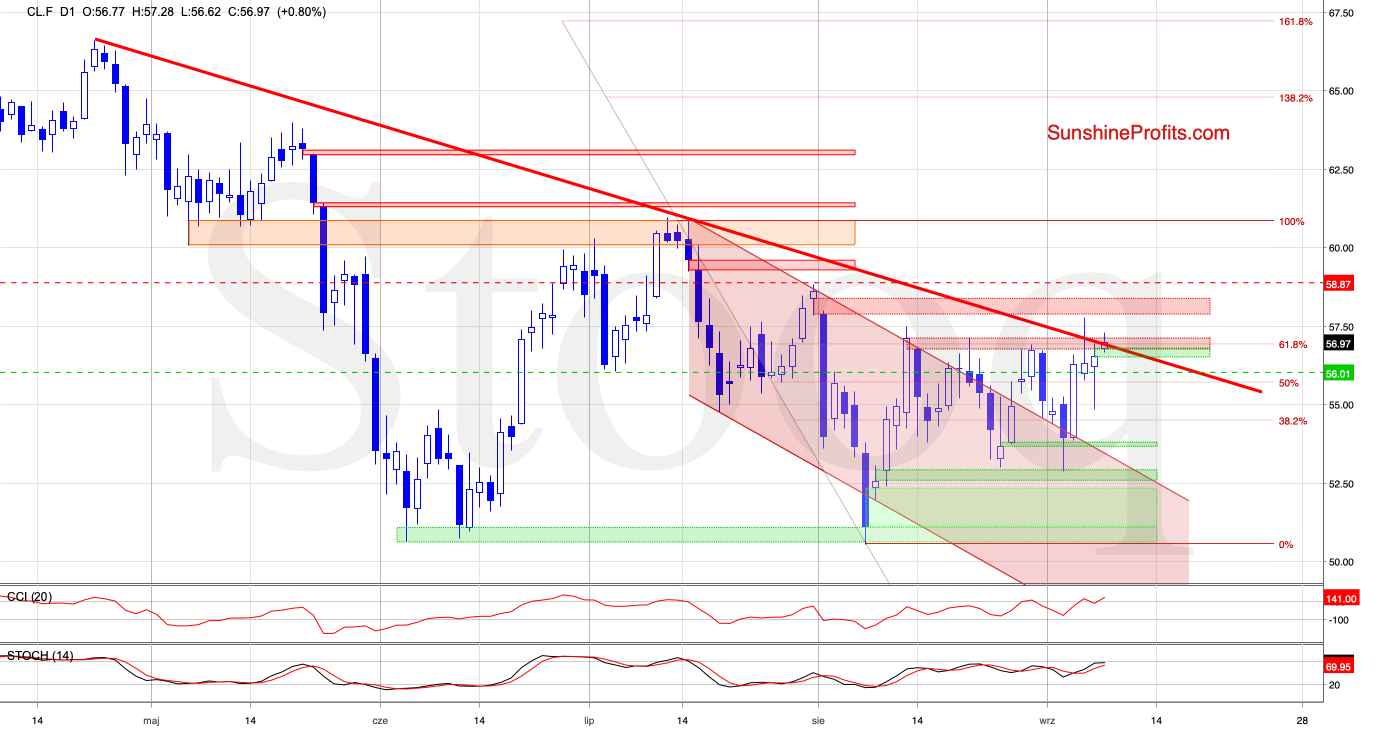

Trading position (short-term; our opinion): short position with a stop-loss order at $58.87 and the exit target at $53.05 is justified from the risk/reward perspective.

The bulls turned the tide on Friday, and are making a strong showing earlier today. Yet they have to grapple with several nearby resistances, the latest peaks being one of them. Can they overcome the main obstacle on a closing basis?

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com and www.stooq.com ).

Crude oil futures opened today with the green gap, and this has triggered further improvement. Prices broke above the declining red resistance line, and tested the upper border of the red gap.

This situation appears similar to what we saw on Friday. While the futures headed higher to trade at around $57.60 currently, as long as the breakout isn't confirmed, another move lower remains likely.

Summing up, after reversing an earlier oil plunge, the bulls have eked out minor gains on Friday. And the buyers are attempting to build on today's opening gains, though the breakout above the declining red resistance line isn't confirmed yet. This resistance has stopped them in recent past already, and our short position therefore remains justified.

Trading position (short-term; our opinion): short position with a stop-loss order at $58.87 and the exit target at $53.05 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist