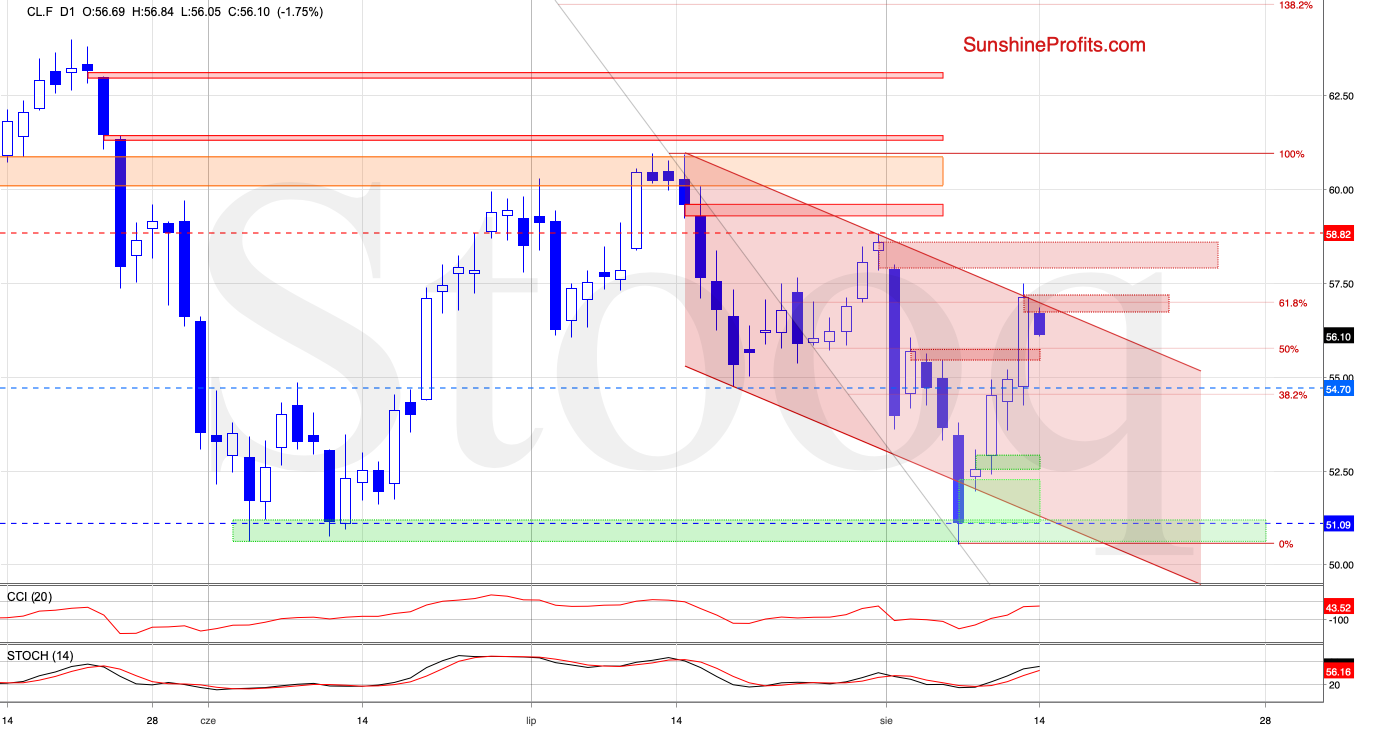

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.82 and the initial downside target at $54.70 is justified from the risk/reward perspective.

Black gold has presented us with an eventful session yesterday. And that gave shape to our plans to proceed with opening a new position. The combination of signs is too rich to ignore - let's dive in.

We'll take a closer look at the chart below (chart courtesy of www.stooq.com ).

During yesterday's session, the bulls powered through both the 38.2% Fibonacci retracement and the red gap. The bulls even went on to test the upper border of the declining red trend channel.

Although crude oil futures rose slightly above this resistance, the improvement proved only temporary and barely visible compared to the size of yesterday's candlestick. Additionally, the 61.8% Fibonacci retracement in combination with the upper border of the channel encouraged the sellers to act, resulting in a pullback before the day's close.

As a result, the futures finished Tuesday back inside the channel, invalidating the earlier tiny breakout. This sign of weakness encouraged the bears to act earlier today, resulting in a daily opening with the red gap. Together with the 61.8% Fibonacci retracement, this gap serves as the nearest strong resistance.

We have seen a similar price action on August 1 already - and it translated into a sharp move to the downside. Taking this fact into account and combining it with the above-mentioned resistances, opening short positions is justified from the risk/reward perspective. All details below.

Summing up, while oil scored a powerful upswing yesterday, its price has reached important resistances and pulled back before the closing bell. Coupled with the opening bearish gap in today's oil futures trading, it indicates a bearish turn of events on the horizon. Opening short positions is therefore justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.82 and the initial downside target at $54.70 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist