Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

Crude oil’s price reversed on Monday, but the volume was low and thus it was not a true reversal. Those who forgot to check for verification were surprised by the follow-up action, which was another daily decline. But you were not surprised as we explained the above and you knew what to expect. What’s next?

Today’s Oil Trading Alert is going to be rather short as the black gold moved exactly in tune with what we wrote previously. In yesterday’s analysis, we emphasized that the decline has most likely resumed and even though Monday’s daily price action looked like a bullish reversal, it really wasn’t one as the volume didn’t confirm it.

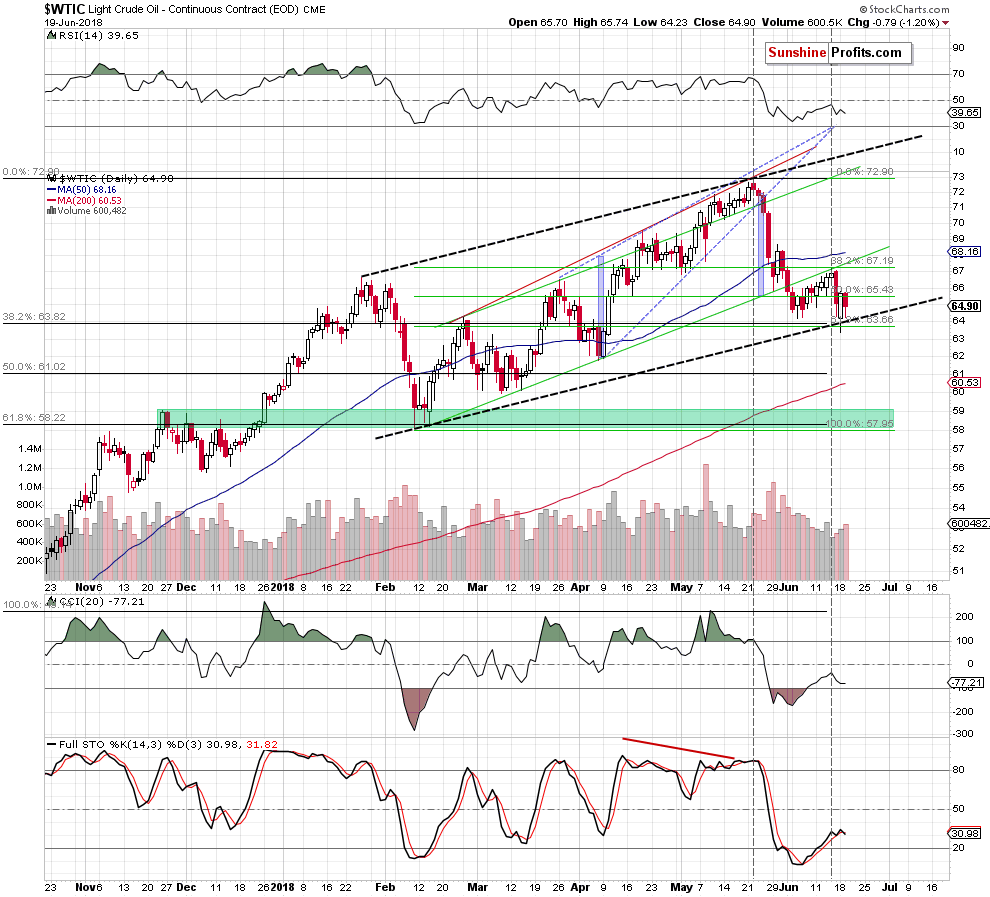

Let’s take a look at crude oil’s short-term chart.

The volume on which crude oil had moved higher on Monday was relatively low and the volume on which it declined yesterday was higher. This serves as yet another indication that the real move in which the price of black gold is moving is down.

The other factors remain in place as well and they are: the monthly May bearish reversal candlestick, and last week’s bearish reversal (weekly) candlestick. We have described them in detail on Monday, so we don’t want to simply repeat everything today – if you haven’t had the chance to read the above analysis so far, we suggest doing so today. The long-story-short version is that both bearish reversals continue to have very bearish implications for the following weeks.

Summing up, no market moves up or down in a straight line and periodic corrections are inevitable in all markets and it seems that we have just seen an example of this rule in case of crude oil. Crude oil moved higher on Monday, but it was back in the decline mode already on the next day. The decline is likely to continue, but we may see corrections from time to time.

Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts