Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Yesterday’s session brought a turn of events: the bulls countered and erased most of the daily losses. Where does it leave black gold now? How far can the bulls take oil before facing headwinds again? Or can we expect a bearish turn in the market?

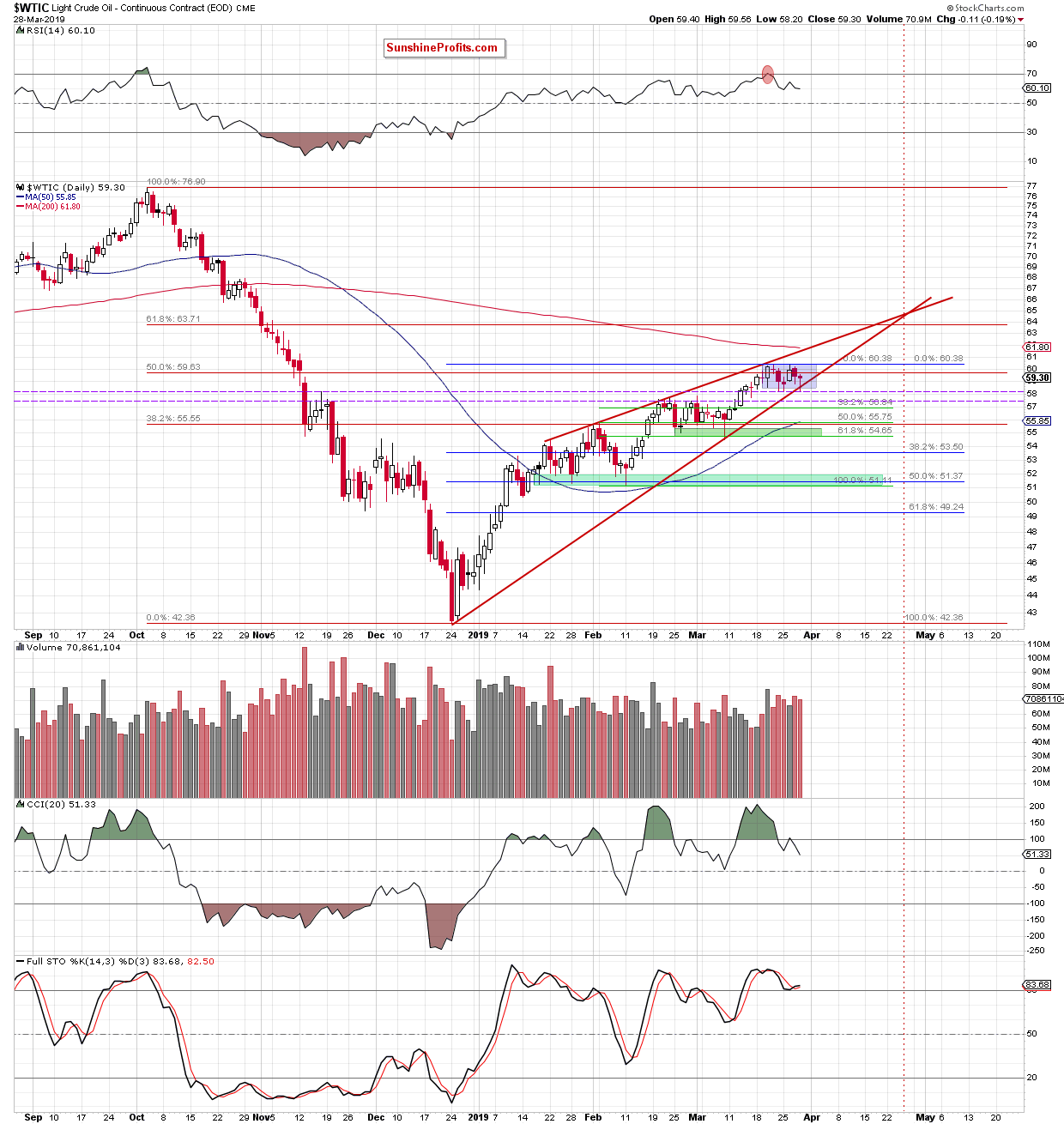

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, crude oil moved lower and tested the following major short-term supports: the lower border of the red rising wedge, the lower border of the blue consolidation and the support area created by the first purple horizontal line (the previously-broken mid-November 2018 peak). The combination of these supports withstood the respectable selling pressure, however.

Black gold rebounded and invalidated the earlier tiny breakdown to close the day just 0.19% below the Wednesday’s close. The buyers followed through earlier today and crude oil futures hit a fresh March high to trade at around $60.20 at the moment of writing these words.

It is reasonable to expect that the commodity will follow through and extend yesterday’s gains after today’s U.S. session opens. Should it be the case, we’re likely to see a test of the upper border of the blue consolidation or even an increase to the upper line of the red rising wedge and the 200-days moving average in the very near future.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. However, if crude oil drops below major short-term supports, we’ll consider opening short positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist