Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

We have seen quite some back-and-forth trading in the crude oil arena in recent days. Today, it’s the bears’ turn. How far will they go and what change of perspective will that bring? Let’s explore the scenarios and opportunities just ahead.

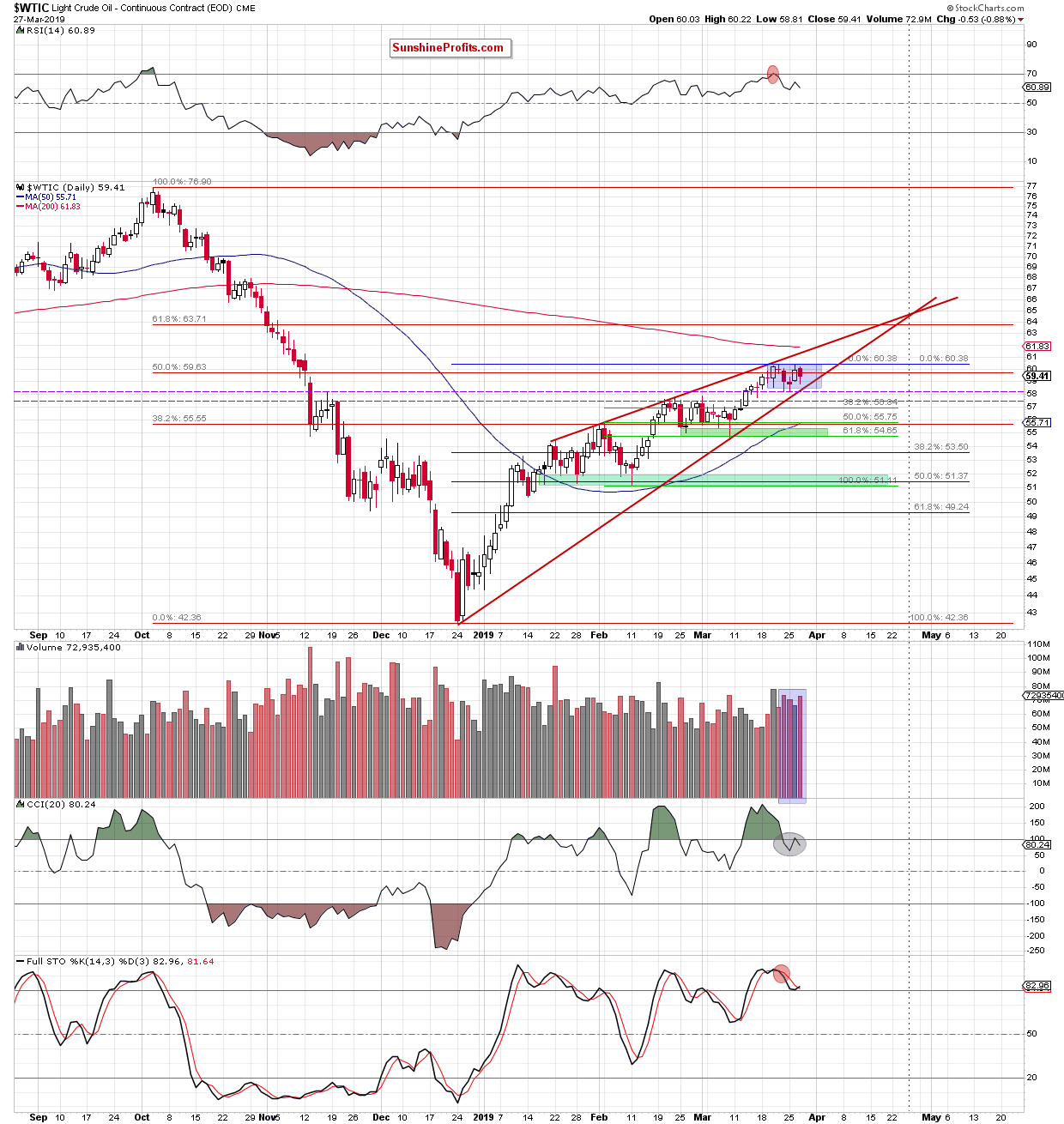

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, we’ve asked the question whether we’re seeing a double top or whether a further rally lies ahead. We have also noted that the short-term picture looks pretty inconclusive and that oil is currently trapped inside the blue consolidation. Evaluating the scenarios of what could happen if either the bulls or the bears win, we have said yesterday:

(...)

- if the buyers take black gold higher, their first upside target would be the upper border of the red rising wedge (currently at around $61.20),

- if the sellers mange to push light crude below the nearest supports (those two dashed horizontal purple lines: the previously-broken February and March 2019 and mid-November 2018 peaks), the way to the first green support zone (created by the late-February and early-March lows and the potential 61.8% Fibonacci retracement of the recent upswing from February lows) would be open as a minimum.

These remain up-to-date. Let’s take a look at today’s price action now. Black gold changes hands at around $58.50 at the moment of writing these words. It means that it’s challenging the lower border of the blue consolidation. It is also testing the lower border of the rising red wedge and the first horizontal dashed purple line (the previously-broken mid-November 2018 peak).

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. However, if crude oil drops below major short-term supports, we’ll consider opening short positions.

On an administrative note, our data center informed us that there might be some connectivity issues lasting two hours tomorrow morning (8 AM - 10 AM EST, which is 1 PM - 3 PM CET), so you may experience some delays while accessing our website. We will strive to provide you with our analysis before that time, but since it depends on the market, we cannot promise that we will manage to do so as intended. In other words, we will be posting our Alerts normally tomorrow, but our website might be slow to load or our e-mail notification might reach you with a 1-2 hour delay tomorrow. We apologize for any possible inconvenience caused.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist