Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $46) are justified from the risk/reward perspective.

On Monday, the price of crude oil moved higher after the market’s open supported by worries over the situation in Iraq and rising U.S.-Iran tensions. Despite yesterday’s increase, the commodity pulled back after the EIA report. In this environment, light crude invalidated a small breakout and closed the day below $52. What does it mean for black gold?

In recent days, the conflict between Iraqi and Kurdish forces raised worries over supply disruptions in the region, which together with concerns over renewed U.S. sanctions against Iran supported the price of black gold. Despite these positive circumstances, yesterday, the Energy Information Administration's drilling productivity report showed that U.S. shale production for November is forecast to rise for a 11th consecutive month. This news affected negatively investors’ sentiment, which resulted in a pullback on Monday. Did this drop change anything in the overall situation in the short term?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and try to find out (charts courtesy of http://stockcharts.com).

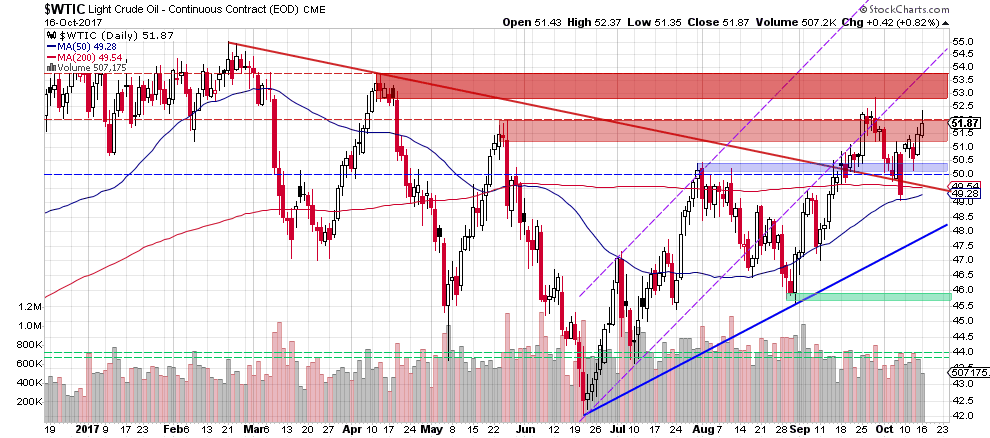

On the daily chart, we see that crude oil extended gains after the market’s open, which resulted in a climb slightly above the May high and the upper border of the red resistance zone. As it turned out, this improvement was temporary and light crude reversed and decline in the following hours. As a result, black gold invalidated the earlier small breakout above the nearest resistances and closed the day below them, which increases the probability of another attempt to move lower.

Additionally, yesterday’s increase materialized on visibly smaller volume that Friday’s move, which suggests that oil bulls may be not as strong as it seems at the first sight. If this is the case, we’ll see lower prices of black gold and (at least ) a test of the last lows in the coming days.

Crude Oil – Gold and Crude Oil – Stock Market Links

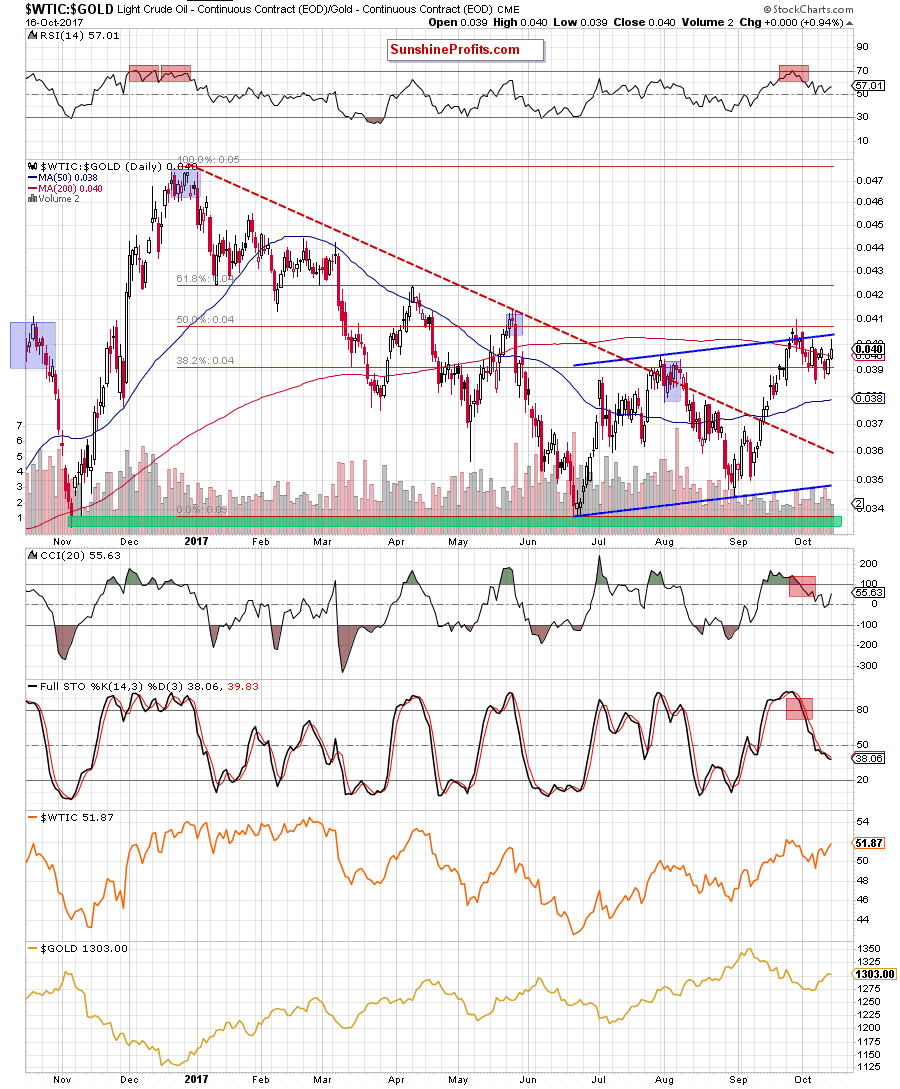

As we mentioned yesterday, this pro bearish scenario is also reinforced by the current situation in the oil-to-gold ratio. Let’s take a look at the chart below.

From today’s point of view, we see that although the ratio increased yesterday, the 50% Fibonacci retracement and the upper border of the blue rising trend channel continue to keep gains in check. Additionally, there are no buy signals, which could encourage bulls to act, which suggests that another downswing (in the case of the ratio and also in the case of crude oil) should not surprise us.

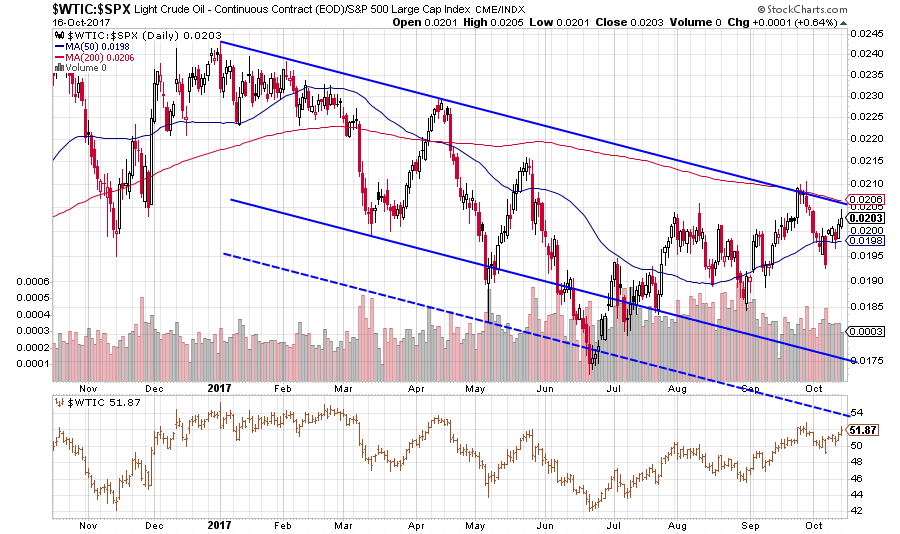

Will the relationship between crude oil and the general stock market give us more clues about future moves? Let’s check the daily chart and find out.

Looking at the daily chart, we see that although oil-to-stocks ratio moved higher in recent days (in tune with the price of crude oil), the key resistances remain in play, blocking the bulls. When we take a closer look at the very short-term chart, we see that the upper border of the blue declining trend channel together with the 200-day moving average successfully stopped further improvement at the end of the previous month, which suggests that history may repeat itself once again and we’ll see a bigger move t the downside (at least to the recent lows) in the very near future.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil is still trading under the resistance area created by the May and August highs. The pro bearish scenario is also reinforced by the current situation in the oil-to-gold and oil-to-stocks ratios, which suggests that lower prices of crude oil are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $46) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts