Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Thursday, the black gold moved higher once again and came back above the barrier of $50 as the bullish EIA report continued to weigh on investors’ sentiment. Will we see higher prices of light crude in the coming week?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

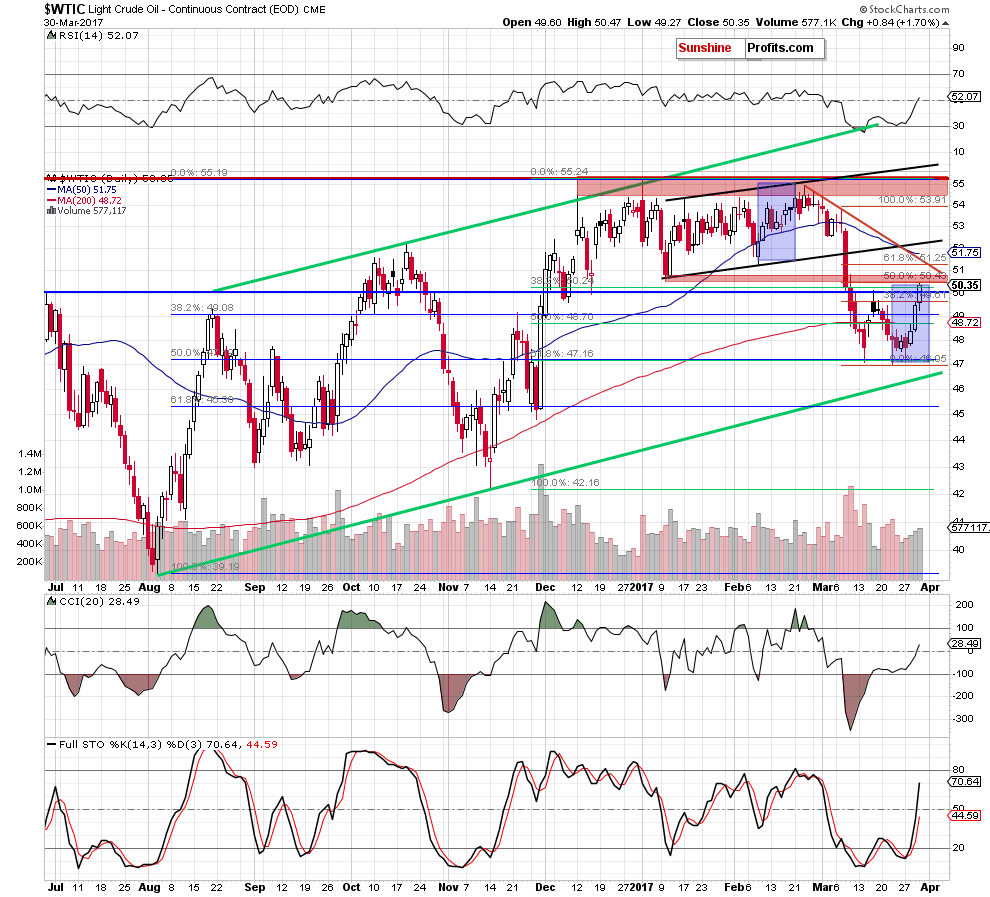

The first thing that catches the eye on the daily chart is an invalidation of the breakdown under the barrier of $50. Although this is a bullish development, which suggests further improvement, we think that the space for gains is limited. Why? Firstly, with yesterday’s increase crude oil reached the 50% Fibonacci retracement based on the March 7 – March 22 downward move, which is the lower border of the red resistance zone marked on the above chart. Secondly, not far from current level are also January’s lows ($50.71-$50.75) and the March 9 high of $50.84, which could encourage oil bears to act. Thirdly, and the most importantly, this week’s upward move is similar to the February’s rebound (both marked with blue rectangles), which means that oil bulls are not stronger than they were in the previous month at the moment of writing these words. This suggests that reversal and lower prices may be just around the corner – especially when we factor in the above-mentioned red resistance zone.

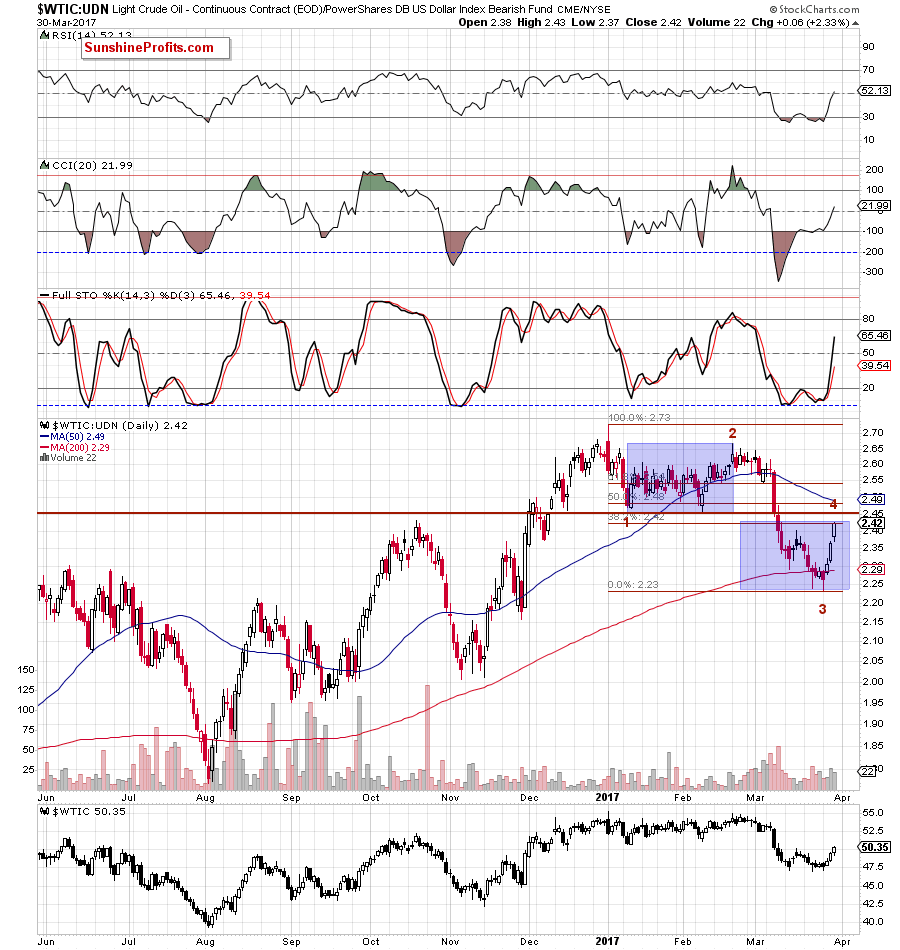

On top of that, there are also interesting signs on the non-USD (WTIC:UDN ratio) charts of crude oil. As a reminder, UDN is the symbol for the PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies".

From the daily perspective, we see that this week’s increases took the ratio to the 38.2% Fibonacci retracement based on the entire 2017 downward move, which could trigger a pullback in the coming week. Additionally, similarly to what we saw in the case of crude oil priced in U.S. dollars, both upswings (the current and the one seen at the beginning of the year) are very similar, which increases the probability of reversal in a very near future.

On top of that, as long as there is no increase above the red horizontal resistance line (the bottom of the potential wave 1), the current move could be considered as the wave 4 in a 5-wave decline (according to the Elliot Wave Theory) . If this is the case, and the ratio reverses and moves lower from here, we’ll see a fresh 2017 low not only in the ratio, but also in crude oil (or even another re-test of the recent lows and the green support line, which will be higher in the coming week).

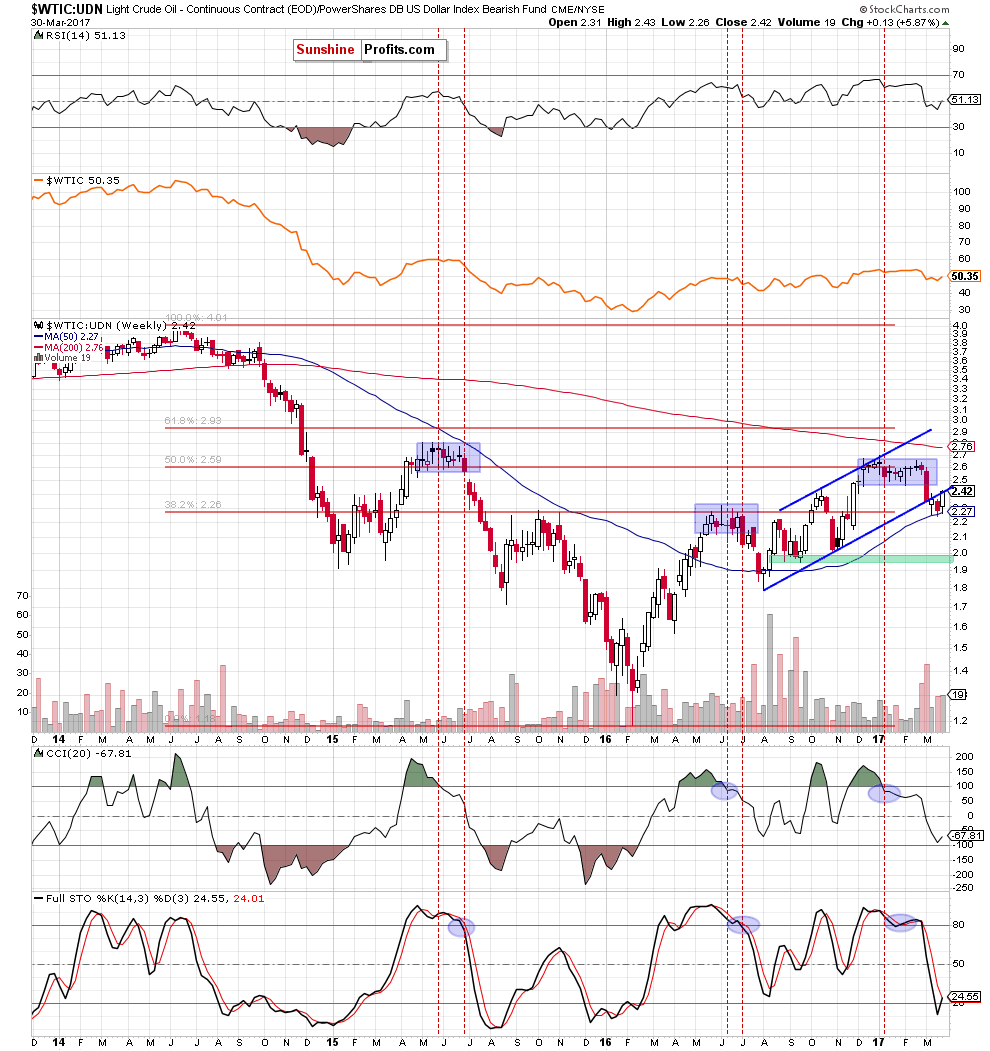

Before we summarize today’s alert, let’s zoom out our picture of the ratio and examine the weekly chart.

From this point of view, we see that although the ratio increased, it is still trading under the previously-broken lower border of the blue rising trend channel, which looks like a verification of the earlier breakdown. If this is the case, oil bears will have another reason to act and push the price of light crude lower in the coming week.

Summing up, short positions continue to be justified as the picture, which emerges from the above charts suggests another attempt to move lower in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts