Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Crude oil declined yesterday, confirming points that we've been making preciously:

In short - crude oil reversed and then started to move sideways below the 61.8 % Fibonacci retracement level.

This means that the odds continue to favor a move lower from here.

Our stop-loss level is slightly above $45, which means that it's above the early-March levels. If this level - and the 61.8% Fibonacci retracement based on the entire 2020 decline - is broken in a meaningful manner, the SL order would take you us of the market - and correctly so, as it would imply that the outlook is no longer nearly as bearish as it is right now. This hasn't happened yet. In fact, based on the most recent invalidation, the bearish outlook just got a fresh bearish confirmation.

The trigger for crude oil's decline might be the rally in the USD Index. USD's quick rally in the first half of March was accompanied by a substantial slide in crude oil prices.

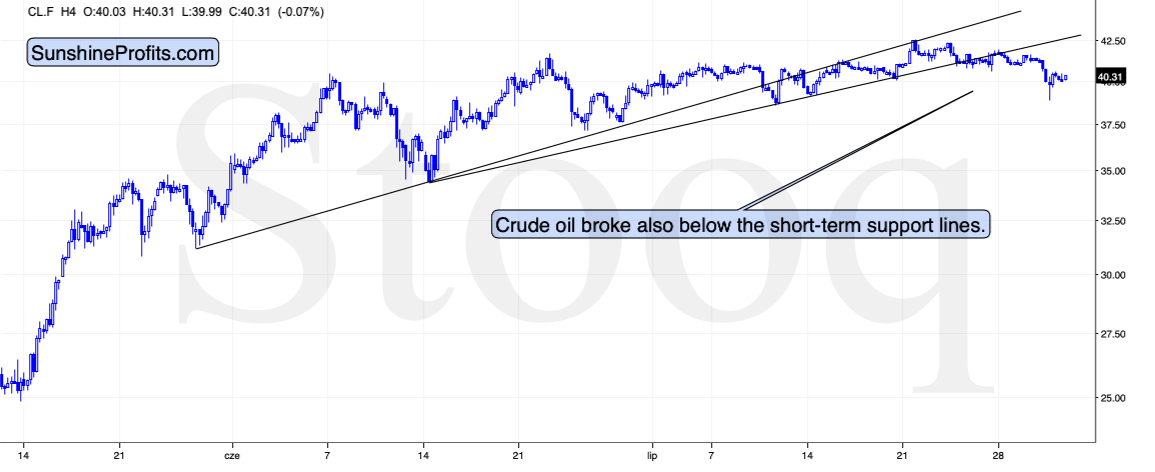

The price of black gold has also broken below a more short-term support line, which further confirms the bearish outlook for the short run.

Please note that all the above happened without USD's help. In fact, it happened regardless of USD's continuous decline. Once the USD Index finally rallies, crude oil's decline is likely to accelerate.

Consequently, in our opinion, keeping the short position intact remains justified from the risk to reward point of view.

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications and on the rapidly increasing Covid-19 cases in the U.S., and we see signs that the bigger decline is likely to finally start.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager