Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Oil bulls could still go higher yesterday. But not noticeably higher. Taking a look at the chart, today's trading promises volatility. Will the bears break the bulls' back, or will the bulls just keep marching on regardless? Presenting you the odds of these moves, the outlook they bring, that's the job of our analysis. Especially that we're on the lookout for something actionable and important.

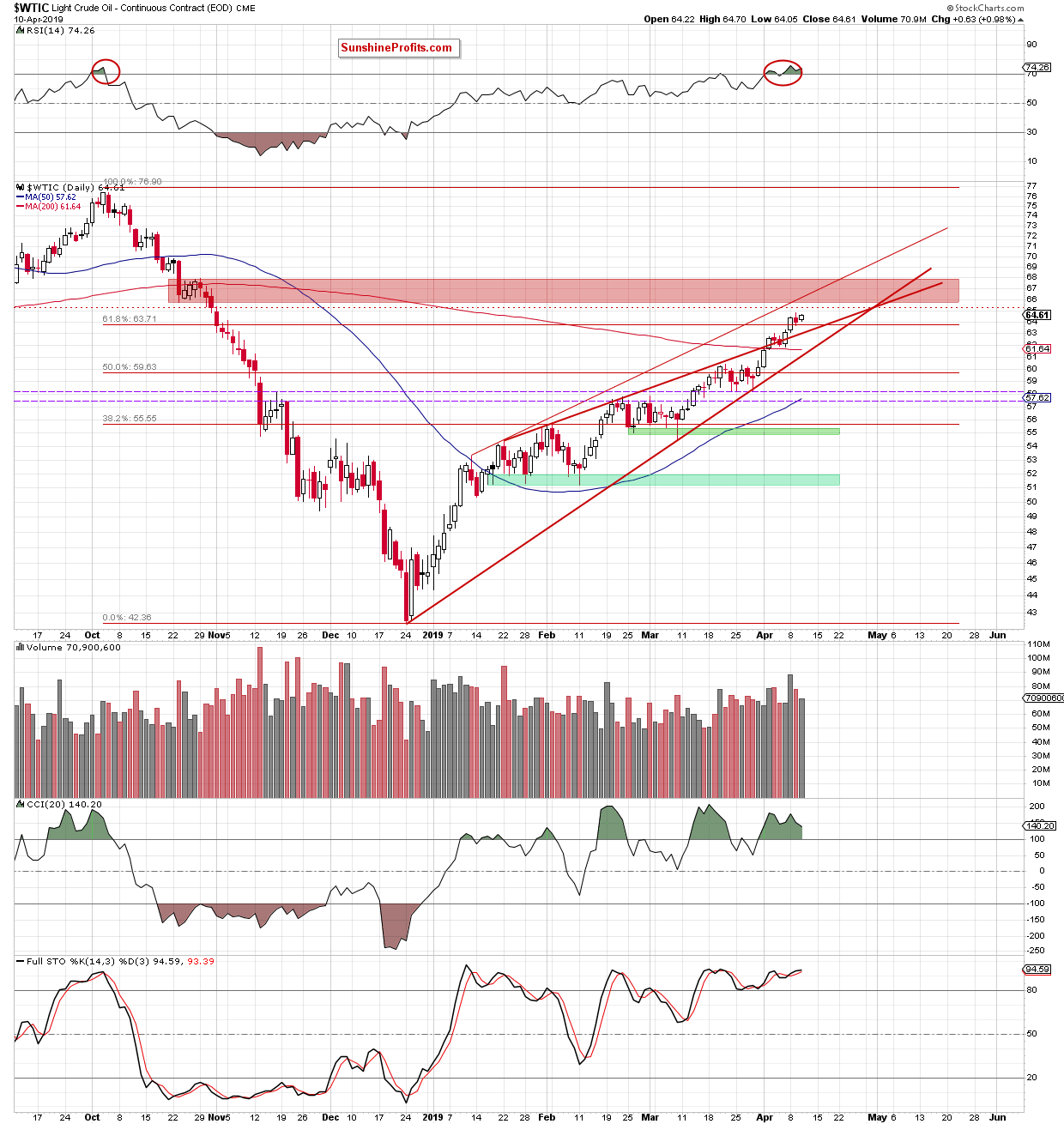

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Crude oil bulls took black gold higher once again yesterday. They didn't manage to hit a fresh high, however. The volume examination reveals a visibly lower level than the day before, not to mention Monday's record volume (record volume of spring 2019).

These factors increase the likelihood of reversal in the very near future. Should we see reliable signs of the bulls' weakness, we'll consider opening short positions.

Summing up, we have seen an upswing yesterday. Regardless of whether that was the final upswing before reversal, or the bulls still have an ace up their sleeves, the judicious course of action is to stay on the sidelines and wait for credible signs of bulls' weakness before taking any short positions.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist