Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. In other words, we decided to close short position and take profits off the table.

Yesterday's oil session was yet another day of potentially deceptive appearances. The bears again pushed the commodity lower but the decreasing volume and significant lower knot are impossible not to notice. What conclusion logically follows?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

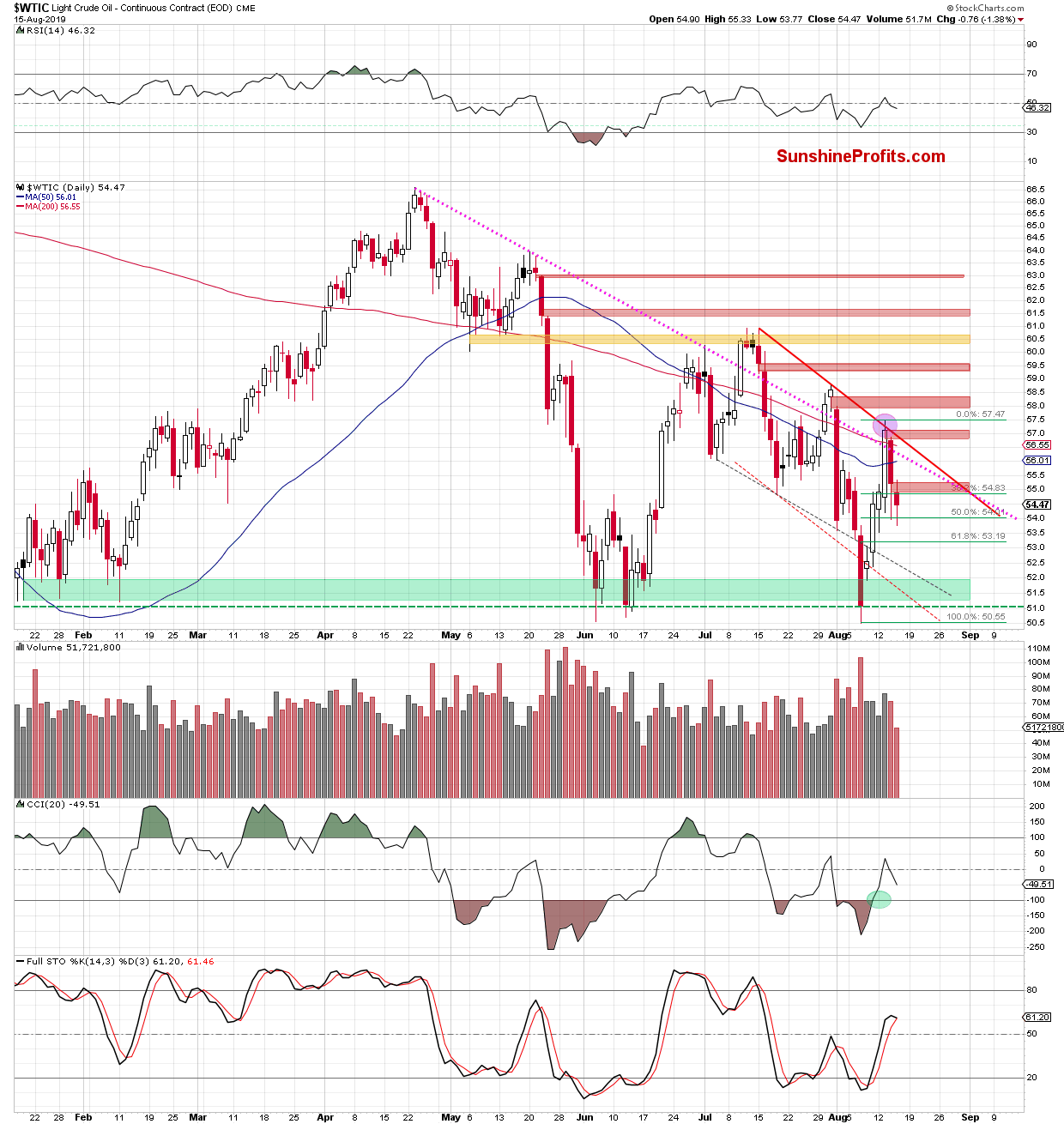

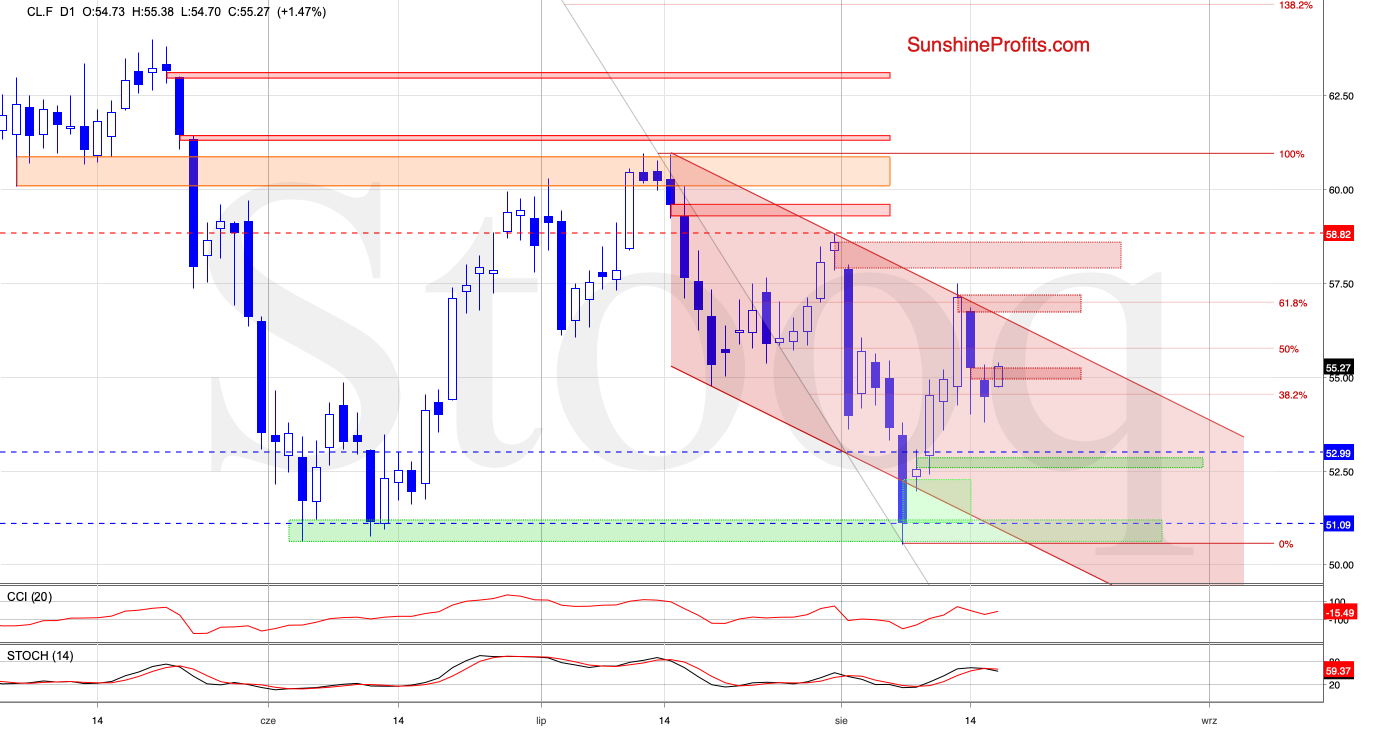

On Thursday, crude oil opened with another bearish red gap. Despite bullish attempts to the contrary, the bears forced their way even lower, and light crude retested the 50% Fibonacci retracement.

This has triggered a rebound, and just as on Wednesday, black gold erased some of its earlier losses. The commodity however closed the day not only below the pink dotted resistance line, but also below the red gap and the 50-day moving average.

While these are certainly bearish signs, let's note that the volume decreased once again. It suggests that the sellers may not be as strong as it seems at first sight.

How did yesterday's session affect investors sentiment earlier today?

Today's opening is a bullish one, and follow-through buying took off. While most of the earlier gains have evaporated as the commodity trades at around $54.75 currently, it suggests strong possibility of further improvement just ahead. Remember about the declining volume of recent sessions - the bears aren't as strong as they appear to be.

If this is the case and crude oil futures moves higher from here, we could see a test of the upper border of the declining red trend channel or even of the red gap created on Wednesday.

Taking all the above risks to the upside into account, closing short positions and taking profits off the table is justified from the risk/reward perspective.

Nevertheless, should we see the bulls' weakness in the above-mentioned areas, we'll consider reopening short positions. As always, we will keep you - our subscribers - informed.

Summing up, while oil again declined yesterday, it happened on yet lower volume. This is a cautionary sign, pointing to decreasing involvement (and strength) of the bears. Today's bullish price action since the open points to upside reversal potential, leading us to take open profits off the table. Should we see the bulls hesitate at their upside targets, we'll consider reopening short position though.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist