Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Oil opened the week with a bang. A bang to the downside, that is. Are we in for a retest of the lows, or what's likely up next?

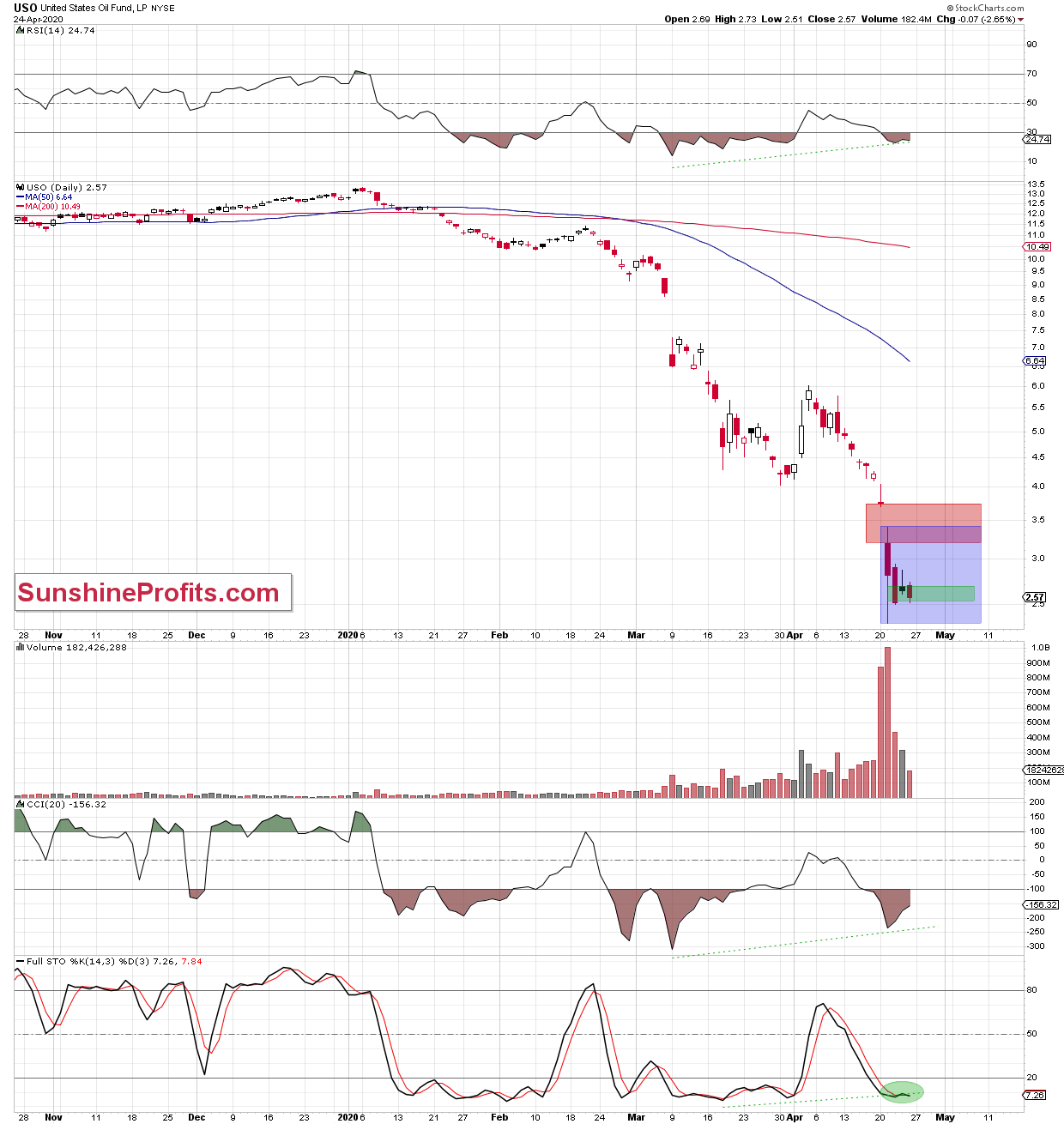

The USO ETF chart shows that the overall situation hasn't changed much as the ETF was trading in a narrow range during Friday's session. The price moved between the Wednesday's high (which is reinforced by the previously broken lower border of the long-term red declining trend channel) and the lower border of the green gap created a day earlier.

Therefore, our Friday's observations remains up to date also today:

(...) What's next?

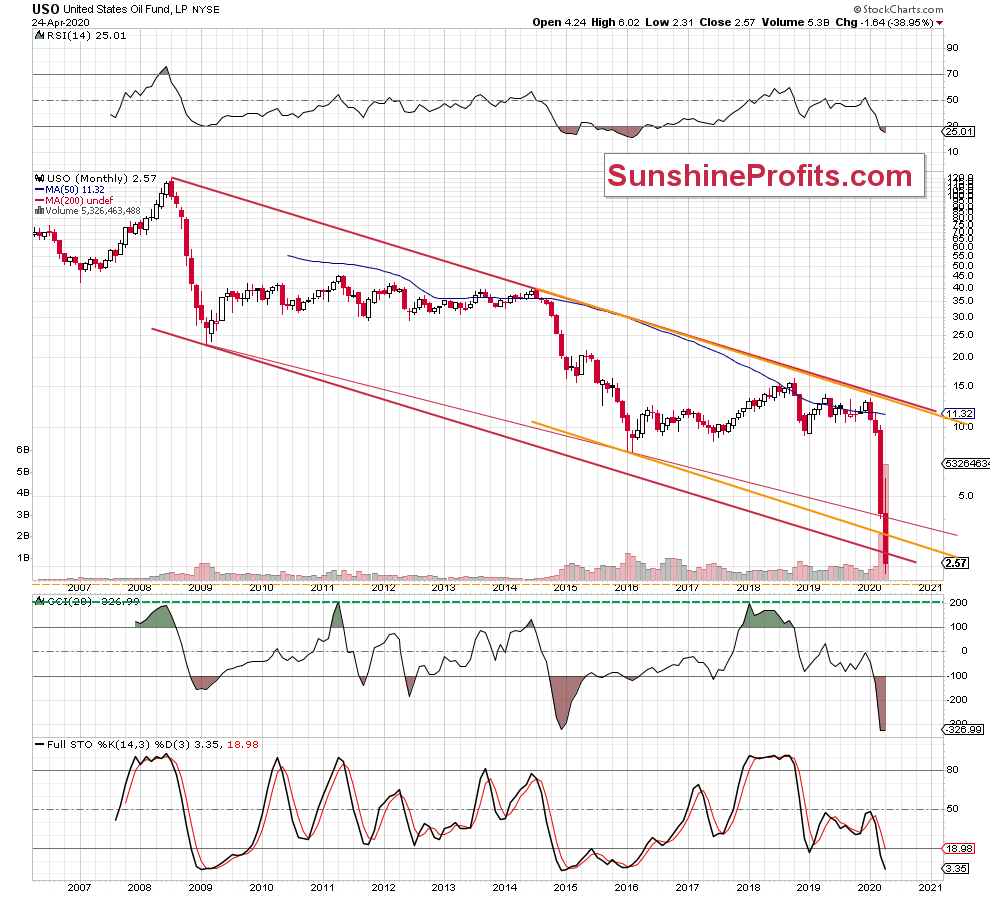

In our opinion, as long as yesterday's green gap remains open, the bulls have a chance to push the ETF prices higher. Nevertheless, a bigger move to the upside will be more likely and reliable onlyif the USO closes today's session (or one of the following) above the above-mentioned lower border of the long-term red declining trend channel.

On the other hand, if the bears manage to close the green gap, the realization of our bearish scenario from Wednesday's Oil Trading Alert will be even more likely:

(...) the USO moved to the previously broken lower border of the red declining trend channel. Unfortunately for the bulls though, this could be just a verification of the earlier breakdown.

Should it be the case, another move to the downside and likely a fresh low (maybe even around 0.50-0.70), is a strong possibility.

(...) in our opinion, it is too early to say that the worst is already behind the bulls, the USO ETF and the oil market. The rush to open any positions can easily prove premature.

Summing up, crude oil entered the week on a weak note, and is selling off. The outlook hasn't really changed since our Friday's Oil Trading Alert, which means that after taking the prior enormous profits a week ago, it still doesn't appear that opening new positions right now is justified from the risk to reward point of view. Soon, it might be though, and we'll keep you informed.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager