Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

A series of unpredictable events like the Colonial pipeline failure and the Mississippi river closure over-ridded fundamentals this week. Is this a good time to double down?

Here’s a quick rundown of what’s happening in the crude sector:

Even though the Colonial pipeline is now functional, after the company paid around $5 million in cryptocurrency to Easter European hackers, the situation will still take a few days before it gets back to normal.

In another risk-driven oil market incident, a bridge fractured near Memphis, US resulting in the closing of the Mississippi river waterway, which is crucial for US crop exports. There is a jam at the spot with 430 oil barges waiting to pass north and 341 barges that are in the queue to go south.

Japan is expanding its state of emergency to three more prefectures, in order to curb a resurgence in Covid-19 cases. The three prefectures will join six prefectures on 16 May to come under the state of emergency till end of this month. Japan, the world’s 4th largest oil consumer, has not yet seen the peak in daily new Covid-19 cases, with the latest numbers at 6367 daily new cases reported. This number is in close vicinity to the high of 6446 daily cases during the last wave.

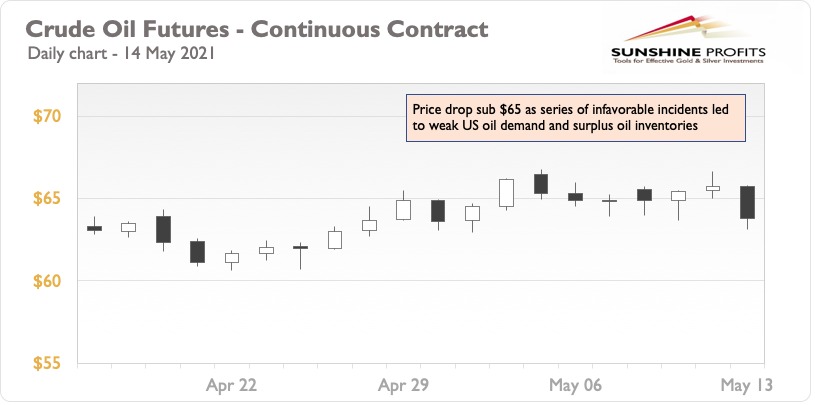

This week of negative news for oil has kept the prices below $65. Weak US demand coupled with strong inventory levels added to the bearish sentiment. There is news of Singapore instituting Covid-19 related restrictions as cases are on rise there as well.

So, what does this mean? Well, where some might head for the hills when they see danger, others see buying opportunities.

I think these dips are an opportunity to enter at attractive prices. Oil is now having solid support at $65 levels and any chance to enter at levels below is a good opportunity. The fundamentals remain the same, as vaccinated countries are seeing a consistent and sustainable increase in oil demand while supply won’t be enough to meet it in coming months.

To summarize, unexpected supply risks resulted in a temporary dip in oil demand, leading to a price drop for this week. Japan and India have still to see a peak in virus cases while the US, UK, and Australia have had consistent increases in oil usage.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist