Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Wednesday, crude oil moved higher after the EIA weekly report showed a drop in gasoline stocks and a bigger-than-expected decline in distillates inventories. In this environment light crude climbed to the major resistance line once again, but then reversed and declined. Where will black gold head in the coming days?

Although the EIA weekly report showed a drop in gasoline stocks and a bigger-than-expected decline in distillates inventories, we should keep in mind that yesterday report also showed a third straight week of increases in crude oil inventories. Additionally, U.S. crude oil production increased to 9.51 million barrels per day and the greenback strengthened, which could affect negatively the price of crude oil in the coming days. Will the short-term picture of the commodity confirm this scenario?

Crude Oil’s Technical Picture

Let’s take a closer look at the chart below and try to find out (charts courtesy of http://stockcharts.com).

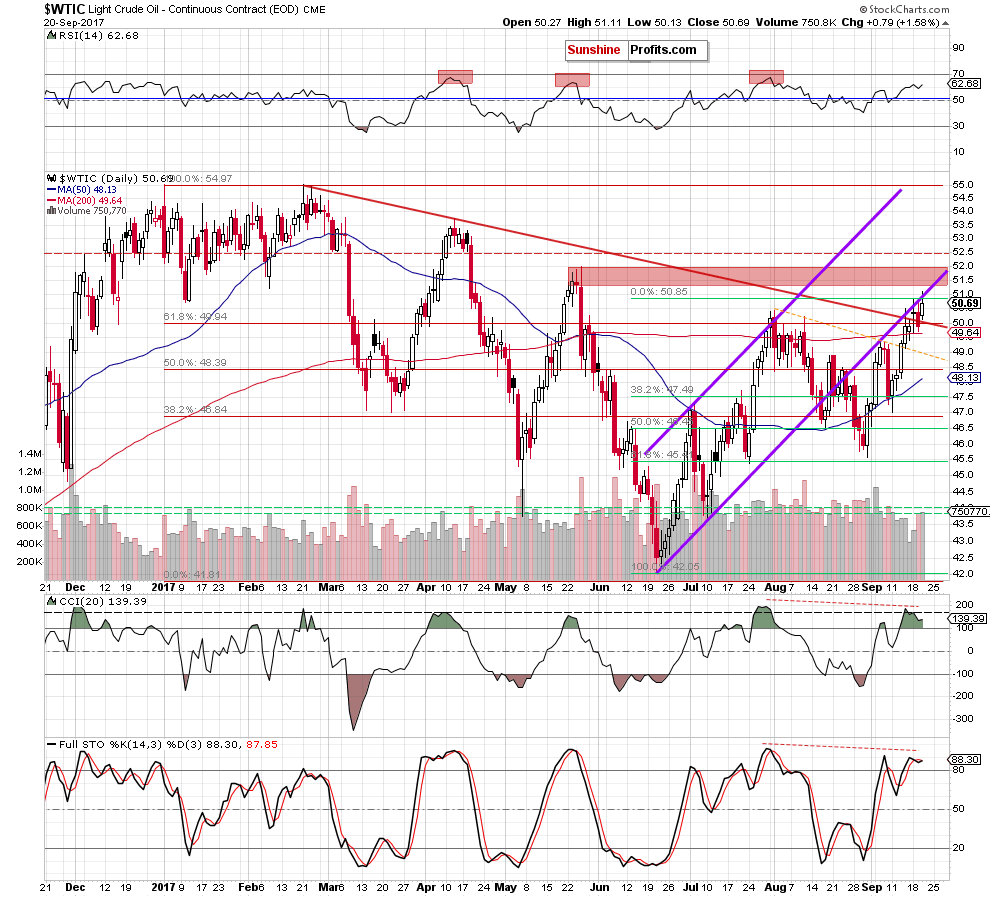

From today’s point of view, we see that crude oil opened yesterday session above the red declining resistance line, the 61.8% Fibonacci retracement and the barrier of $50, which encouraged oil bulls to act. As a result, light crude increased slightly above the lower border of the purple rising trend channel once again, but then reversed and closed the day below this important line, invalidating the earlier tiny breakout.

In our opinion, this is a repeat of what we already saw in the previous week, therefore, yesterday price action didn’t change anything in the overall situation and the outlook remains bearish.

What’s next for black gold?

Taking into account another verification of the breakdown under the lower border of the purple rising trend channel and negative divergences between the CCI, the Stochastic Oscillator and the price of light crude, we believe that lower prices of the commodity are just around the corner. Therefore, if crude oil moves lower from current levels, the initial downside target for oil bears will be around $47.50, where the 38.2% Fibonacci retracement (based on the entire June-September upward move) is.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil verified the earlier breakdown under the lower border of the purple rising trend channel once again, suggesting that oil bulls are not strong enough to invalidate the earlier breakdown and push the price of light crude higher. This show of their weakness increases the probability of another move to the downside in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts