Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Crude oil has taken the bulls for quite a ride last week. The direction has however been mostly down. Yet again earlier today, the bulls are fighting hard and retracing the opening gap lower. Can it mean a lasting improvement? Let's see the full details and what they mean for our open position.

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

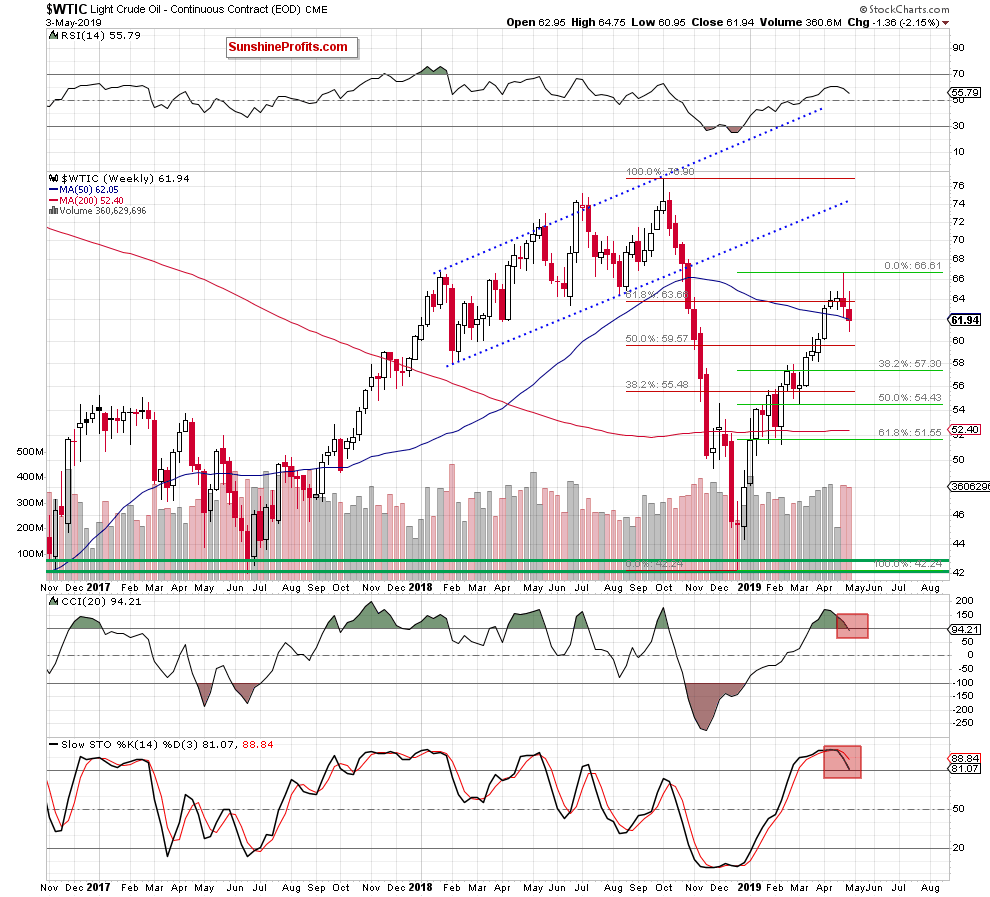

We'll start with the weekly perspective first. Last week, crude oil verified its breakdown below the 61.8% Fibonacci retracement. This has brought the bears to life and the commodity extended losses. It has closed the week below the 50-week moving average.

This is a bearish development. Combined with the sell signals generated by the CCI and the Stochastic Oscillator, it increases the probability of further deterioration in the coming week(s).

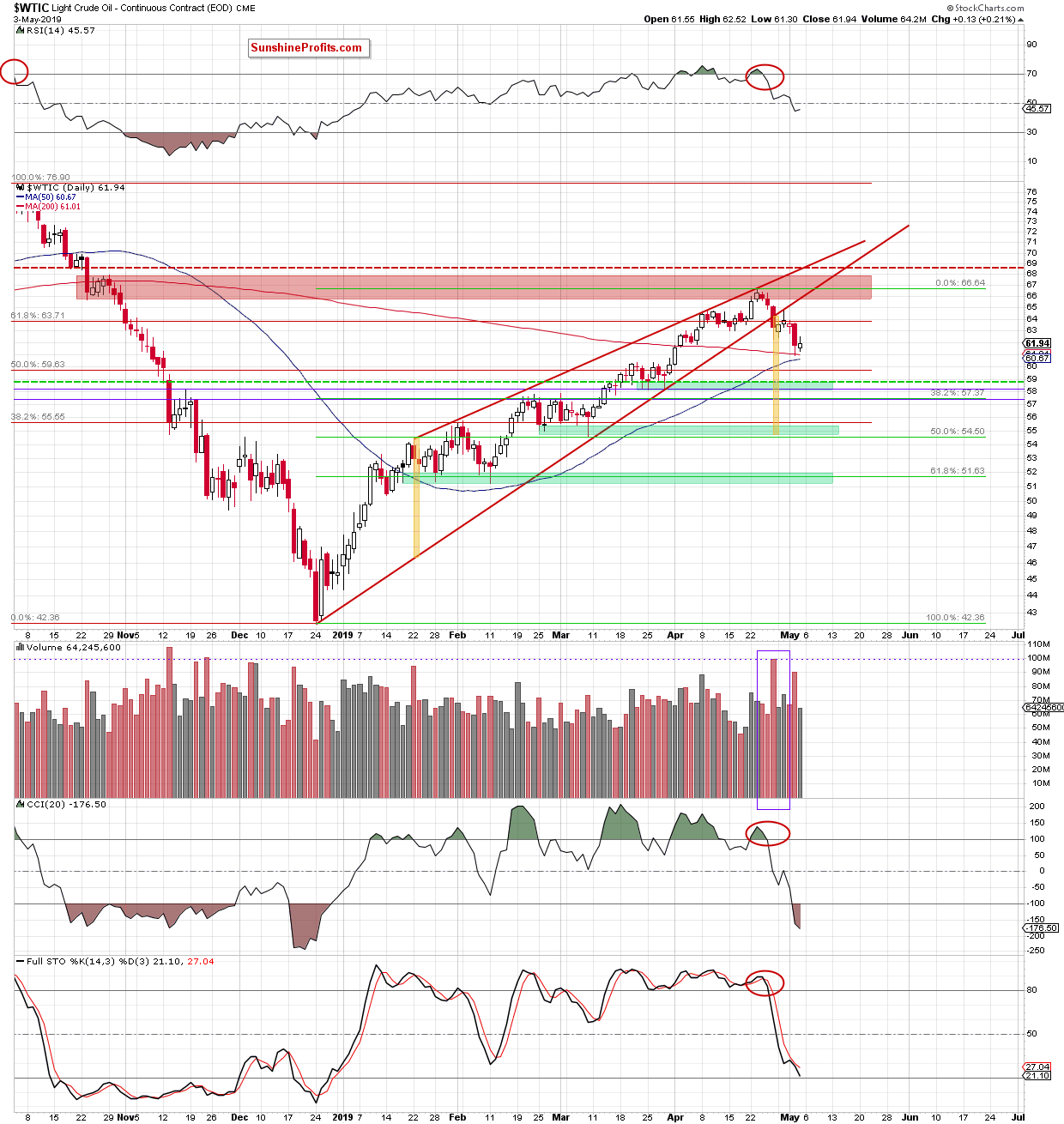

Let's continue with the daily perspective. On Friday, black gold has moved a bit higher but that's nothing to write home about as the upswing didn't even reach the mid-April lows. And the bulls gave up most of their gains before the session was over.

Of note, the volume Friday's upswing was made on, was visibly lower than that of the preceding decline. It reveals the decreasing strength of the bulls.

The sell signals of the daily indicators remain in place. They suggests that lower prices are still ahead of us.

How low could oil fall? Let's recall our Wednesday's Alert. It remains up-to-date also today:

(...) Taking into account the shape of the current decline, black gold could move even lower than the first green support zone. It could visit the second green support zone because there the size of the decline would correspond to the height of the wedge that the oil price has broken down from.

Summing up, the outlook for oil remains bearish. After Thursday's plunge, Friday's upswing made virtually no retracement on a closing basis. Instead, the upper knot and low volume of Friday's session have bearish implications. The weekly indicators are on their sell signals and the same is true about the daily ones. The bearish divergences between the daily indicators and the oil price itself are receiving their downward price resolution. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist