Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Oil bulls tried hard for an oil upswing yesterday but have ultimately failed. Today's situation looks increasingly bleak for them. Seems fitting to have asked here yesterday about that hurdle they still have to clear. Or do the bulls still have some tricks to play? Looking at the chart, what can they realistically aim for? Or is it more like hope for?

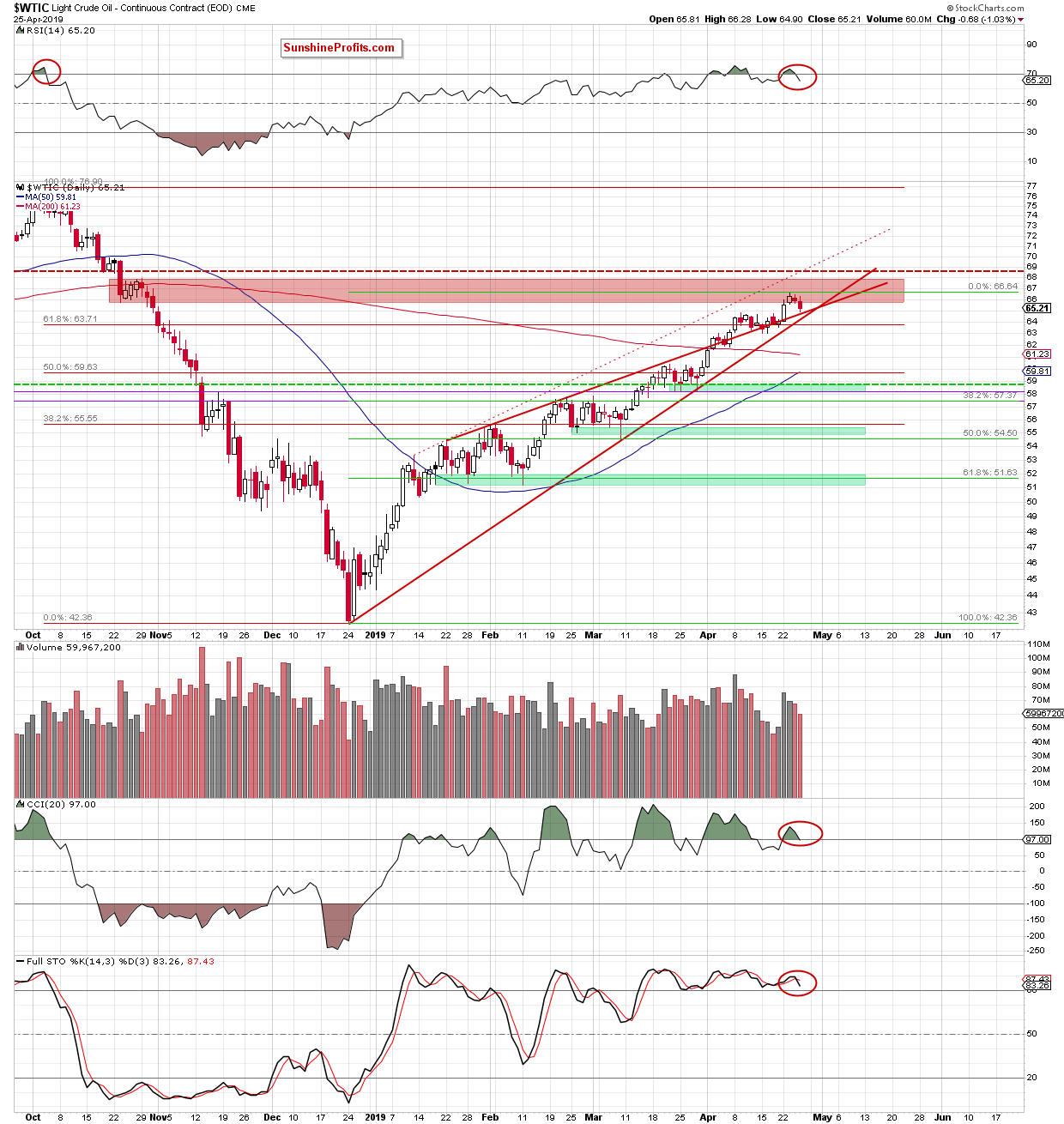

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

During yesterday's session, crude oil has moved visibly lower. It has approached our first downside target - the previously-broken upper border of the red rising wedge. This downswing means that black gold has closed the day back below the red resistance zone.

Additionally, all the daily indicators (RSI, CCI and Stochastics) generated their sell signals. These increase the probability of further deterioration down the road.

Indeed, today's trading has brought us follow-through selling action and the previously mentioned bearish divergences between the indicators and the oil price itself continue to manifest themselves. Black gold changes hands at around $63.80 at the moment of writing these words.

If we see light crude closing the day back inside the red rising wedge, the sellers would likely push the price of crude oil even lower and a test of the lower border of the formation would be the order of the day.

Summing up, the red resistance zone has proved to be a tough nut for the bulls to crack this time. Their yesterday's weakness has been met with follow-up selling earlier today. Combined with all the daily indicators on sell signals and their manifesting bearish divergences with the oil price itself, lower oil prices remain probable. All these factors support the sellers and the short position remains justified from the risk-reward point of view.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist