Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Oil succumbed to Covid’s impact in India (one of the world’s largest oil importers), dropping ~3% on Tuesday. What does this mean for the black gold?

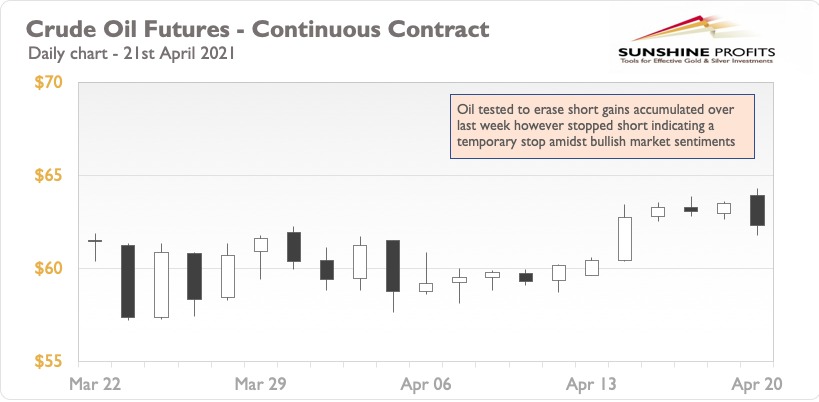

As I predicted in the last alert, supply chain risks might be the theme of this week. I expected prices to take a breather in the early part of it, as the market absorbs demand risk reduction due to strict lockdowns across the world - especially in India. As can be seen in the chart below, downward adjustment on Tuesday (Apr. 20) indeed happened, driven mainly by demand concerns on the Indian Peninsula. An interesting point to take note of is the sharp reversal of the market – prices have shot upwards after India’s Prime Minister addressed the nation at around 11 AM EST. PM Modi mentioned lockdowns as the last resort and did not impose a national lockdown during the live telecast. Hence, oil prices’ rapid ascent indicates a strong correlation with lockdowns, which is what I also discussed in last week’s trading alert.

Another minor factor contributing to Wednesday’s sell-offs is the unexpected increase in US crude oil and distillates stocks in accordance with the data released by the American Petroleum Institute (API). An increase in stocks is interpreted by the market as lower demand, even though the US driving season is expected to bring a strong uptick in oil distillates consumption.

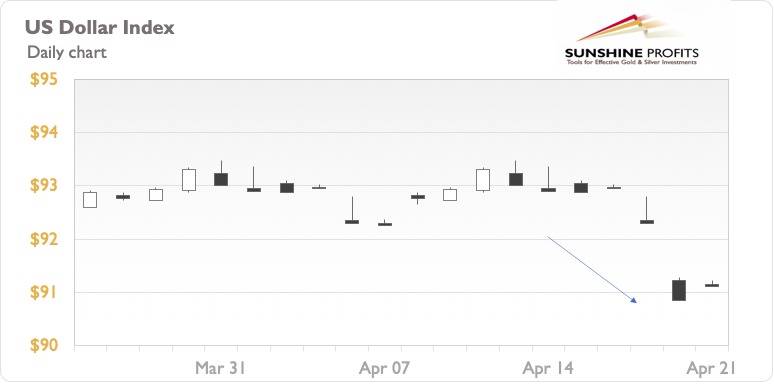

There are multiple bullish accelerators in play – therefore, this fall is a brief respite before we cross $65 levels again. One of the many supporting factors upholding this statement is the fact that the US Dollar Index is declining and has fallen by around 2.25% since the start of April 2021. Again, my prediction of the continuation of the weakening dollar trend has played out correctly, as shown in the chart below.

Another supply risk event favorable for oil’s price rise has played out this week in Libya, an OPEC+ member. The country’s National Oil Corporation had to stop oil exports because of budgetary issues, which led to insufficient funds for the energy sector. The drop in Libya’s oil output will further restrict total output from OPEC+, which has already practiced production restraint quite diligently in the past few months.

There is also a discussion around the nuclear deal of Iran progressing at its own pace. If successful, it will bring additional and, furthermore, cheaper oil to the market. Analysts, however, believe that it will make a minimal impact as Iran oil finds its way into the Asian market at much lower market prices anyway.

On top of that, pushbacks arose from groups not at all happy with high crude prices. The US, for example, has advanced a bill called NOPEC, being an anti-trust suit against OPEC for collusion and price manipulation. Although similar bills have appeared in the past, they have never seen the light of day as the law. Considering the current times, when unexpected risks are actualizing over fundamentals-driven events, the regulatory risk of NOPEC needs to be monitored closely.

To summarize, lockdowns induced demand drops are the only key factors putting brakes on an oil rally. After all, price accelerators in forms of supply risks, as well as the economy uptick will keep oil prices rushing upwards and reaching new levels.

As always, we’ll keep you, our subscribers well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist