Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

Crude oil soared through its resistance area created by i.a. the late November lows. The move was huge and confirmed by huge volume – should we expect more upside, or did the rally just ran out of steam?

It seems that the former is more likely at this time. Let’s take a look at the chart for details.

Let’s start with quoting our previous comments on the above chart:

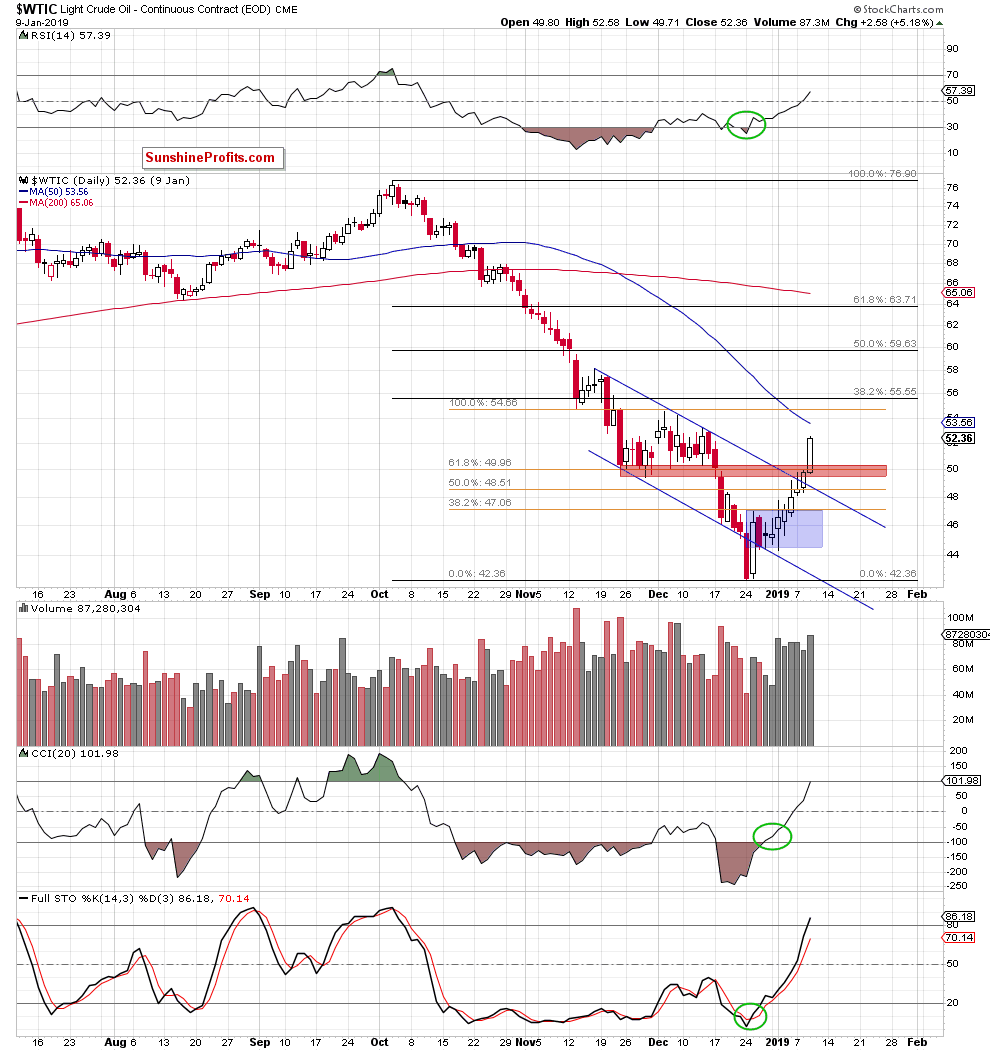

(…) we should keep in mind that the price of black gold is still trading under the red resistance zone (created by the 61.8% Fibonacci retracement, the barrier of $50, the late-November and early-December lows) and the upper border of the blue declining trend channel.

Therefore, in our opinion, higher prices will be more likely and reliable if crude oil breaks above these resistances in the following days. If this is the case and the commodity extends increases from current levels, we’ll likely see an increase to around $53.30-$54.55, where the December peaks are.

(…) slightly above them we can notice the 38.2% Fibonacci retracement based on the entire October-December downward move, which serves as an additional resistance that could encourage oil bears to act once again.

However, (…), if the buyers show weakness in this area and fail to break above the red zone, the price of black gold will likely pull back and test the recent lows and the lower border of the blue consolidation (around $44.35-$44.40) in the near future.

That’s exactly what happened. Crude oil moved decisively higher yesterday and it didn’t do so only in intraday terms – the black gold managed to close above $52. The daily upswing was bigger than the preceding ones, so a quick breather here should not be surprising. In fact, crude oil declined a bit today, but with the intraday low at $51.37 (based on finance.yahoo.com prices) it seems that we already saw the above-mentioned breather.

However, does this imply that the rally is over? No. The nearest upside target is the $53.30 - $54.55 range that we mentioned earlier. There’s also the 38.2% Fibonacci retracement level based on the most recent decline at $55.55 – it could also trigger a potential turnaround.

The RSI is not yet at 70, but the CCI is above 100 and the Stochastic moved above 80, which may indicate overbought status of the market. Should this be a significant concern for the bulls? Not necessarily. When the CCI moved above 100 in late August 2018, crude oil continue to move higher for a few days.

The early September move above 100 was quite specific, because crude oil did move lower right after this signal, but this day (the decline right after the local top) was a perfect opportunity to go long as that’s when the next rally started. The next time in September 2018, when CCI moved above 100 was followed by several days of higher prices.

Stochastic did move above 80, but a sell signal will be generated only after the indicator declines below the signal line and this has yet to happen. The signal line is not even above 80 yet.

Summing, it seems that the short-term rally in crude oil is not over yet and we can expect higher values in the near term. Consequently, we are opening a speculative long position in crude oil. We don’t intend to hold this position for long, however, given the strength that we saw yesterday and today’s pause, it seems that it’s a good occasion to reap some quick profits.

Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager