Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

With yesterday's action, oil bulls have made up for their bad day on Monday. And they may suddenly look to some as having the upper hand. Not that fast! There're still quite a few factors speaking up for the bears. Where does that leave us and the decision made? Let's explore the action together.

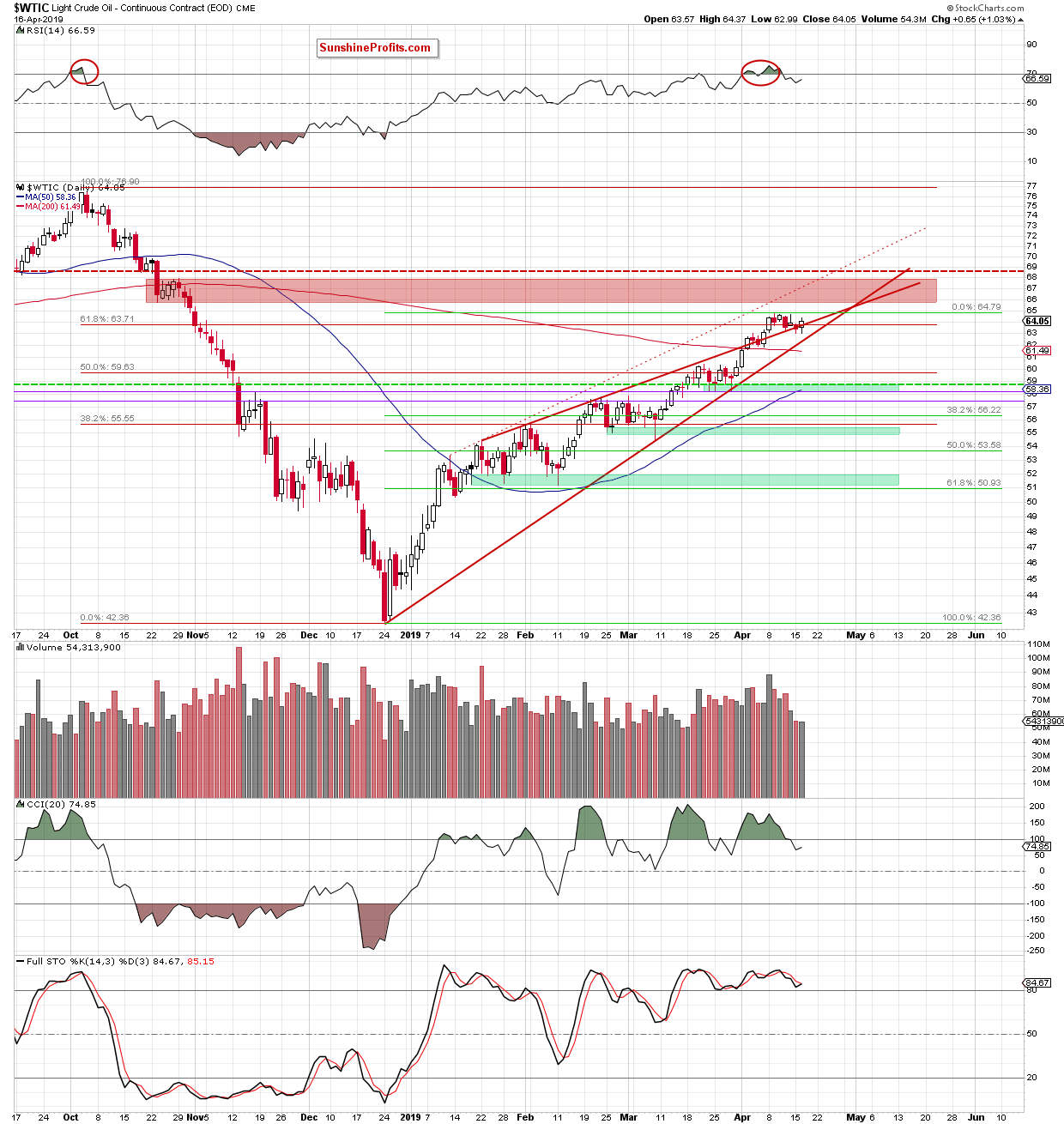

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, crude oil moved higher and closed the session above both the 61.8% Fibonacci retracement and the previously-broken upper border of the red rising wedge. This action invalidated the earlier breakdowns below both of these supports.

Although this is a bullish development, we should keep in mind that sell signals generated by the daily indicators still remain on the cards. Additionally, the volume accompanying yesterday's session was smaller than day before. This raises some doubts about oil bulls' strength.

Connecting the dots, as long as the commodity is trading below the red resistance zone, a move to the downside remains more likely than further price improvement.

Summing up, notwithstanding yesterday's invalidation of the breakdown below both the 61.8% Fibonacci retracement and the previously-broken upper border of the red rising wedge, the odds still favor a downside move. The reasons are: the sell signals by the daily indicators, lower yesterday's volume and the oil price still being below the red resistance zone.

Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist