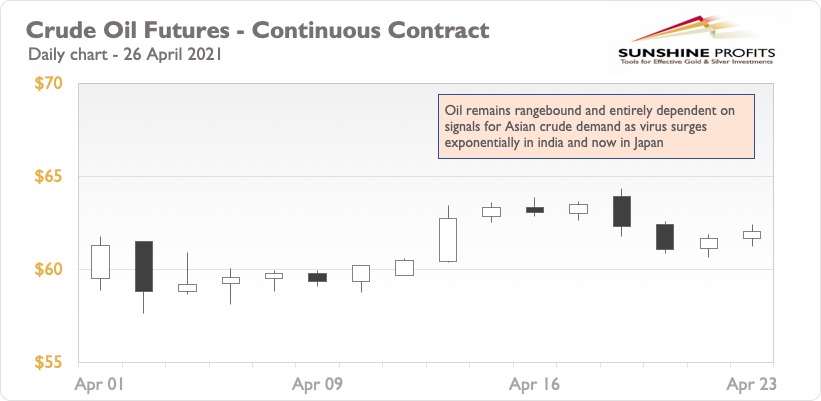

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

The pandemic is wreaking havoc in Asia – especially in India and Japan - raising the threat of a halt to economic activity in the foreseeable future. So far, oil has held its ground and not backed off significantly, but for how long?

Signals of a weakening oil demand from India are now visible. India’s state-owned company is offering gasoline on the spot market, which is a rare occurrence. Being most likely a sign of weakened demand, it is also an indication of subdued demand in the coming weeks.

Japan, the fourth largest oil-consuming country, is also going through a massive wave of Covid-19 cases amidst a slow vaccine rollout. For both India and Japan, the peaks of their current waves are yet to come. Assuming that the rate of the case reduction is going to be almost the same as that of the surge, we are easily two months away before any normalcy returns.

The US, on the other hand, is doing quite well. The vaccination drive is in full flow, and the gasoline demand is back above 9mbpd (Pre-Covid). Hopes of the US recovery are perhaps the key reason for oil holding its position so strongly.

Meanwhile, Libya has resolved the issue with its financing of oil companies, which previously led to a halt in oil production at Hariga oil terminal. Additionally, supply chain risks continue, as another drone attack took place on an oil tanker near Syria’s coast.

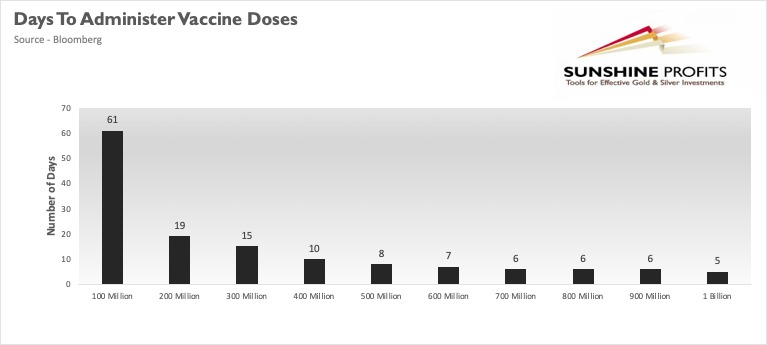

On the one hand, the virus surge is leading to massive lockdowns, however, we have an accelerated rate of vaccine administration as can be seen from the chart above. Overall, one billion jabs have been given, and the last 100 million took just five days. As the forces on both sides are comparable, oil is expected to fluctuate without a specific direction in the coming days.

To summarize, the oil market will remain rangebound for the coming days while the long-term outlook is still bullish. Asia needs to be closely watched for its response to the virus surge as any positive sign from there will lead to the shoot-out rally we all have been expecting for quite some time.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist