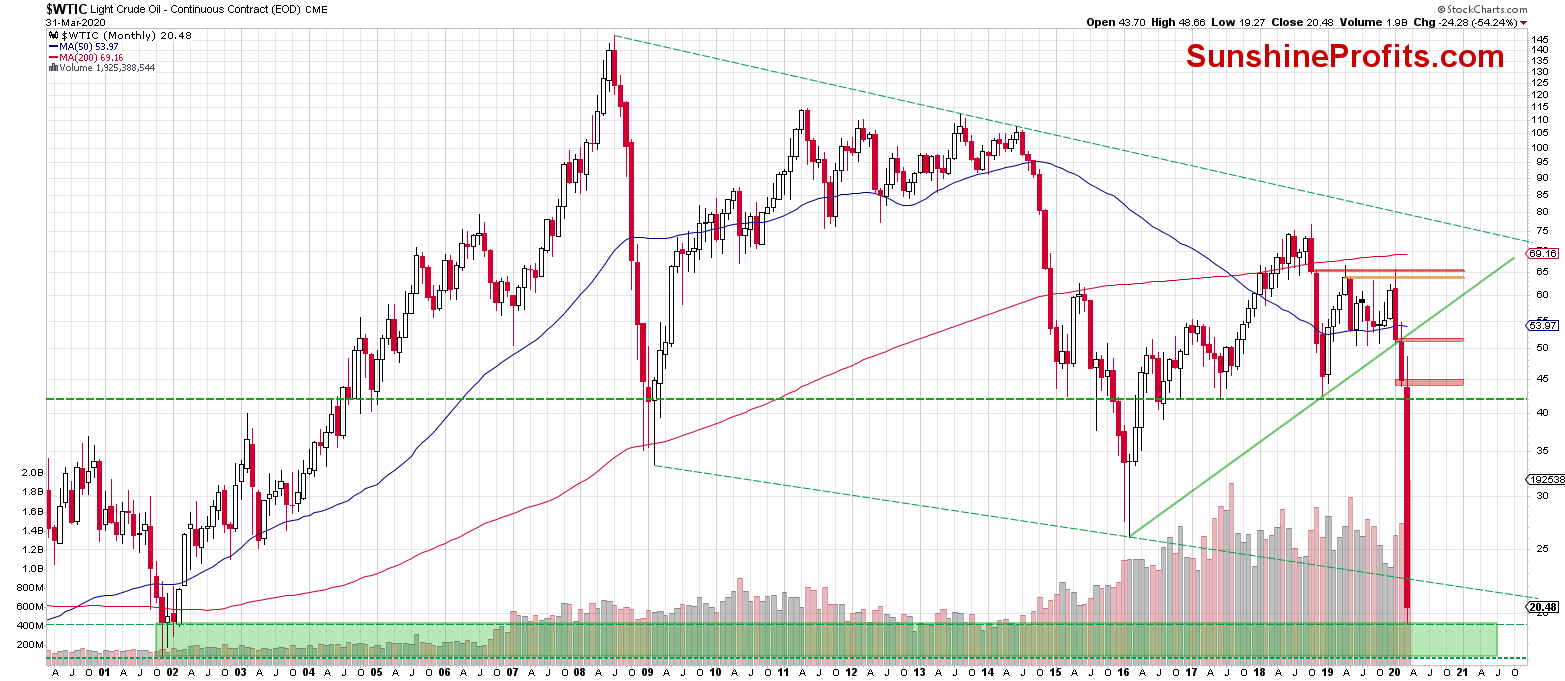

Let's start today's analysis looking at the long-term (chart courtesy of http://stockcharts.com and www.stooq.com ).

These were our yYesterday, we wrote the following notes:

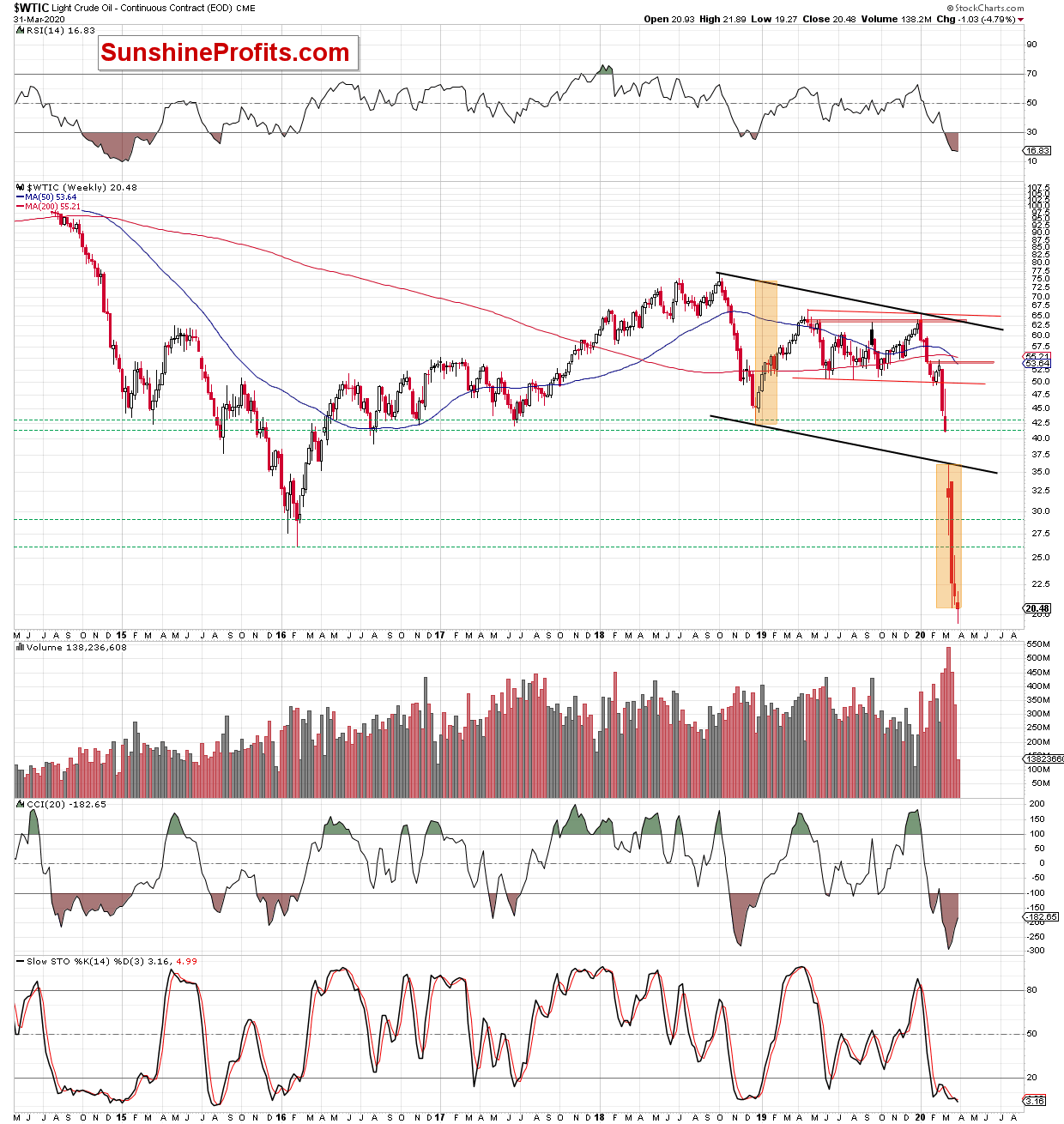

(...) Crude oil futures opened the day with the green bullish gap, which triggered further improvement in the following hours. Thanks to this upswing, the futures invalidated yesterday's breakdown below the lower border of the blue consolidation marked on the above chart.

However (...) despite today's very short-term improvement, the futures are still trading below the upper border of the red bearish gap created yesterday. This means that as long as it remains open, the way to the north is blocked and another reversal from this area is likely.

The daily crude oil futures chart clearly shows that although the bulls tried to close the red gap, they failed. Quite a sharp pullback followed before the session's close.

As a result, market participants formed a candlestick with a long upper shadow, which highlighted the weakness of the bulls and shows the area where the bears wake up.

Thanks to this price action, the futures opened today with a small pink bearish gap. Although the buyers tried to close it in the following hours, they failed and the gap remains open at the moment of writing these words.

Additionally, yesterday's session finished below the lower border of the blue consolidation, which suggests that Tuesday's upswing could be nothing more than a verification of Monday's breakdown.

Today's bulls' weakness seems to confirm this assumption, however, as long as there is no another daily close below the consolidation, the bulls still have a chance to improve their standing. This is especially the case when we take into account our yesterday's commentary on the broader situation in black gold:

(...) The long-term chart shows that the commodity approached the upper border of the green support zone based on the late 2001 and early 2002 lows.

Additionally, this month's decline took black gold to the area, where the size of the downward move corresponds to the height of the long-term black declining trend channel. Both factors could encourage the bulls to fight for higher prices ahead.

Before summarizing today's Alert, please keep in mind yesterday's American Petroleum Institute's data. Although the report showed that distillate fuel inventories fell by 4.5 million barrels (compared with expectations for an increase of 1 million barrels), US crude oil stocks rose by 10.5 million barrels in the week to March 27 to 461.9 million barrels, missing analysts' expectations for an increase of 4 million barrels. Additionally, gasoline inventories rose by 6.1 million barrels, also missing analysts' expectations for a 1.9 million-barrel increase.

Therefore, if today's EIA report confirms these bigger-than-expected increases in crude oil and gasoline inventories, the buyers could have issues defending the $20 barrier. In this case, we'll likely see another reversal after the unsuccessful attempt to close the red Monday's gap and at least a test of this week's low.

However, if that is broken, the way to around $17.12 (the November 2001 low) will likely come into play.

On the other hand, if the bulls manage to invalidate the breakdown below the lower border of the blue consolidation (marked on the daily chart of crude oil futures) and close the red gap, we'll consider closing our already profitable short positions and taking profits off the table.

Summing up, today's petroleum report will bring more clarity into the bulls' ability to continue defending the $20 WTI mark. As the report is likely to show greater inventories than anticipated, it would likely serve as a catalyst of further selling. This would result in another reversal lower. This way, Tuesday's upswing would be nothing more than verification of Monday's breakdown. Should the bulls invalidate this breakdown, we'll consider closing the profitable short positions. Stay tuned, however likely it appears that our profits on the current short position are likely to grow considerably in the following days.

Trading position (short-term; our opinion): Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $33.78 as the stop-loss level. We might adjust this target in the following Alerts.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager