Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

What a change a day makes. Friday, that was such a day in the oil market. Heavy follow-through selling from Thursday's session brought a weekly close full of important hints. One by one, elaborating on each, we' re bringing them to your attention. Powerful and actionable implication not to miss!

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

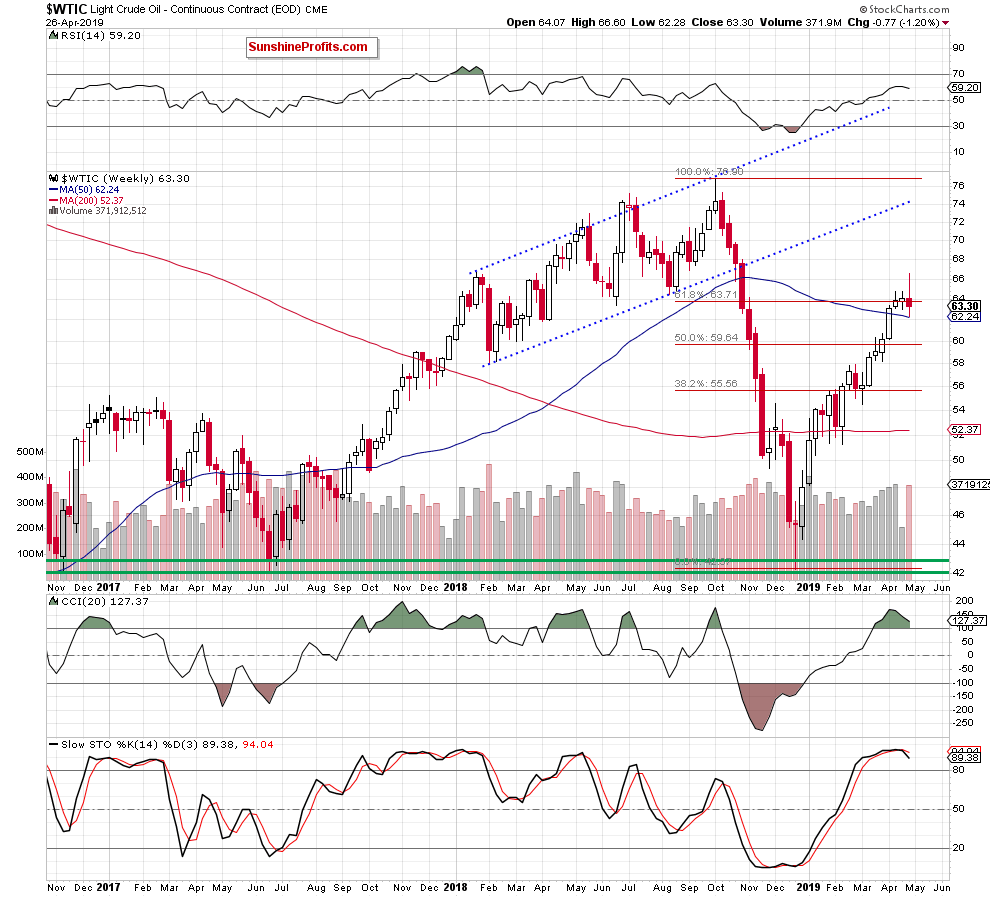

Let's start with the weekly perspective. The most important event was Friday's sharp move to the downside. It erased the entire previous upswing, which resulted in an invalidation of the earlier breakout above the 61.8% Fibonacci retracement.

This is a bearish development as it marks the first weekly close below the 61.8% Fibonacci retracement after two previous closes above it. The long upper shadow also signifies the area of increasing bearish participation.

Let's comment now on the very high volume of last week. It confirms the readiness of the bears to push oil prices down in the coming days or possibly even weeks. Examining the weekly indicators, there's a bearish divergence between the Stochastics Oscillator and crude oil. Stochastics gave a sell signal, which increases the probability of further deterioration.

Let's continue with the daily chart.

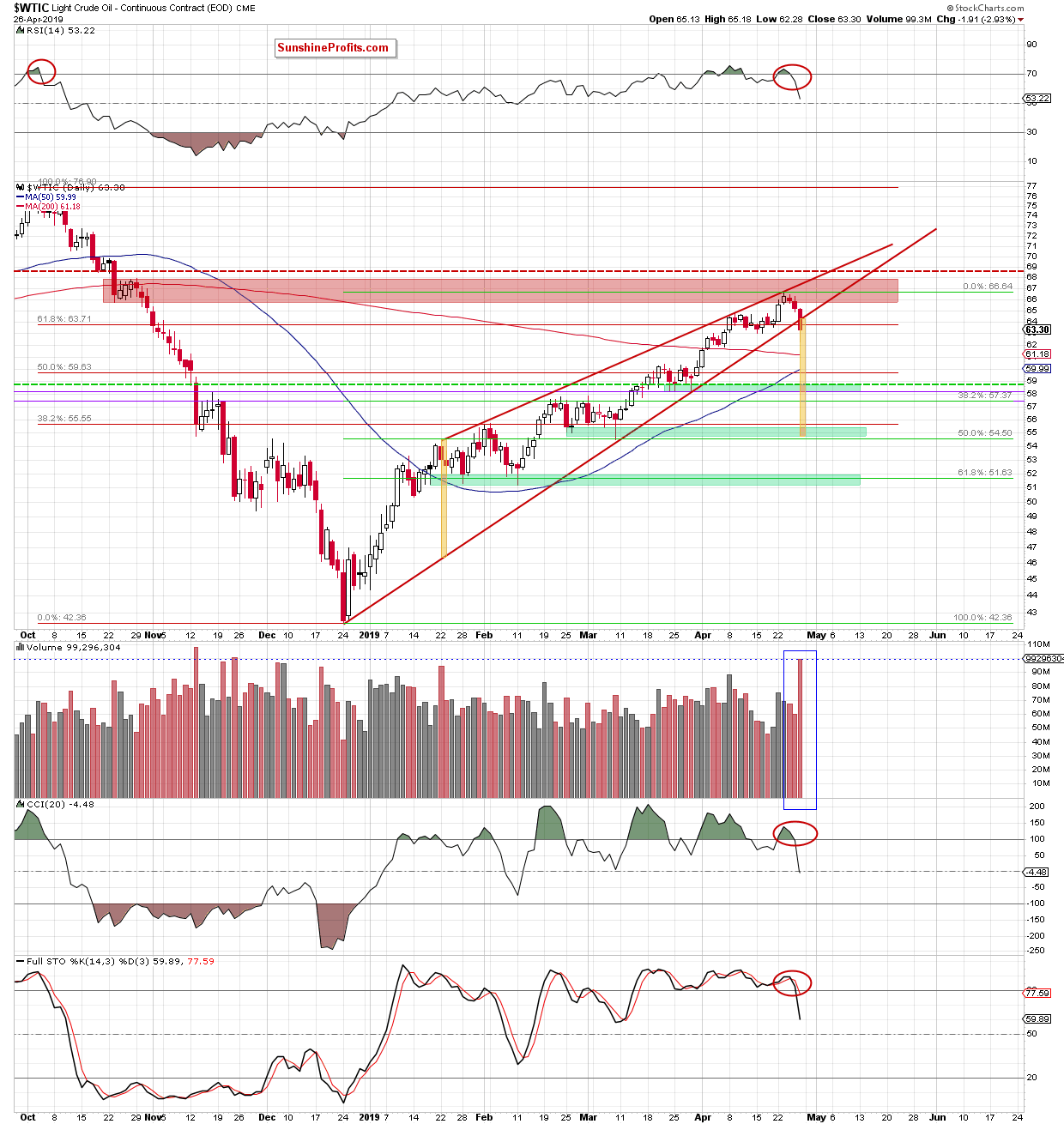

Crude oil has moved sharply lower on Friday. Black gold not only tested but also broke below our next downside targets, making our short positions profitable. It has closed the day below the lower border of the red rising wedge, opening the way to lower levels.

How low could oil fall? Let's remember our April 18 commentary - the first downside target has been broken, now it's the second one's turn:

(...) If the commodity indeed moves lower from here, the first downside target will be the lower border of the red wedge. If that is broken, the way to the first green support zone (created by the late-March lows) would open.

Taking into account the shape of the current decline, black gold could move even lower than the first green support zone. It could visit the second green support zone because there the size of the decline would correspond to the height of the wedge that the oil price has broken down from.

Summing up, Friday's sizable decline has strong implications going forward. Oil price action has left the rising and red wedge and moved lower. Let's remember the huge volume of the decline: it has bearish implications by itself. The daily indicators are on sell signals and the bearish divergencies are in place. Lower oil prices remain probable and our short position is justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist