Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Oil continues trading in a tight range, and accounting for its Friday's decline and Monday's session, it's confirming the points that we've been making preciously:

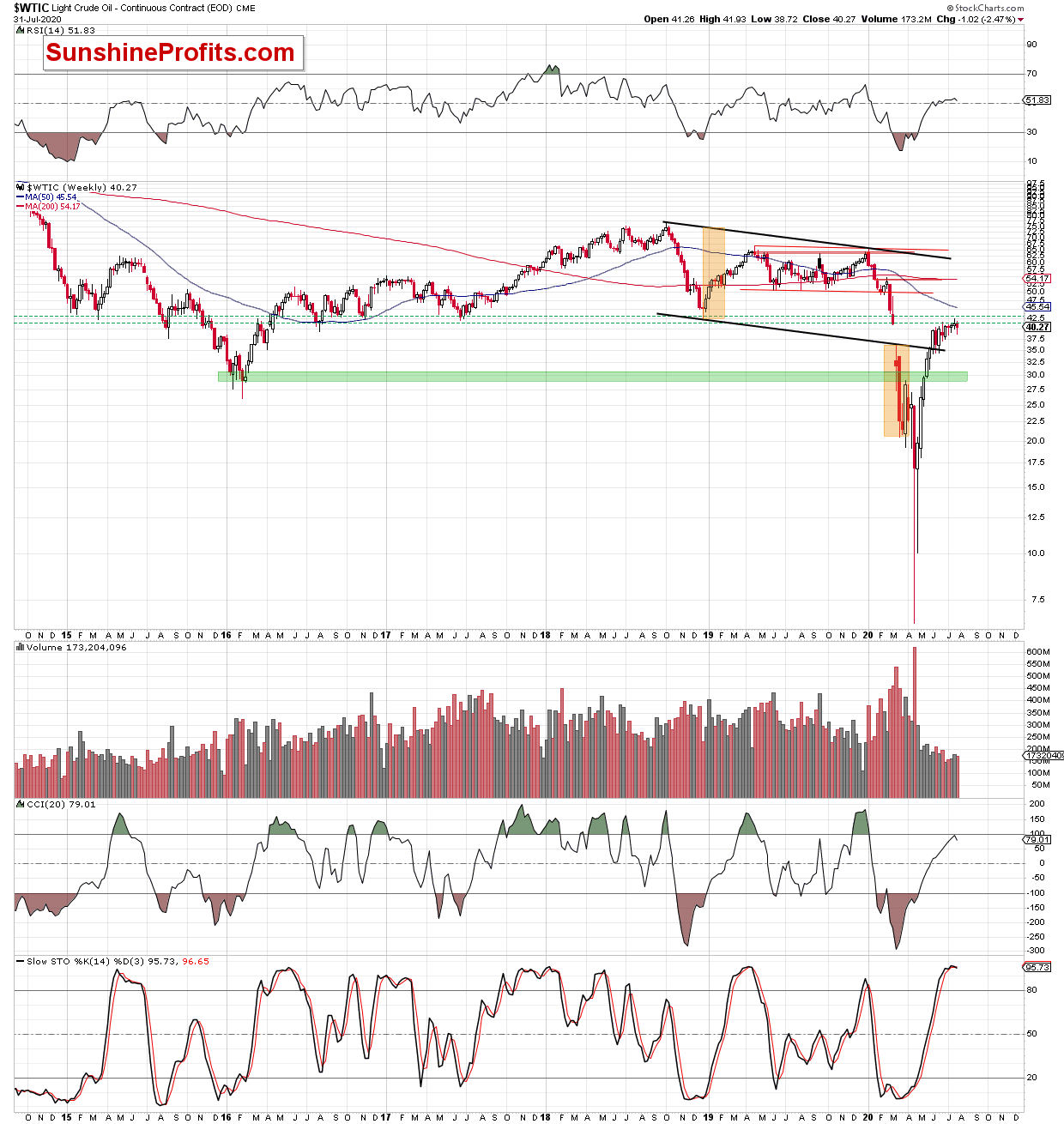

In short - crude oil reversed and then started to move sideways below the 61.8 % Fibonacci retracement level.

This means that the odds continue to favor a move lower from here.

Our stop-loss level is slightly above $45, which means that it's above the early-March levels. If this level - and the 61.8% Fibonacci retracement based on the entire 2020 decline - is broken in a meaningful manner, the SL order would take you us of the market - and correctly so, as it would imply that the outlook is no longer nearly as bearish as it is right now. This hasn't happened yet. In fact, based on the most recent invalidation, the bearish outlook just got a fresh bearish confirmation.

The trigger for crude oil's decline might be the rally in the USD Index. USD's quick rally in the first half of March was accompanied by a substantial slide in crude oil prices.

From the long-term point of view, it's clear how the rally lost steam and buying power dried up. Crude oil verified the breakdown below the 2016, 2017, and 2018 lows by moving back to them and then declining once again. The volume during this upswing was also relatively small suggesting that it won't be long before we see another big decline.

The tiny (but still) sell signal from the Stochastic indicator confirms the bearish outlook for the price of black gold in the near term.

Please note that all the above happened without USD's help. In fact, it happened regardless of USD's continuous decline. Once the USD Index finally rallies (and given today's strength it seems that a bigger move higher in the USDX is underway), crude oil's decline is likely to accelerate.

Consequently, in our opinion, keeping the short position intact remains justified from the risk to reward point of view.

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications and on the rapidly increasing Covid-19 cases in the U.S., and we see signs that the bigger decline is likely to finally start.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia SimmonsDay Trading and Oil Trading Strategist

Przemyslaw Radomski, CFAEditor-in-chief, Gold & Silver Fund Manager