Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

While oil has bounced yesterday, the question to ask is whether it had clarified its outlook for the coming sessions.

Let's dive right into the charts to find out.

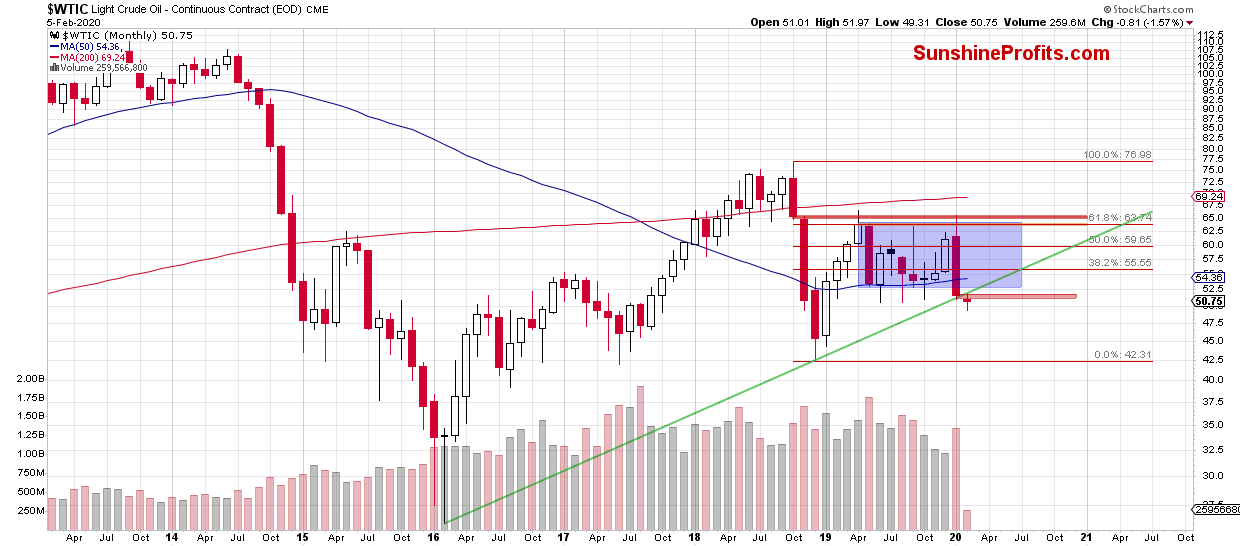

We'll start by taking a closer look at the monthly chart (charts courtesy of http://stockcharts.com).

Although crude oil moved a bit higher, the overall situation in the long term hasn't changed much as the commodity is still trading below major resistances: the previously broken long-term green line, the red gap and the lower border of the blue consolidation.

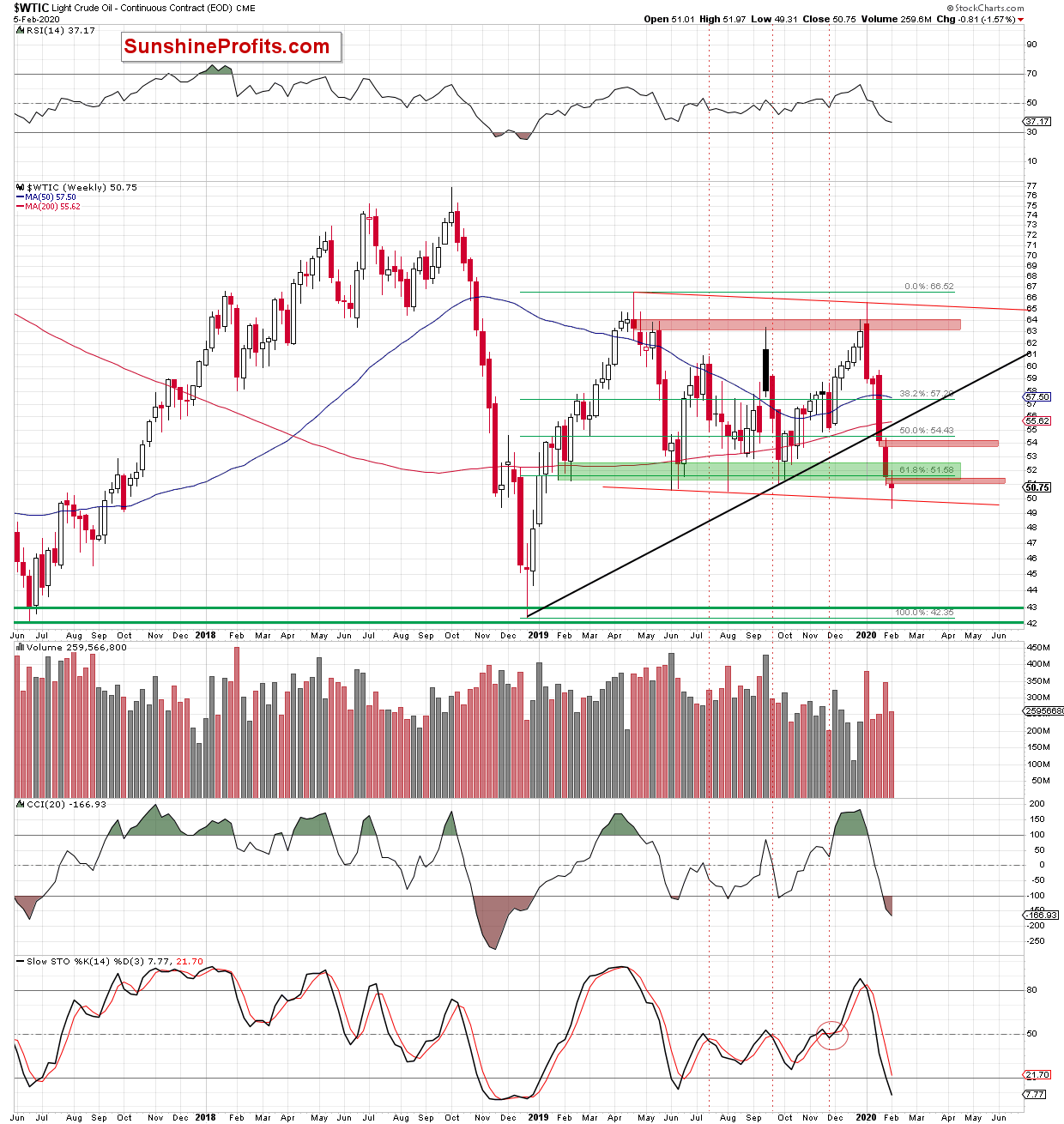

How did this price action affect the medium-term picture? Let's check the chart below.

The first thing that catches the eye on the weekly chart, is an invalidation of the earlier breakdown below the lower border of the red declining trend channel. Is this a positive sign for the bulls? Yes, but only at first sight. Why? Because the week is not over yet, and the upcoming two days will decide whether this factor can be considered as a bullish.

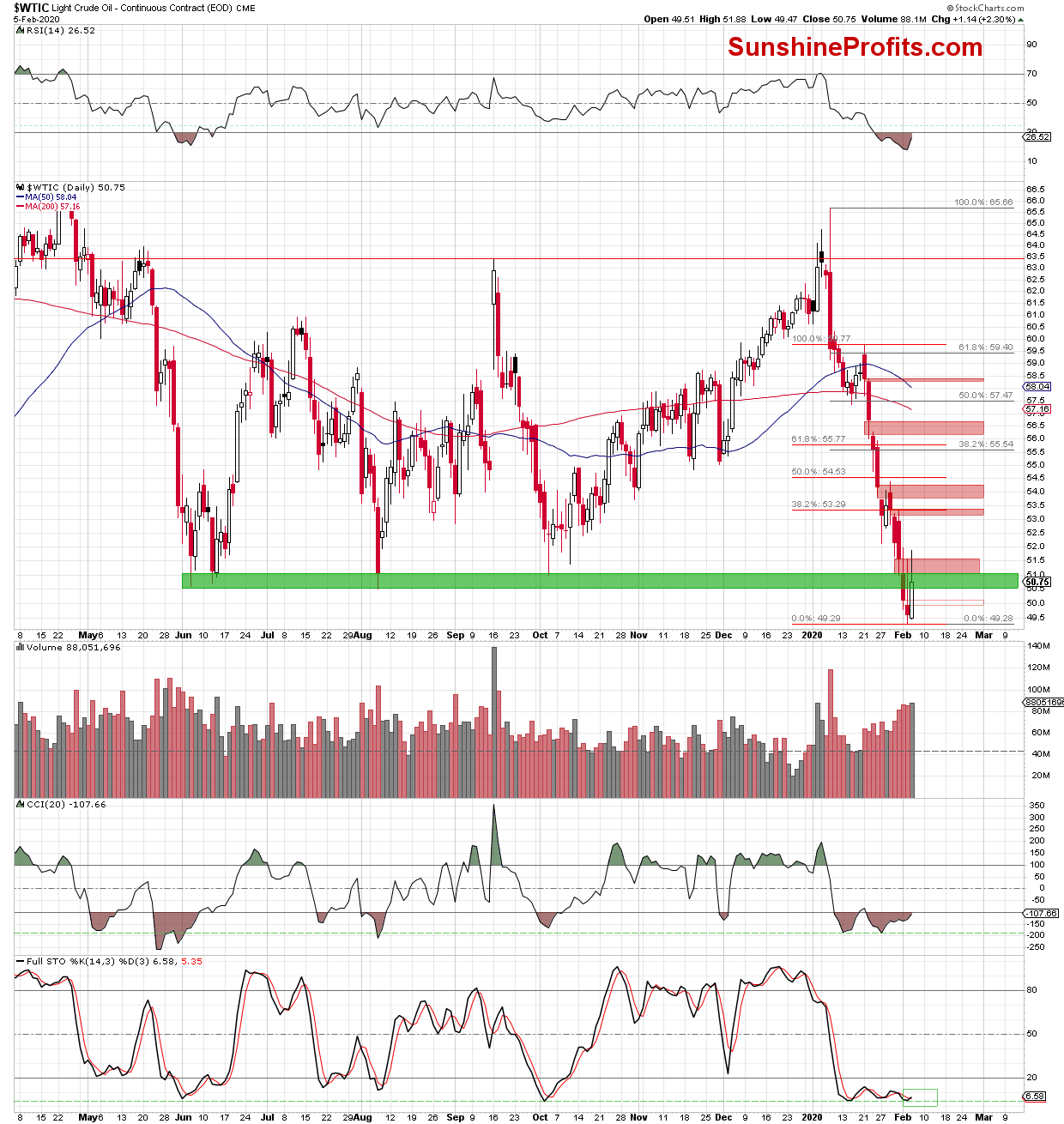

And what was the impact of yesterday's increases on the daily chart?

Smaller than one would expect. What do we mean by that? Looking at the above chart, we see that although black gold moved sharply higher after the market open and climbed slightly above the green zone and the red gap created at the beginning of the week, the bulls didn't manage to hold these levels. Eventually, prices pulled back.

As a result, the commodity finished the day not below both the gap and the previous lows in terms of daily closing prices. The elongated upper shadow thus shows where the sellers become more active.

Did this discourage the oil bulls from taking on the nearest resistance zone? Let's take a closer look at today's pre-market price action.

From this perspective, we see that crude oil futures opened Thursday with a green gap (that's a bullish factor) and extended gains in the following hours. Despite this price action and another climb above the green zone and the red gap, crude oil futures are currently trading below the upper border of the gap, which continues to serve as resistance at the moment.

Therefore, what we wrote yesterday remains up to date also today:

(...) the current position of the indicators is on [the bulls] side (...). However, in our opinion, as long as the nearest resistance zone remains in the cards the way to the north is closed and another decline can't be ruled out (...)

Nevertheless, if the bulls manage to close the day above the mentioned zone and invalidates the breakdown under the lower border of the red declining trend channel marked on the weekly chart, we'll consider opening long positions.

Summing up, the situation in crude oil is currently too unclear to justify opening any trading positions, but it seems that we might get more signs and decide to open a new trading position shortly.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager