Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Yesterday, we asked whether crude oil can move higher and shake off the preceding waterfall decline. Can it still rise like a phoenix?

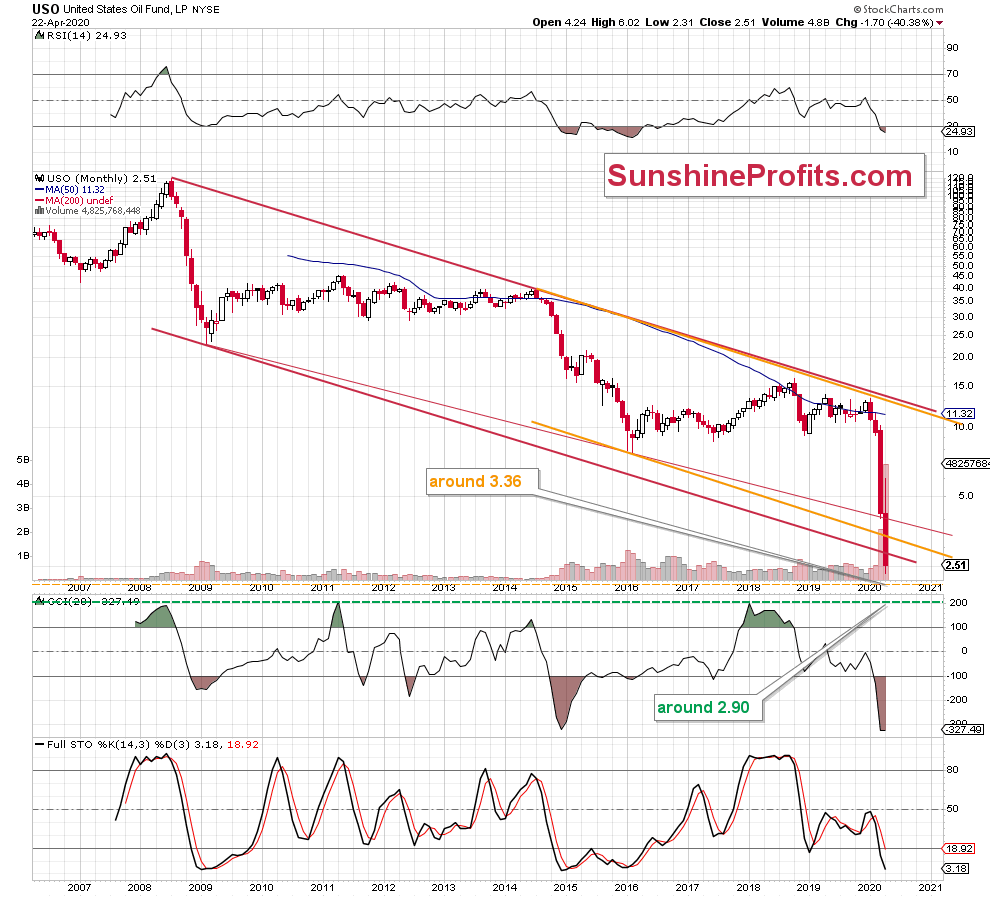

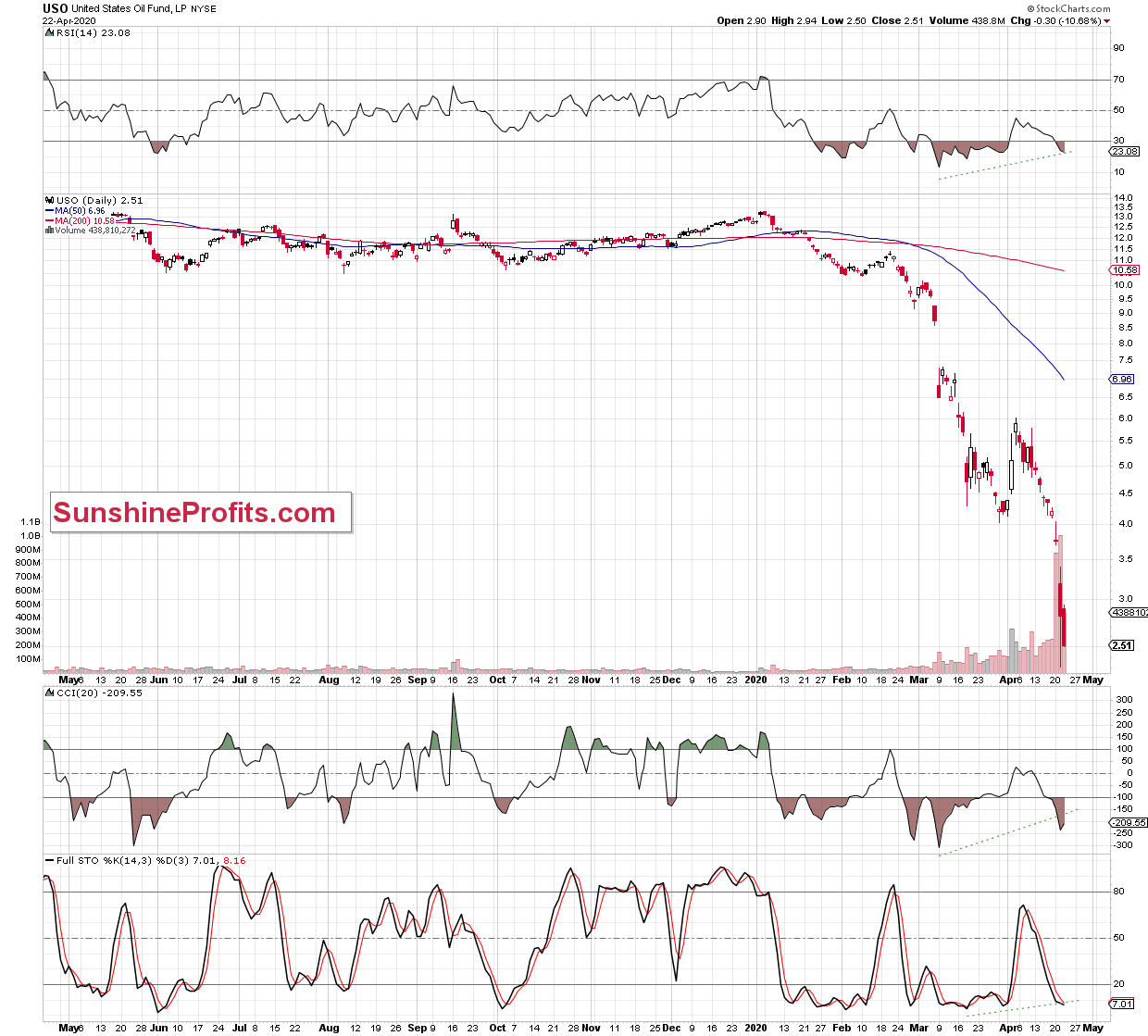

Since the situation in the futures market is too unclear right now, our chart analysis will focus on the most popular crude oil ETF, the USO ETF. We'll look at both the monthly and daily charts (charts courtesy of www.stockcharts.com ).

The bulls have failed once again - this simple sentence basically sums up yesterday's session. Although the buyers had some favorable technical conditions on their side before the market open that we discussed in our yesterday's Alert, they didn't make good use of them. A decline of over 10% came in the following hours.

Although the USO ETF moved a bit higher after the market's open (actually barely visible from the daily perspective), the previously broken lower border of the red declining trend channel as seen on the long-term chart stopped them. Another move to the south and a fresh 2020 low of 2.50 followed.

This time, there wasn't a sizable rebound before the session's close, which doesn't look encouraging from the daily point of view. Nevertheless, at the moment of writing these words the USO ETF is trading over 4% above yesterday's close, which could encourage the bulls to fight for higher levels in the following hours. Perhaps that will bring the kind of result that yesterday didn't.

However, if the buyers disappoint, the realization of our bearish scenario from yesterday's Oil Trading Alert will be even more likely:

(...) the USO moved to the previously broken lower border of the red declining trend channel. Unfortunately for the bulls though, this could be just a verification of the earlier breakdown.

Should it be the case, another move to the downside and likely a fresh low (maybe even around 0.50-0.70), is a strong possibility.

(...) in our opinion, it is too early to say that the worst is already behind the bulls, the USO ETF and the oil market. The rush to open any positions can easily prove premature.

Summing up, while crude oil disappointed the bulls and dropped some more yesterday, it's rebounding now. Its strength will determine whether the short-term outlook turns bullish. After Monday's enormous and unbelievable profits in crude oil, it doesn't appear that opening new positions right now is justified from the risk to reward point of view. Soon, it might be though.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager