Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Crude oil moved higher recently, likely due to the move lower in the USD Index. However, both moves seem to be of counter-trend nature. The price of black gold moved only very briefly above its resistance at the 38.2% Fibonacci retracement level and - just as briefly - it touched the early-2020 low.

This means that nothing really changed as far as the technical picture is concerned.

Our stop-loss level is slightly above $45, which means that it's above the early-March levels. If this level - and the 61.8% Fibonacci retracement based on the entire 2020 decline - is broken in a meaningful manner, the SL order would take you us of the market - and correctly so, as it would imply that the outlook is no longer nearly as bearish as it is right now. This hasn't happened yet. In fact, based on the most recent invalidation, the bearish outlook just got a fresh bearish confirmation.

The trigger for crude oil's decline might be the rally in the USD Index. USD's quick rally in the first half of March was accompanied by a substantial slide in crude oil prices.

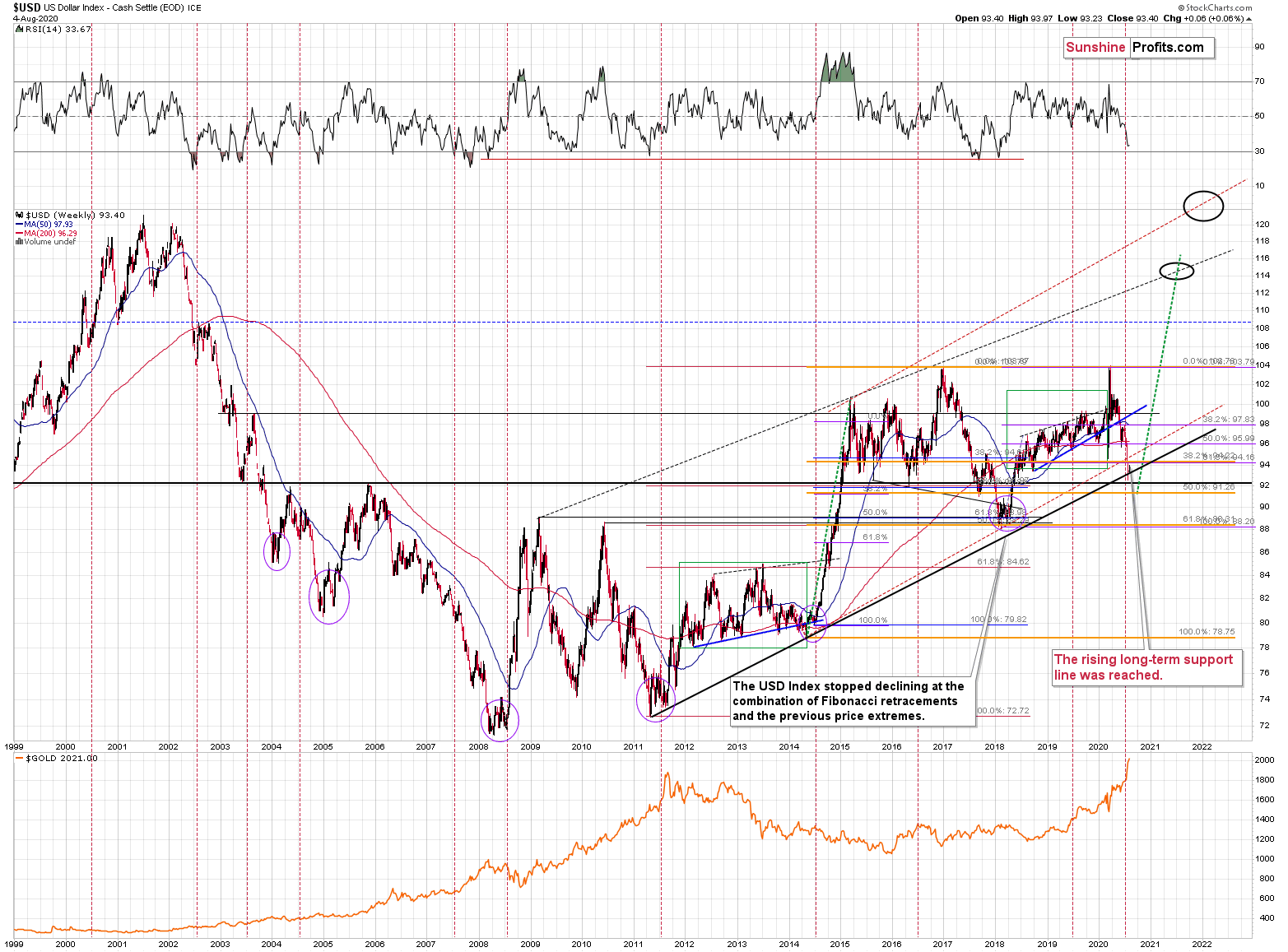

And right now, the USD Index is at the combination of very important support levels.

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone "knew" that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it's the same right now.

The USD Index is at a powerful combination of support levels. One of them is the rising, long-term, black support line that's based on the 2011 and 2014 bottoms.

The other major, long-term factor is the proximity to the 92 level - that's when gold topped in 2004, 2005, and where it - approximately - bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, and it's very oversold on a short-term basis. It all happened in the middle of the year, which is when the USDX formed major bottoms on many occasions. This makes a short-term rally here very likely.

Please note that double bottoms were not that uncommon in the past. We marked the previous cases, when the USDX bottomed in this way with purple circles.

Moving back to the USD Index, please note that - in my opinion - the current pandemic is likely to have much more severe implications than the stock market investors seem to believe right now. Stocks are very close to their all-time highs while the economy has been seriously hit.

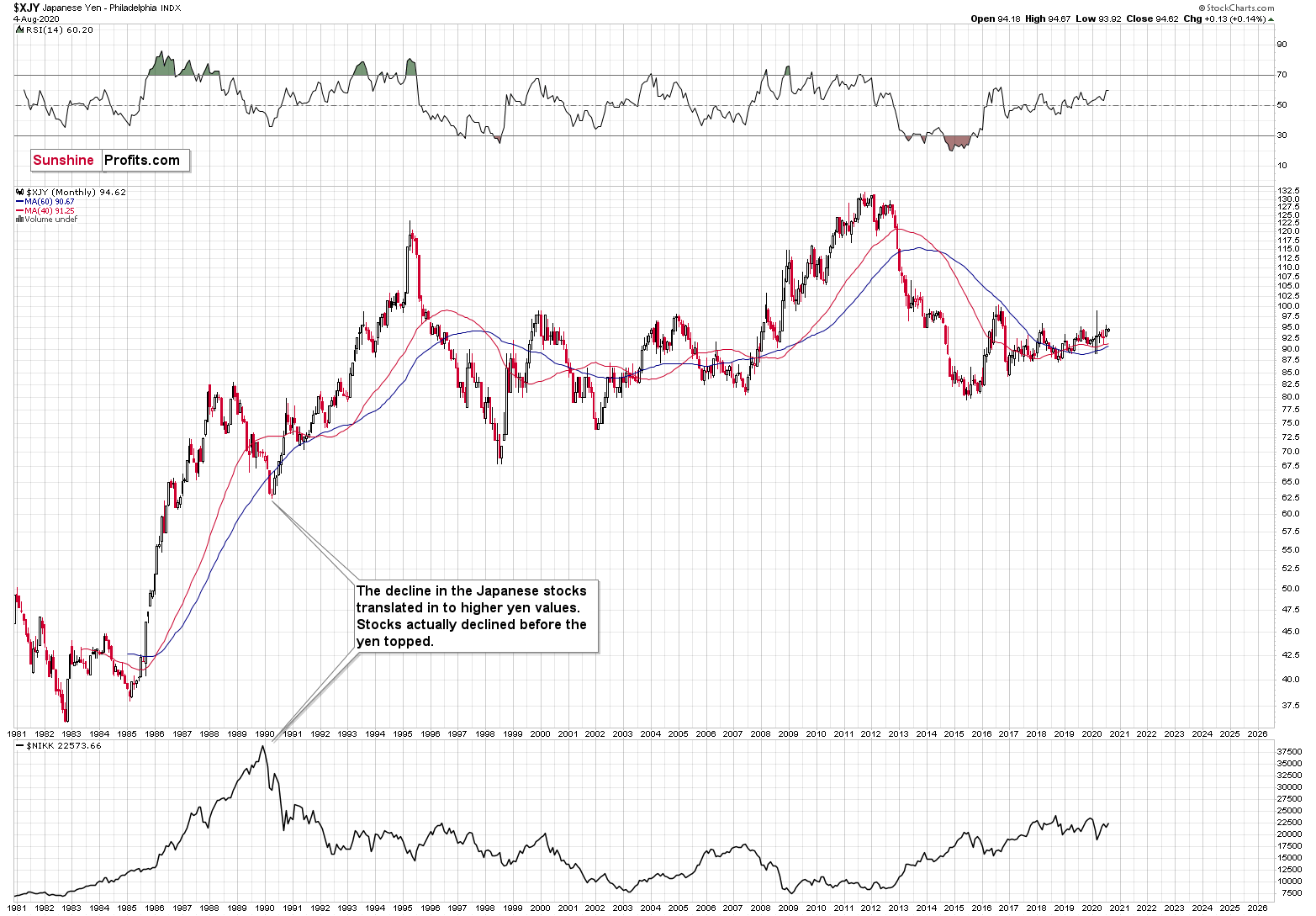

The question one might be asking themselves is why would this be good for the U.S. dollar. Well, we have an example from Japan from a few decades ago. As people sold stocks, they moved to holding the currency.

One might say that rising yen was what triggered the decline in Nikkei, but actually the latter topped first.

So, if stocks are to decline from here based on the much grimmer economic outlook than it is commonly believed, the U.S. currency would be likely to rally - similarly to how it rallied in March. Crude oil would be likely to decline in this scenario.

Consequently, in our opinion, keeping the short position intact remains justified from the risk to reward point of view.

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications and on the deteriorating economic picture connected with rapidly increasing Covid-19 cases in the U.S., and we see signs that the bigger decline is likely to finally start.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager