Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

IEA recently published a report recommending taking no new investments in the oil and gas industry for environmental reasons. Will it be taken seriously?

As per IEA’s latest publication, a rather extreme approach is needed to hit the Paris agreement goals. The suggested roadmap includes a halt to new investments in oil and gas fields, no more investments in coal power plants, and all-electric cars globally by 2035!

Is it the right message to send to the world? While we understand the dire need for energy transition, we must also look at the practicality and timeframe for this change. And the reality is that oil investments will continue to happen for some more time now to meet the ever-growing oil demand across the world.

Shell’s CEO van Beurden stated in response that Shell would continue drilling wells after 2025 in key basins such as the Gulf of Mexico in order to "fulfill the needs for oil & gas that the world needs."

Optimistic news keeps rolling out regarding demand increase in high-vaccinated countries. As per the latest data from OpenTable, the American restaurant industry is in recovery mode with seated diners from online, phone, and walk-in reservations at just 14% lower level than that of 2019 level.

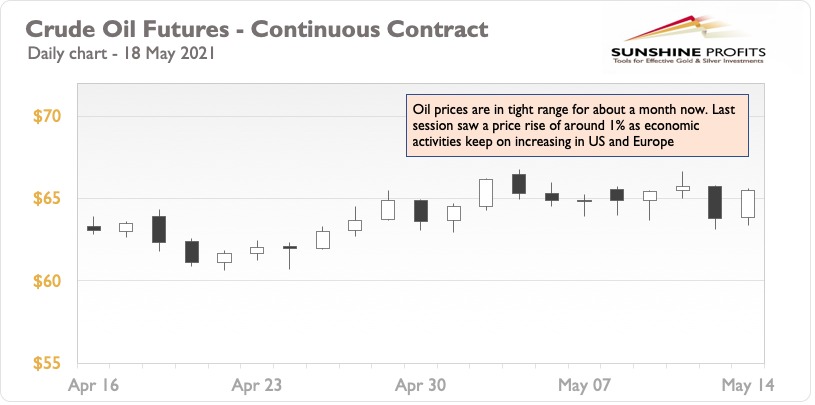

As per the latest news, the Colonial Pipeline has been restored to fully operational level. It will take some time, however, for the fuel supply chain to catch up. As can be seen in the chart below, prices responded favorably to the indications of normalcy in terms of both economic activity and risk mitigation.

The US dollar index keeps decreasing as can be seen in the below chart. Now, we have crossed the psychological support at (and we are currently hovering) around 89.85$. This weakening of the dollar is one of the key reasons for oil maintaining its higher levels despite supply risks and demand concerns.

We can expect a bullish week for oil as the market has yet to absorb the positive news of demand recovery and rising inflation (weakened dollar). Keeping the long position intact, any dips will be a good opportunity to aggregate further.

To summarize, oil is rangebound although we may expect a bullish week as optimistic signals are in majority.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist