Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Note: Starting from yesterday, I’ll be providing you with key updates for crude oil. The Oil Trading Alerts will be published as usual on Mondays, Wednesdays, and Fridays, but on Tuesdays and Thursdays I'll provide you with a brief market update.

US gas stations are going dry, as the Colonial Pipeline remains non-operational and people started hoarding fuel. How will this impact oil prices?

In a scene reminiscent of a movie, a man and a woman were caught on video in North Carolina, as they fought at a gas station. Unfortunately, it seems that this is what can happen when there is a fuel shortage.

The Colonial Pipeline shutdown driven by a cyberattack has begun to put gas stations out of fuel in multiple cities in the Eastern US. Also, the fact that people have started panic buying and hoarding fuel is adding to the shortage. The US Energy Secretary had to appear on a press conference to announce that there is no need to hoard fuel to assure people that the problem would be solved shortly.

The International Energy Agency (IEA) issued its oil demand forecast for the year. The position that demand is going to exceed supply is maintained, and it predicts that the supply won’t rise fast enough to keep pace with the expected demand recovery. As per IEA, global oil consumption is now expected to rise by 5.4 mb/d in 2021.

India’s daily new Covid-19 cases report is showing signs of a steady decline with the last number around 0.35 million cases per day. If this trend continues, we may see a large improvement in oil demand from India in mid-June and onwards.

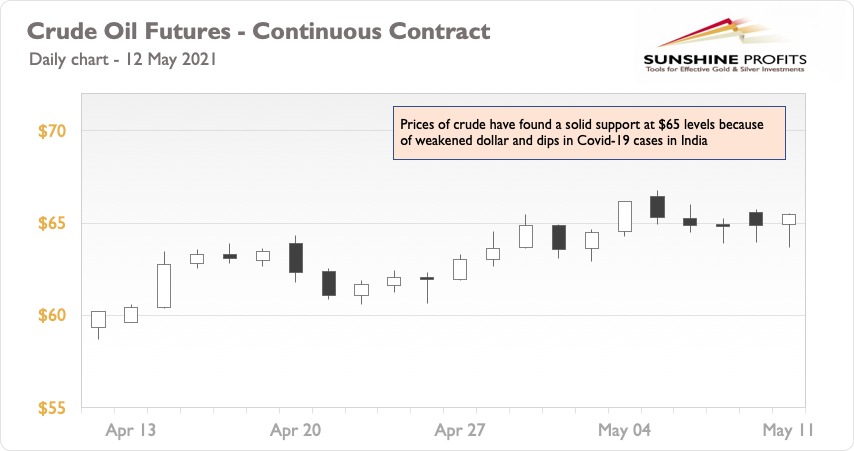

The dollar is on a weakening spree as can be seen in the chart above. Although the Colonial Pipeline shutdown has led refiners to scale back production, the weakened dollar has provided solid support to oil so far. Also, the fact that the US and the UK oil demand recovery is steadily reaching pre-pandemic levels is constantly increasing gasoline & jet fuel consumption.

The key drivers for oil this week were inflation and pipeline shutdown, though. Both forces acted against each other to keep oil in a steady position. Inflation is here to stay, while the shutdown is not. So, we are likely to see another rally as soon as the pipeline starts being operational again.

To summarize, inflation and the weak dollar saved an oil price dip which was likely caused by the pipeline-driven supply disruption in the US. I stand by my long position on oil based on the signals of demand recovery from the US and the UK and the fact that Covid-19 cases seem to be declining in India.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist