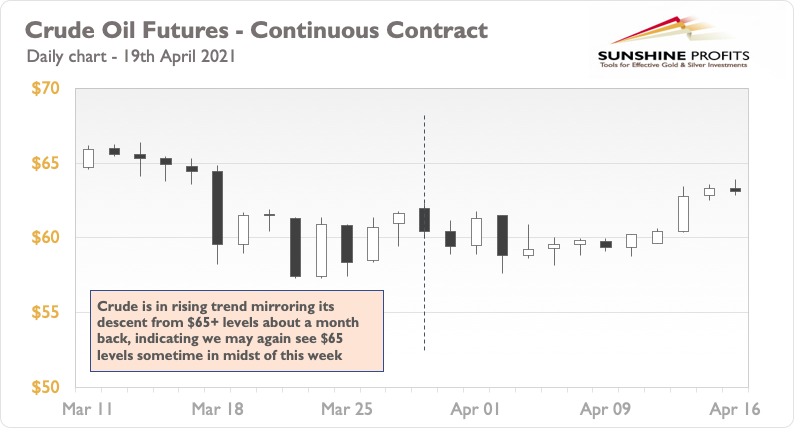

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Multiple oil supply chain risks related to logistics, the geopolitical situation, the economy etc., are lurking around the corner. Combined together, will they play a key role or just remain a side-factor?

On Sunday (Apr. 18), Iran experienced a 5.9 magnitude earthquake causing some damage at the Goureh Pump Station. This is expected to impact oil exports, as around 80% of Iran's oil exports are piped through the Goureh pump station. The extent of this supply disruption will be clearer in the coming days. For now, an oil hungry China will have to take the hit as Iran’s key export destination.

On Saturday (Apr. 17), there was a rocket attack at Northern Iraq’s Bay Hassan oilfield. The oil production was not impacted, but this again serves to remind us of the present oil supply risk in the Middle East region.

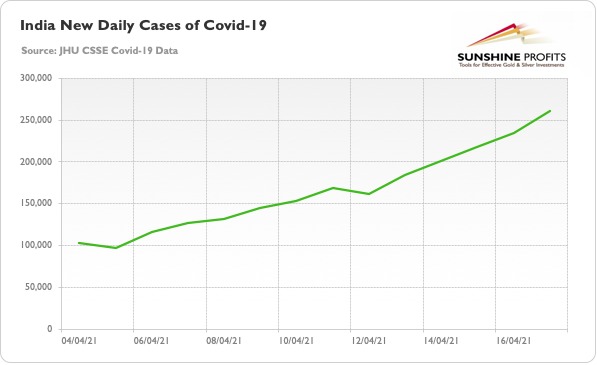

Demand is being driven by top two consumers – the U.S. and China, with both having around 35% oil consumption share before the pandemic. On the other hand, India, the third largest consumer with 5% global consumption share, is shutting down its cities as Covid-19 cases are soaring exponentially, as shown in the below chart. In just two weeks, daily new cases have more than doubled to more than 0.25 million. In comparison, the peak case count was reached in September of last year, with around 0.1 million cases.

The U.S. dollar was in a weakening spree last week and the coming week is expected to be flat or slightly bearish on account of inflation concerns. So, there are no worries of downward pressure on oil because of a strong dollar.

Volatility in oil has been low in the last two trading sessions while providing support at $63 levels. While the market may still remain undecided early next week, we can expect a rally to $65 towards the later part of the week.

In the coming days it will be interesting to note if sanctions on Iran’s oil and gas market get lifted by the U.S., as the talks are ongoing.

To summarize, oil supply risks combined with rising demand keep bullish sentiments alive. We can expect prices to accelerate further in the later part of this week.

As always, we’ll keep you, our subscribers well informed.

Letters to the Editor

Q: Mr. Jain, what's your outlook for oil? Will it go lower first, before going higher? Thank you,

- Chee

A: My outlook for oil is bullish, with prices taking breather at certain price points. In my opinion, I don’t expect prices to fall significantly. Overall, I see a rising trend in the coming many weeks.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist