Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

After three (in a row) unsuccessful attempts to break above the previously-broken lower border of the short-term red declining trend channel (you could see it several times in our alerts on the daily chart), oil bears showed their claws and pushed the price of light crude sharply lower during yesterday’s session.

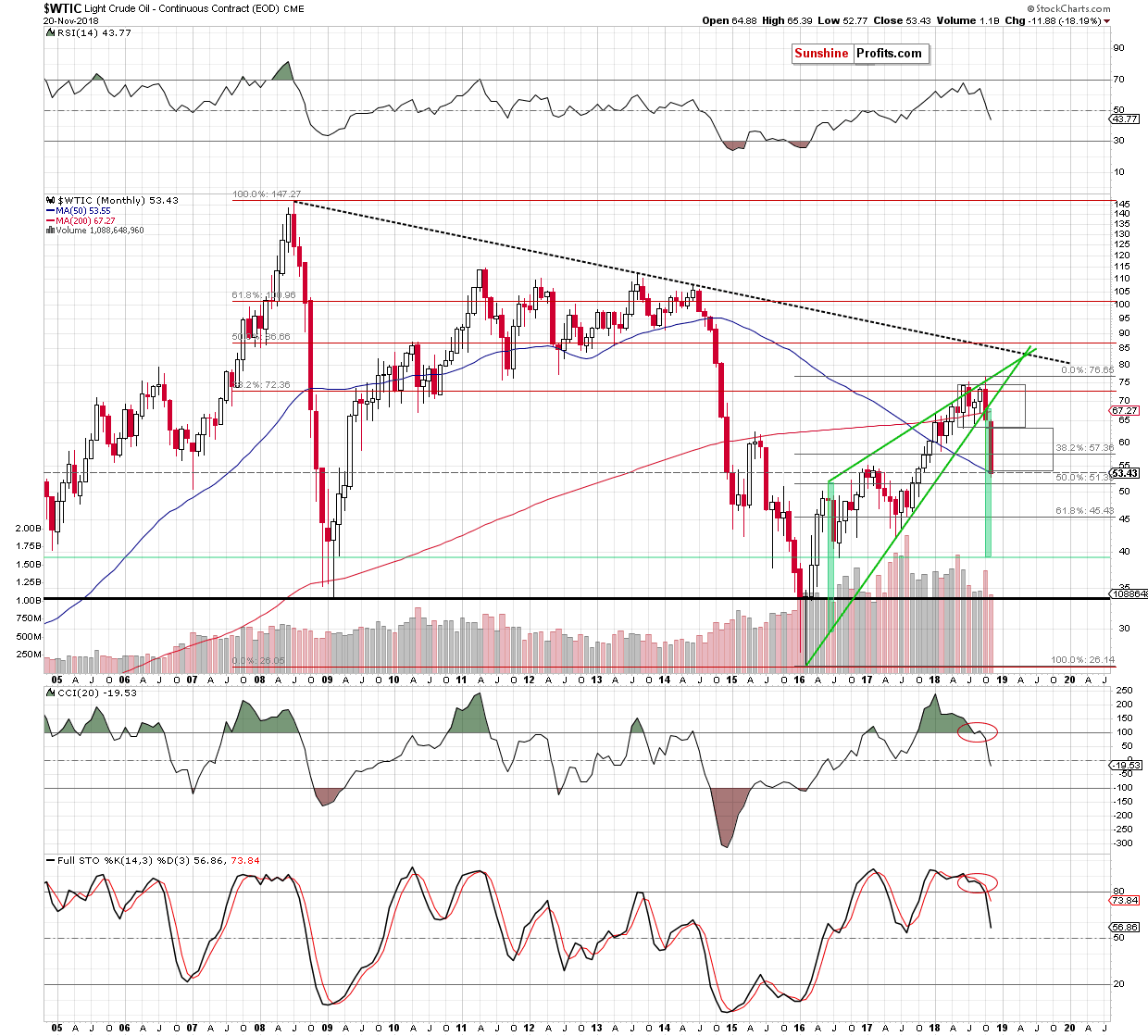

Thanks to their attack, crude oil lost over 6% and closed the day below $54. In this way, the commodity declined to the 50-month moving average, tested the strength of the early 2017 peaks (in terms of monthly openings and closures – we marked them with the grey horizontal dashed line) and dropped to the area, where the size of the downward move corresponded to the consolidation marked on the long-term chart below (charts courtesy of http://stockcharts.com).

Taking all the above into account it seems that the pressure of sellers may somewhat weaken in the coming days. Nevertheless, if today’s government data on crude oil and its products disappoint market participants, further deterioration and a test of the 200-week moving average (currently at $52.27) or even the 50% Fibonacci retracement based on the entire 2016-2018 upward move can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts