Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

After Thursday's defeat, oil bulls pulled themselves together and attacked on the following day. Shortly after the opening of the Friday session, they took control, which resulted in a comeback above the level of $66. But not everything was as bullish as it might seem at first glance.

What do we mean by that? Let’s take a look at the charts below (charts courtesy of http://stockcharts.com) to find out.

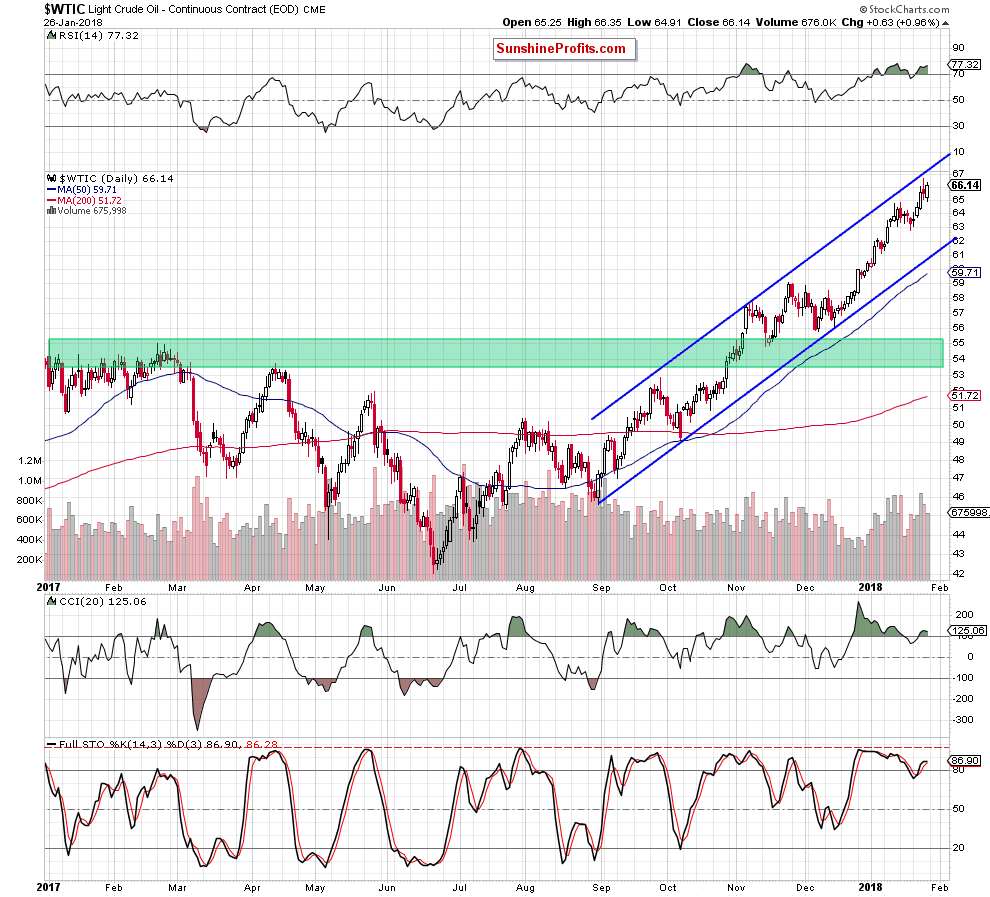

From today’s point of view, we see that oil bulls took crude oil above $66 on Friday, but they didn’t manage to erase all Thursday decline, not to mention the attack of the upper border of the blue rising trend channel.

Although they did their best, black gold is still trading under the last week high. Additionally, the volume, which accompanied Friday’s increase was visibly lower than day earlier, which suggests that the potential to growth may already be exhausted.

On top of that, it seems to us that the daily indicators are just waiting only for the next oil bears’ attack to generate sale signals and help them to push the price of the commodity down. This scenario is also reinforced by the fact that there are clearly visible strong bearish divergences between all daily indicators and the price of light crude.

If there are so many negative signals, you can ask why we do not open short positions. The answer to this question you will find below the long- and medium-term charts.

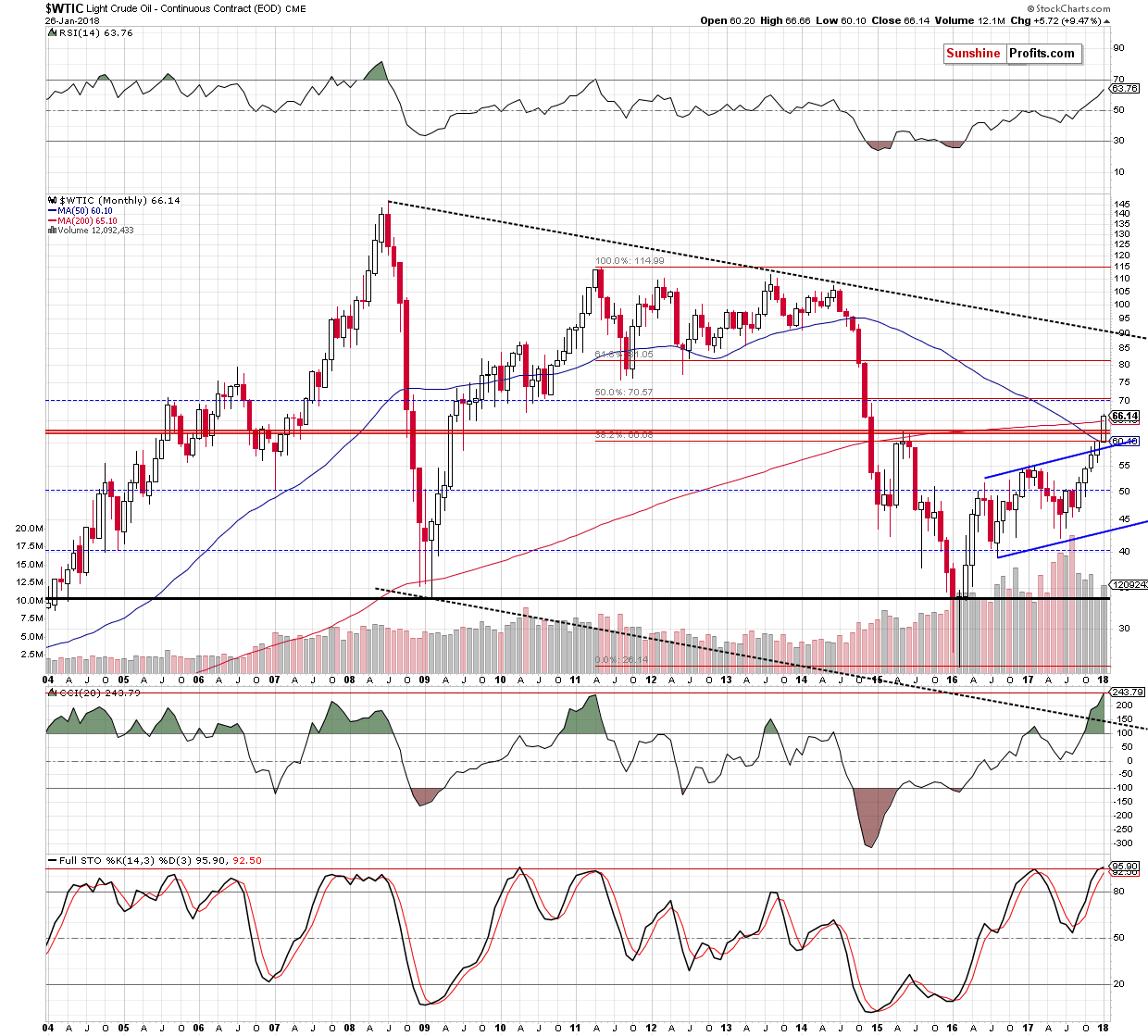

Firstly, as you see on the monthly chart, crude oil is still trading slightly above the previously-broken 200-month moving average, which serves as the nearest important support and continues to keep declines in check.

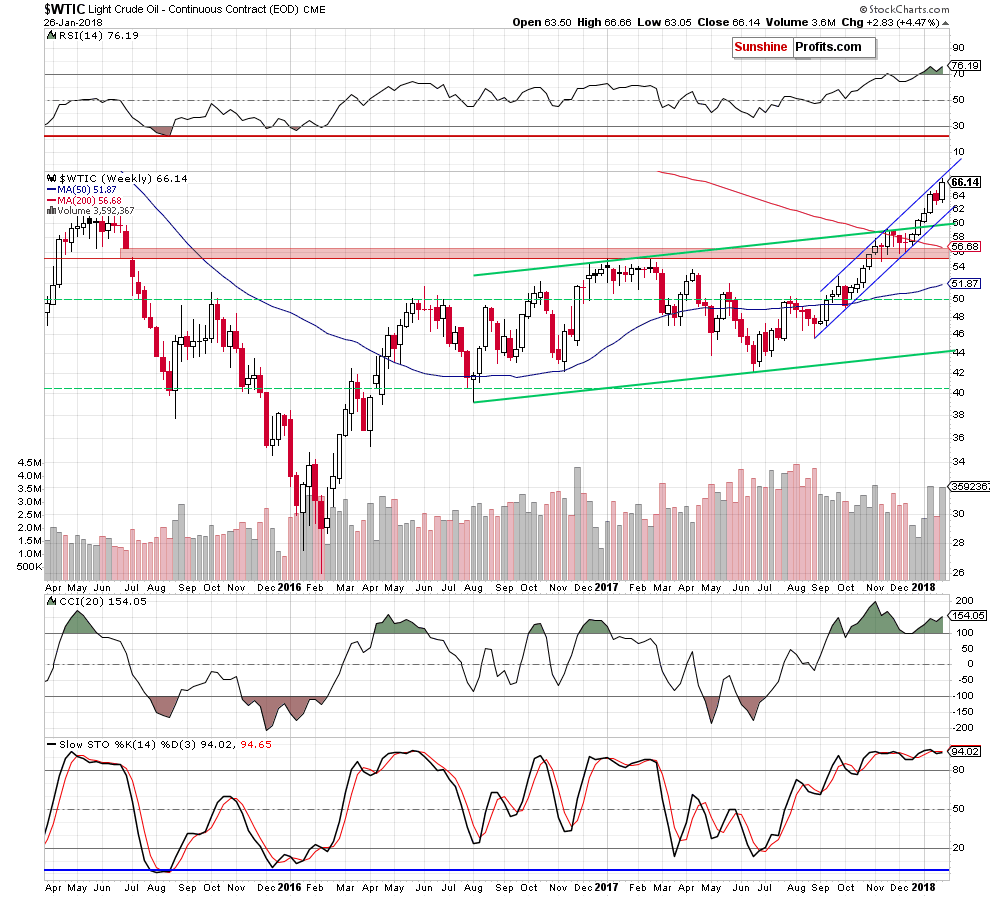

Secondly, the medium-term chart shows that the last week’s increase materialized on significant volume, which can’t be simply ignored. Therefore, we will wait at the sidelines without open positions to gain more certainty that opening short positions will bring profits in the short time.

Nevertheless, we continue to think that as long as there is no breakout above the upper line of the blue rising trend channel higher prices of crude oil are not likely to be seen and a bigger move to the downside is just around the corner.

As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts