Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $63.30 and the next downside target at $56.13 is justified from the risk/reward perspective.

The relative calmness of recent sessions certainly looked a bit disconcerting, just like the silence on Iran. Now it appears that oil is about to make a move. And yesterday, black gold has indicated it wants to go down. Is it really the case and lower oil prices are ahead of us?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

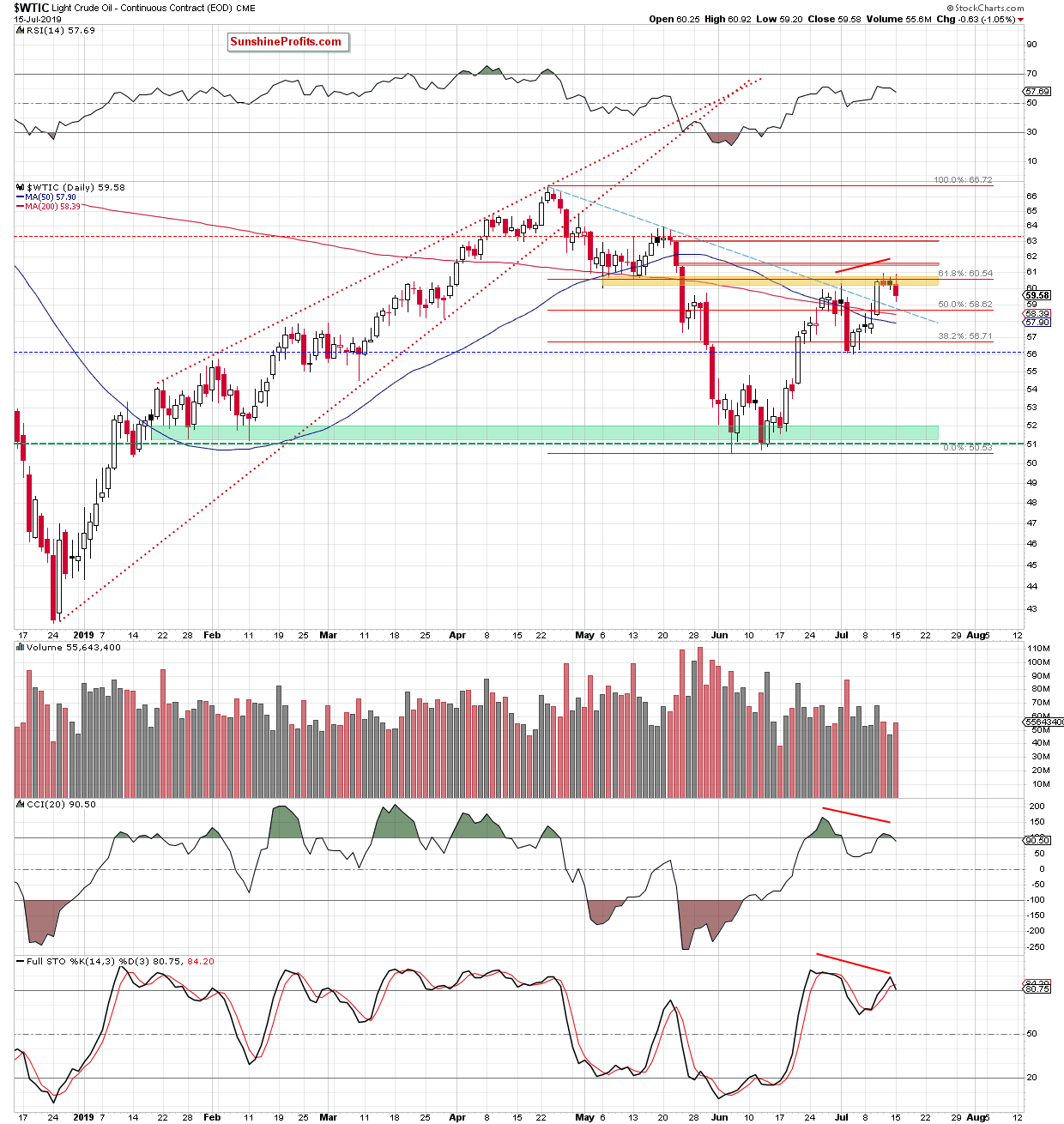

The daily chart shows that crude oil had moved higher after the market open, but the bulls didn't have much success breaking above the yellow resistance zone. The commodity reversed and invalidated two earlier tiny intraday breakouts: above the yellow resistance and above the 61.8% Fibonacci retracement.

The CCI and the Stochastic Oscillator generated their sell signals, encouraging the sellers. The volume picked up, suggesting that another downswing may be just around the corner.

Let's see today's action in the oil futures for more details.

Yesterday's drop took crude oil futures to the 38.2% Fibonacci retracement that is based on the recent upward move. While its vicinity encouraged the bulls to act, the short-term situation continues to favor a bigger move to the downside rather than to the upside.

Should it be the case, we'll see at least a test of our initial downside target in the following days. While a retest of recent peaks prior to such a decline remains a possibility, it wouldn't change the bearish outlook in the least.

Summing up, after a couple of days of sideways trading, oil has decidedly declined yesterday. It happened after black gold reached a strong combination of resistances (the red resistance zone and the 61.8% Fibonacci retracement). There're also bearish divergences between the CCI and oil prices, and between the Stochastic Oscillator and oil prices. All these factors support the bears, and the short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $63.30 and the next downside target at $56.13 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist