Trading position (short-term; our opinion): Short position with a stop-loss order at $56.78 and a downside target at $50.70 is justified from the risk/reward perspective.

The oil session wasn't marked by much movement yesterday, but saw quite an overnight upswing. While bullish at first sight, let's count the obstacles in the bulls' way. There're quite a few and the dust isn't yet settled after yesterday's Fed move. Where does that leave us in the oil market? Let's assess the situation objectively.

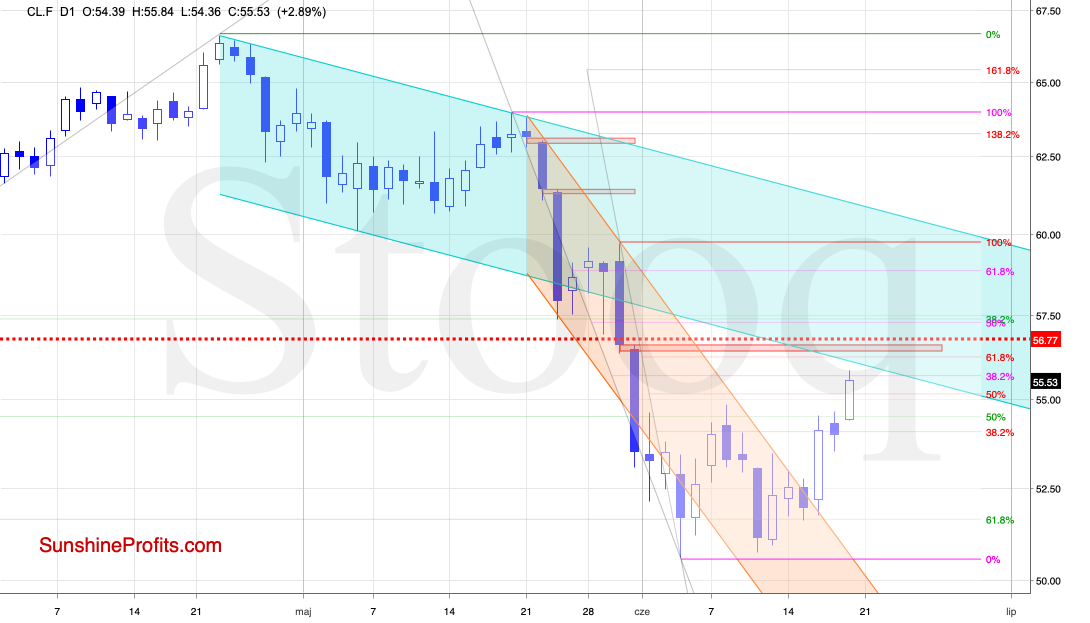

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

While the resistance area at the early-June peak stopped the buyers yesterday, the bulls drove oil price higher earlier today. Thanks to today's upswing (oil is at around $55.85 currently), they have reached the 38.2% Fibonacci retracement based on the downswing that started in late May.

Light crude sits now at three other important resistances: the previously-broken lower border of the declining blue trend channel, the 61.8% Fibonacci retracement and the red gap created at the end of May. These will act as powerful hindrances to further attempts to go north in the very near future.

Summing up, yesterday's oil session didn't bring much of a price movement, however today's aftermath of the Fed move took black gold higher. As oil almost challenges $56 mark, let's remember it's at several important resistance that the bulls would have to deal with first. The short position therefore remains justified from the risk/reward point of view.

On a side note, there would be no regular Alert tomorrow due to Your Strategist's travel schedule. We apologize for possible inconvenience and we'll be back on Monday.

Trading position (short-term; our opinion): Short position with stop-loss order at $56.78 and a downside target at $50.70 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist