Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

While consolidating, crude oil has been moving tentatively higher. Is there any stopping them now or is it clear skies ahead? We have multiple time perspectives to show you the odds of the next move. Where would that one run into headwinds? Please take a look at what we can infer about its strength.

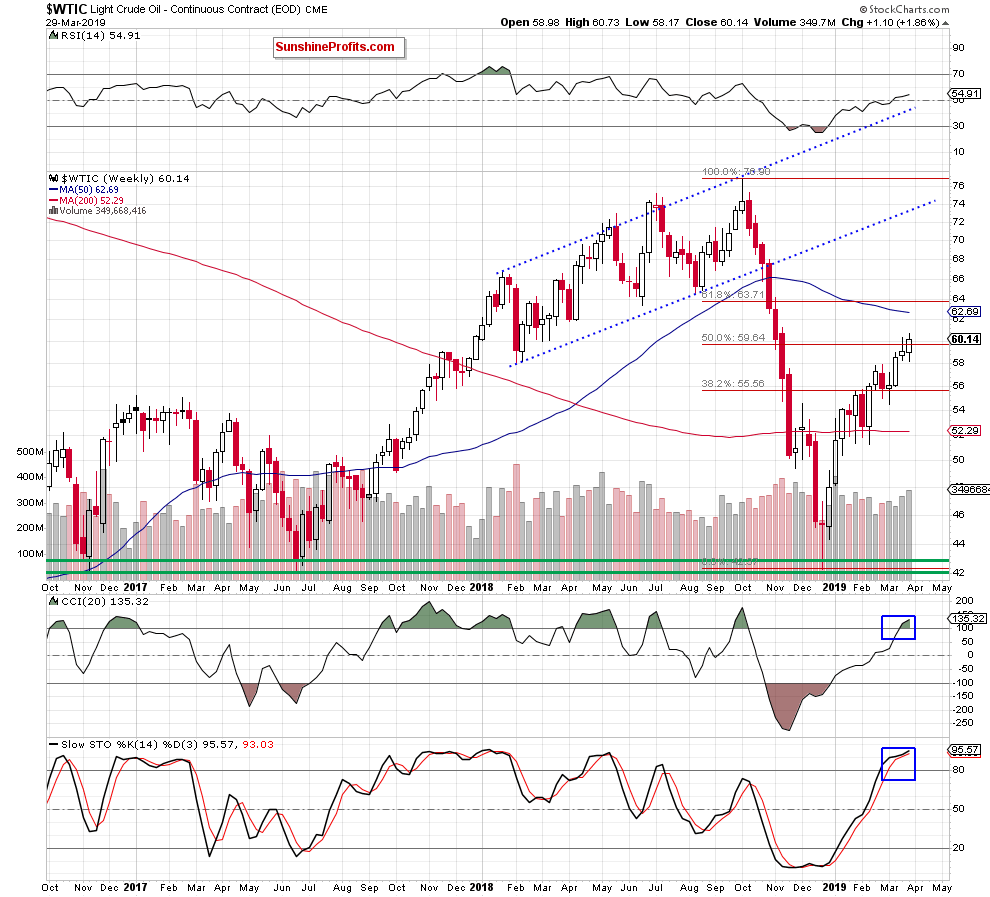

Let’s take a closer look at the weekly chart below (both charts courtesy of http://stockcharts.com).

On Friday, crude oil extended gains and closed the week (and the whole month of March) above the 50% Fibonacci retracement of the downswing starting in October 2018. The volume accompanying past week’s rise increased, suggesting underlying buying power.

This is a bullish development, which suggests the likelihood of yet another attempt to move higher. Nonetheless, we should pay attention to the current position of the weekly indicators. They suggest that the space for gains looks limited and reversal in the near future remains likely.

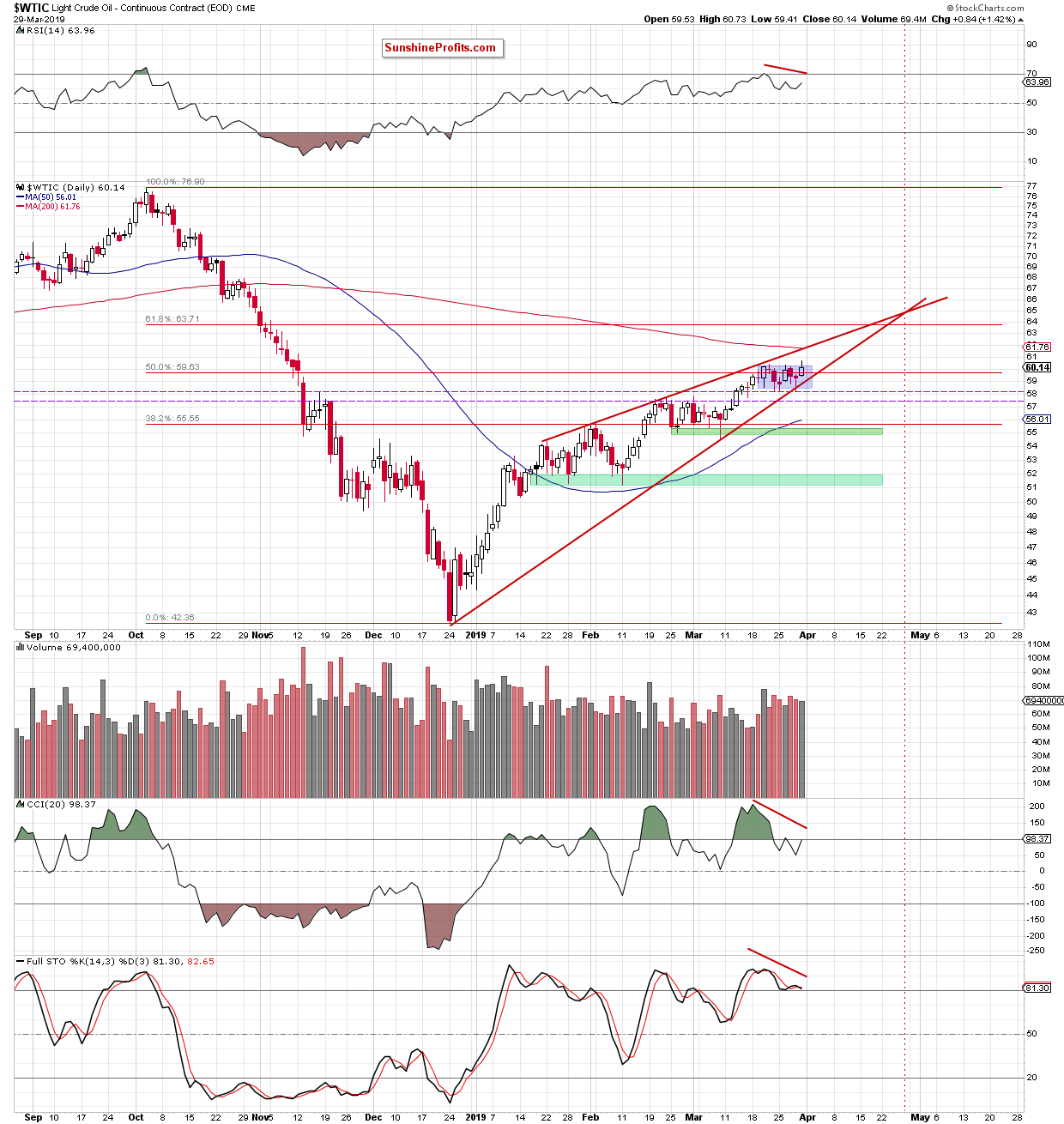

Moving to the daily perspective, crude oil hit a fresh March high and broke above the upper line of the blue consolidation. This improvement turned out to be only temporary and the commodity reverted to the consolidation before the session was over.

This way, black gold invalidated the earlier tiny breakout. There are also clearly visible bearish divergences between the oil price and all daily indicators. The Stochastic Oscillator has already generated a sell signal, which increases the probability of deterioration down the road.

Nevertheless, before we see any downside price action, one more upswing can’t be ruled out. At the moment of writing these words, crude oil changes hands at around $60.80. The test of our upside target as discussed on Friday wouldn’t come out of the left field:

(…) we’re likely to see a test of the upper border of the blue consolidation or even an increase to the upper line of the red rising wedge and the 200-days moving average in the very near future.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. However, if crude oil drops below major short-term supports, we’ll consider opening short positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist